- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3044

Global Dividend Stocks Featuring Three Top Picks

Reviewed by Simply Wall St

As global markets navigate a landscape of solid corporate earnings and fluctuating inflation rates, investors are increasingly focused on the resilience of dividend stocks. In this environment, a good dividend stock often combines stable financial performance with the ability to generate consistent income, making it an attractive option for those seeking to balance growth with income amidst economic uncertainties.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.43% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.17% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.27% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 1523 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

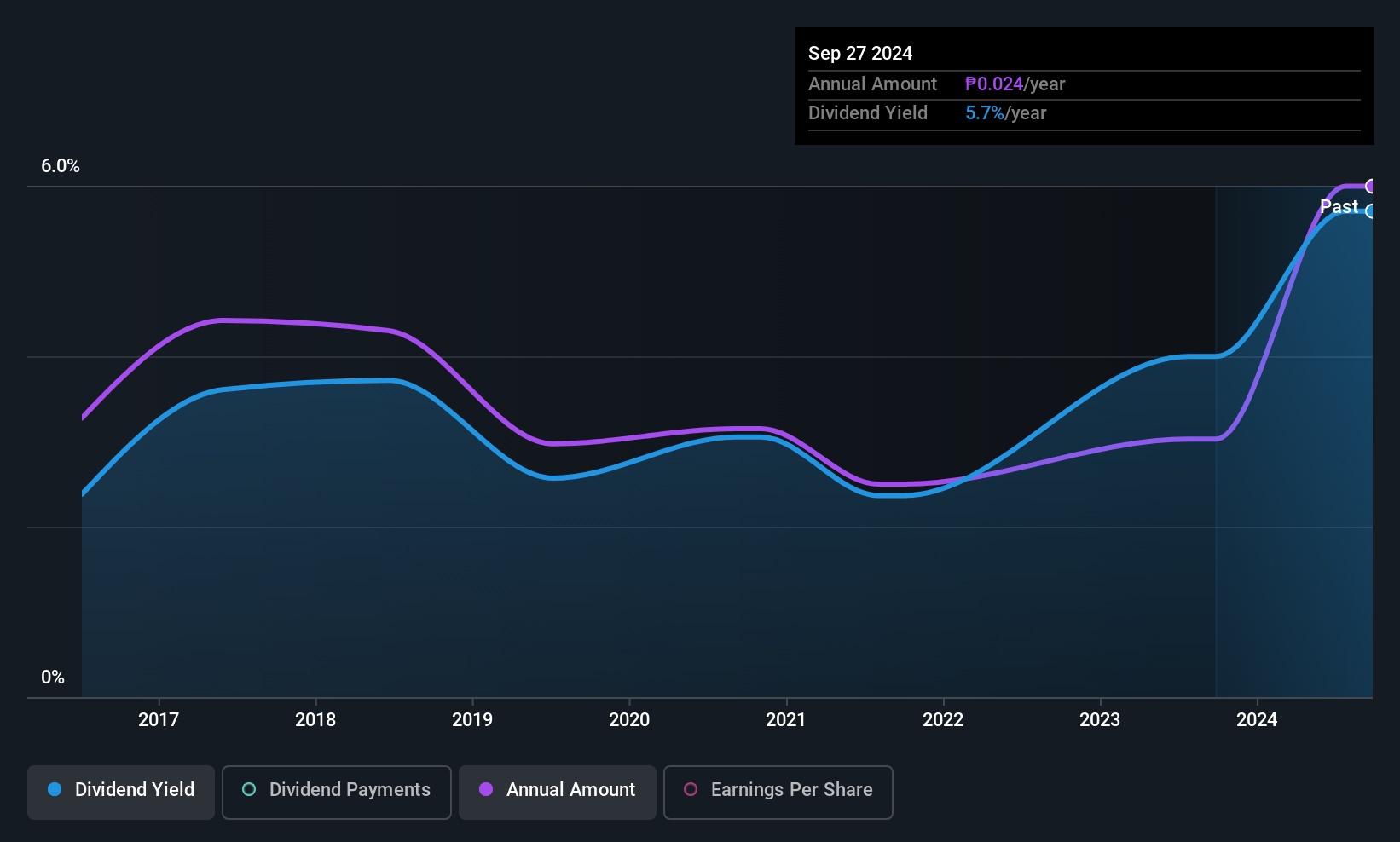

Century Properties Group (PSE:CPG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Century Properties Group, Inc. is a real estate company operating in the Philippines with a market capitalization of approximately ₱8.58 billion.

Operations: Century Properties Group, Inc. generates revenue from several segments including Real Estate Development at ₱13.15 billion, Leasing at ₱1.12 billion, and Property and Hotel Management at ₱626.82 million.

Dividend Yield: 6.6%

Century Properties Group's dividend strategy reflects a robust financial position, with a payout ratio of 20.7% covered by earnings and an 84% cash payout ratio. Recent policy enhancements increased the regular dividend from 10% to 20% of net income, alongside a special dividend for 2025, totaling P610.63 million. Despite past volatility in dividends, the company's strong earnings growth and strategic pivot towards faster turnover projects bolster its ability to sustain these payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Century Properties Group.

- The valuation report we've compiled suggests that Century Properties Group's current price could be inflated.

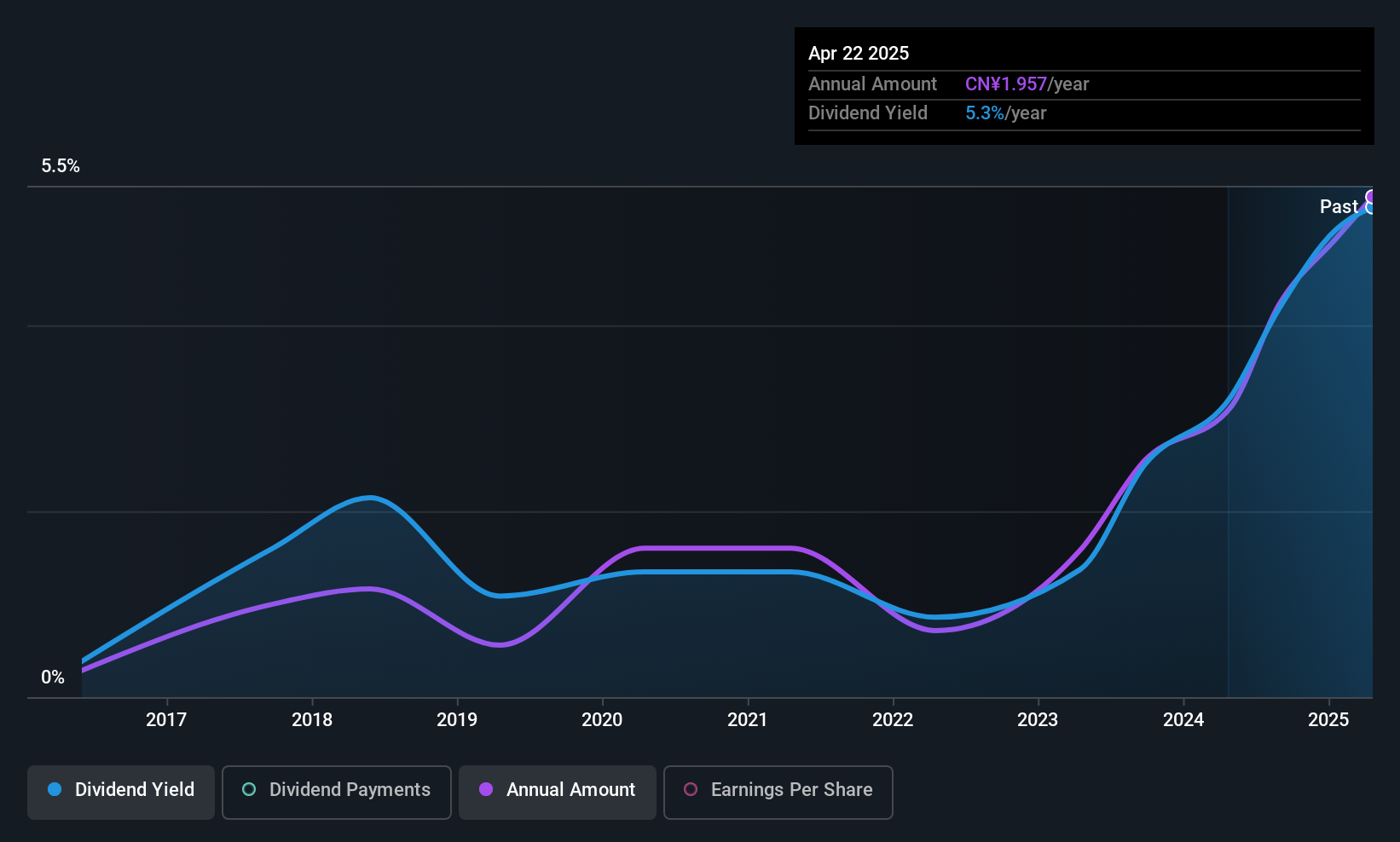

Tibet Rhodiola Pharmaceutical Holding (SHSE:600211)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tibet Rhodiola Pharmaceutical Holding Co. operates in the pharmaceutical industry, focusing on the development and sale of traditional Tibetan medicines, with a market cap of CN¥12.36 billion.

Operations: Tibet Rhodiola Pharmaceutical Holding Co. generates its revenue primarily from the development and sale of traditional Tibetan medicines.

Dividend Yield: 4.7%

Tibet Rhodiola Pharmaceutical Holding's dividends are supported by a 62.5% payout ratio, ensuring coverage by earnings and cash flows with a 76.2% cash payout ratio. Despite its high dividend yield of 4.73%, placing it among the top in the Chinese market, dividends have been historically volatile and unreliable over the past decade. The company trades at a discount to estimated fair value but is affected by large one-off items impacting financial results.

- Get an in-depth perspective on Tibet Rhodiola Pharmaceutical Holding's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Tibet Rhodiola Pharmaceutical Holding is priced lower than what may be justified by its financials.

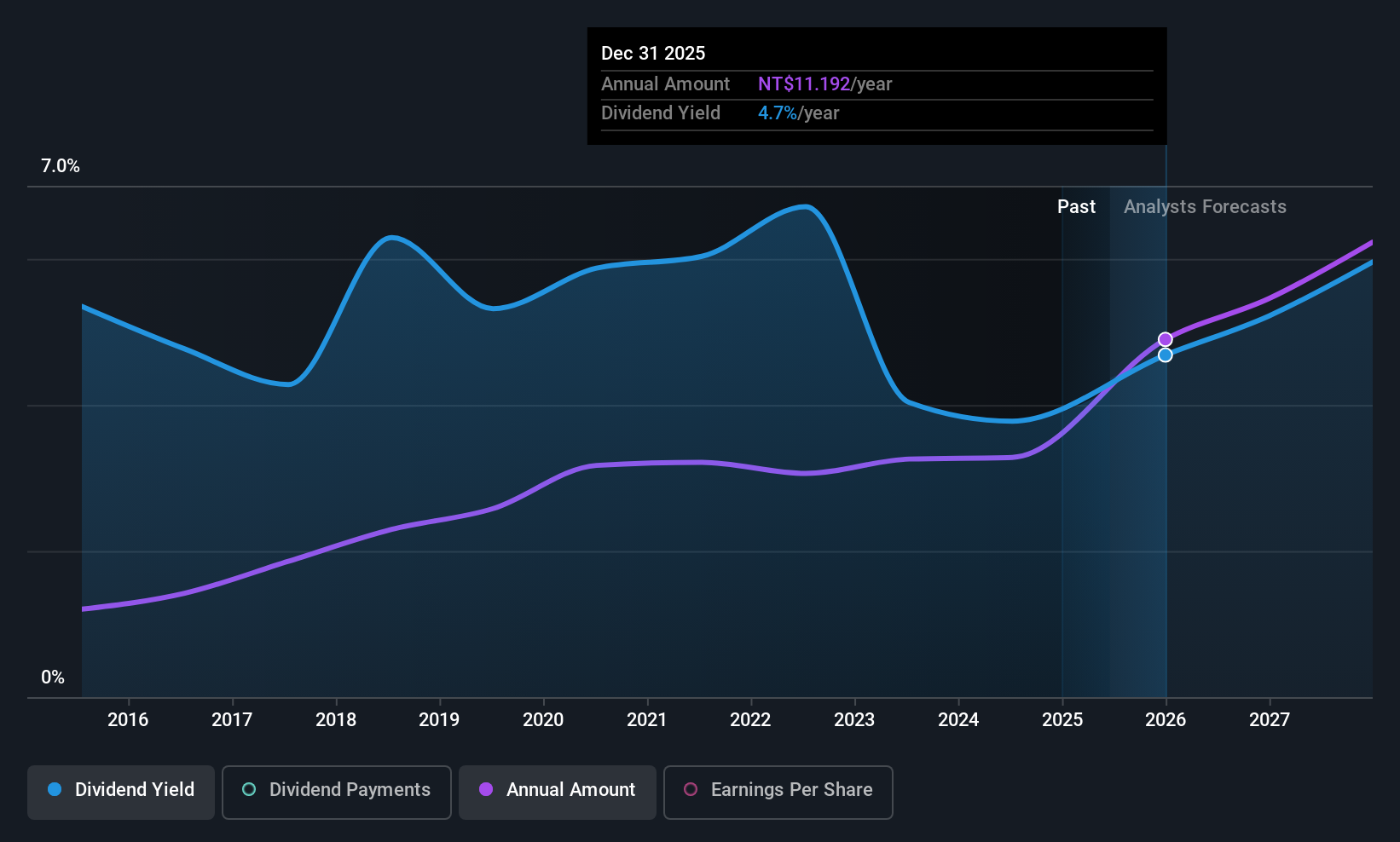

Tripod Technology (TWSE:3044)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tripod Technology Corporation processes, manufactures, and sells printed circuit boards and related components across various countries including Taiwan, China, Vietnam, Thailand, South Korea, Malaysia and has a market cap of approximately NT$130.35 billion.

Operations: Tripod Technology Corporation generates revenue primarily from its Printed Circuit Board segment, which accounts for NT$67.39 billion.

Dividend Yield: 3.8%

Tripod Technology's dividends are well-supported with a payout ratio of 60.8% and a cash payout ratio of 58%, indicating coverage by earnings and cash flows. The dividend yield stands at 3.8%, lower than the top tier in Taiwan, yet payments have been stable and growing over the past decade. Recent approval for a TWD 5.41 billion dividend distribution underscores its commitment to shareholders, while trading at below estimated fair value may offer additional appeal.

- Dive into the specifics of Tripod Technology here with our thorough dividend report.

- Our valuation report unveils the possibility Tripod Technology's shares may be trading at a discount.

Key Takeaways

- Navigate through the entire inventory of 1523 Top Global Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripod Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3044

Tripod Technology

Processes, manufactures, and sells printed circuit boards and other related components in Taiwan, China, Vietnam, Thailand, South Korea, Malaysia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives