- Philippines

- /

- Real Estate

- /

- PSE:SHNG

3 Dividend Stocks Offering Yields Up To 7.3%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile corporate earnings and geopolitical uncertainties, investors are increasingly drawn to the stability offered by dividend stocks. In this context, identifying stocks with attractive yields can provide a reliable income stream, making them appealing options amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.56% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

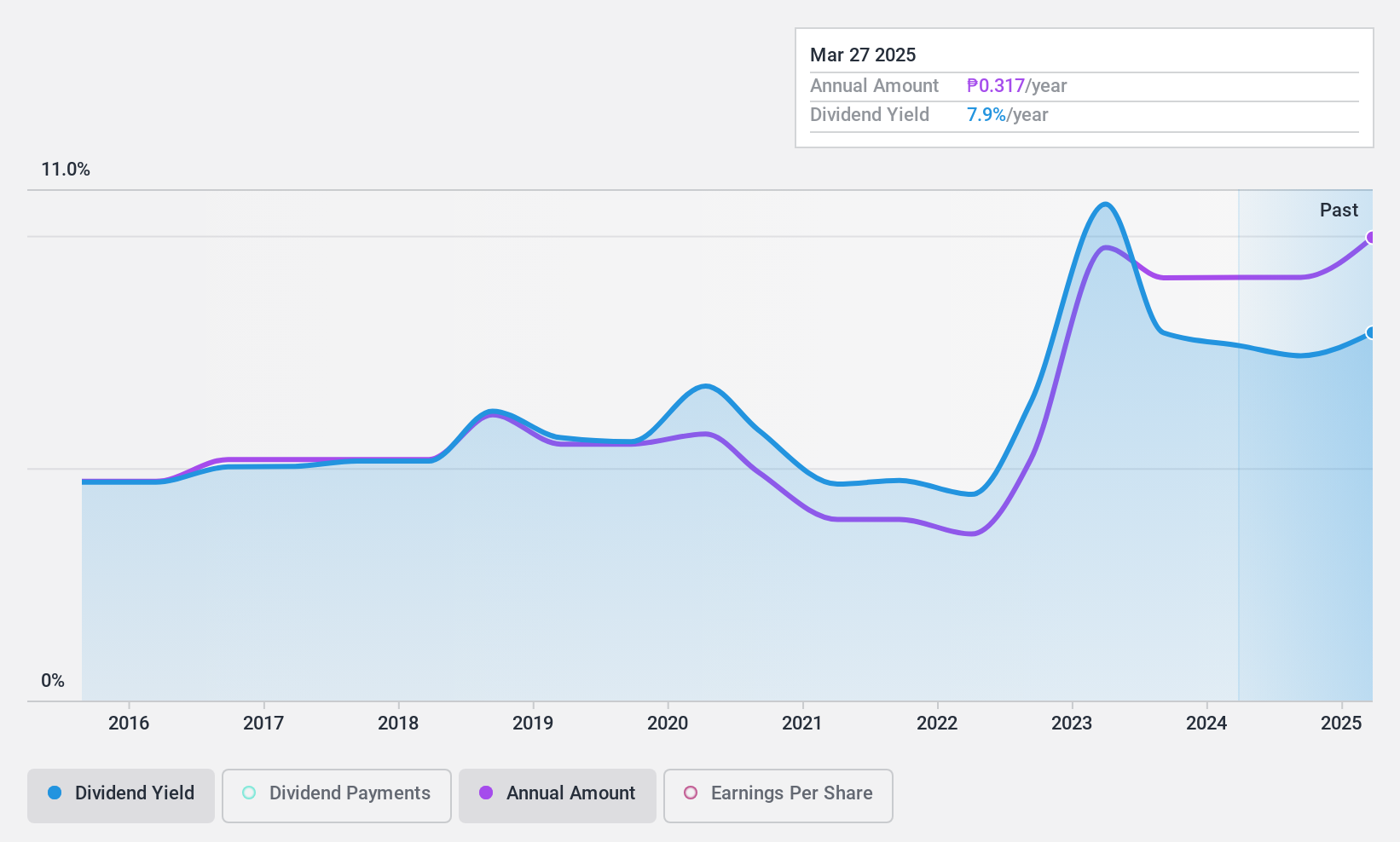

Shang Properties (PSE:SHNG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shang Properties, Inc., along with its subsidiaries, operates in the property investment and development sector mainly in the Philippines, with a market cap of ₱18.86 billion.

Operations: Shang Properties generates revenue through its property investment and development activities in the Philippines.

Dividend Yield: 7.3%

Shang Properties has shown strong earnings growth, with a 21.9% increase over the past year and a low price-to-earnings ratio of 3.1x compared to the Philippine market average of 9.6x. However, while its dividend yield is in the top 25% at 7.31%, coverage by free cash flows is inadequate due to a high cash payout ratio of 1990.2%. Additionally, dividends have been volatile and unreliable over the past decade despite having a low payout ratio of 22.9%.

- Click here to discover the nuances of Shang Properties with our detailed analytical dividend report.

- Our valuation report unveils the possibility Shang Properties' shares may be trading at a premium.

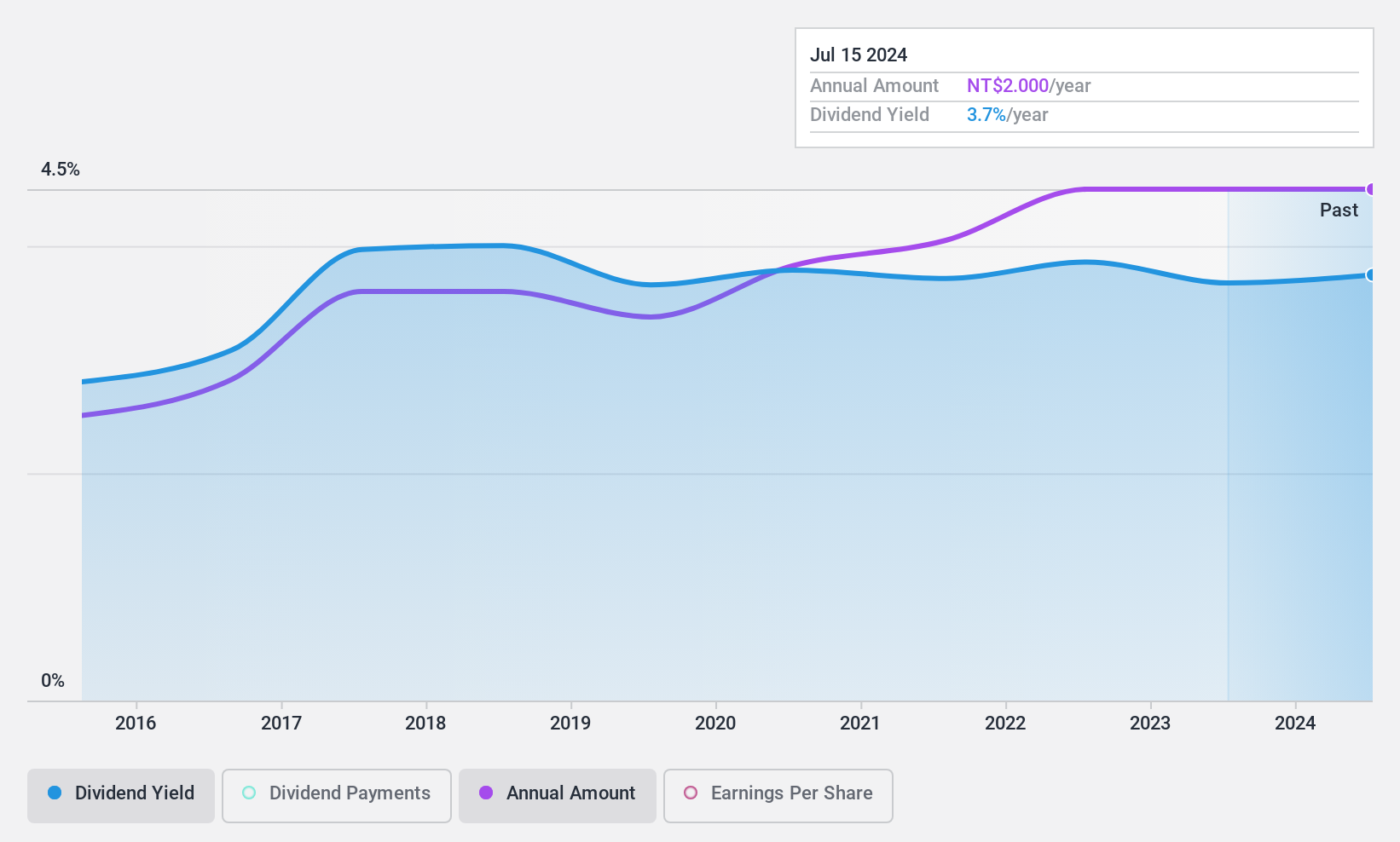

SYN-TECH Chem. & Pharm (TPEX:1777)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SYN-TECH Chem. & Pharm. Co., Ltd. manufactures and sells active pharmaceutical ingredients (APIs) in Taiwan and internationally, with a market cap of NT$4.20 billion.

Operations: The company's revenue primarily comes from its Drugs Manufacture segment, which generated NT$1.22 billion.

Dividend Yield: 3.7%

SYN-TECH Chem. & Pharm. has experienced significant earnings growth, with a 31.6% increase over the past year, and maintains a low price-to-earnings ratio of 12.8x compared to the TW market average of 20.4x, suggesting good value. However, its dividend yield of 3.72% is below top-tier levels in Taiwan (4.55%), and dividends have been volatile over the past decade despite being well-covered by earnings (47.7%) and cash flows (40.1%). Recent earnings reports show improved financial performance with net income rising to TWD 116 million for Q3 from TWD 92 million a year ago.

- Click to explore a detailed breakdown of our findings in SYN-TECH Chem. & Pharm's dividend report.

- Upon reviewing our latest valuation report, SYN-TECH Chem. & Pharm's share price might be too optimistic.

Shin Hai Gas (TWSE:9926)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shin Hai Gas Corporation is involved in the supply of natural gas in Taiwan and has a market capitalization of NT$93.70 billion.

Operations: Shin Hai Gas Corporation generates revenue through its Gas Supply segment (NT$1.74 billion), Installation Segment (NT$378.45 million), and Telecommunication Segment (NT$16.75 million).

Dividend Yield: 3.8%

Shin Hai Gas offers a stable dividend profile with consistent payments over the past decade, though its yield of 3.83% is below Taiwan's top-tier levels. The company's payout ratio of 73.3% suggests dividends are covered by earnings but not by cash flows, as indicated by a high cash payout ratio of 93.6%. Recent financials show steady growth in earnings and sales, with Q3 net income rising to TWD 134.73 million from TWD 119.55 million last year.

- Take a closer look at Shin Hai Gas' potential here in our dividend report.

- Our expertly prepared valuation report Shin Hai Gas implies its share price may be too high.

Seize The Opportunity

- Embark on your investment journey to our 1960 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SHNG

Shang Properties

Engages in the property investment and development business primarily in the Philippines.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives