- Philippines

- /

- Food

- /

- PSE:FB

Does San Miguel Beer Present an Opportunity After Recent Stock Price Decline?

Reviewed by Simply Wall St

If you have been eyeing San Miguel Food and Beverage on the Philippine Stock Exchange, you are probably wondering if now is a good time to jump in or hold back. The ticker FB has seen plenty of action lately, with its share price dipping slightly over the past week and month, yet showing strong resilience over the longer term. Just take a look at the numbers: the stock is up almost 15% in the past year and has delivered an impressive 47% total return over three years. In addition, with a one-year price target of ₱86 compared to the latest close of ₱53.60, the market is pricing in significant growth potential.

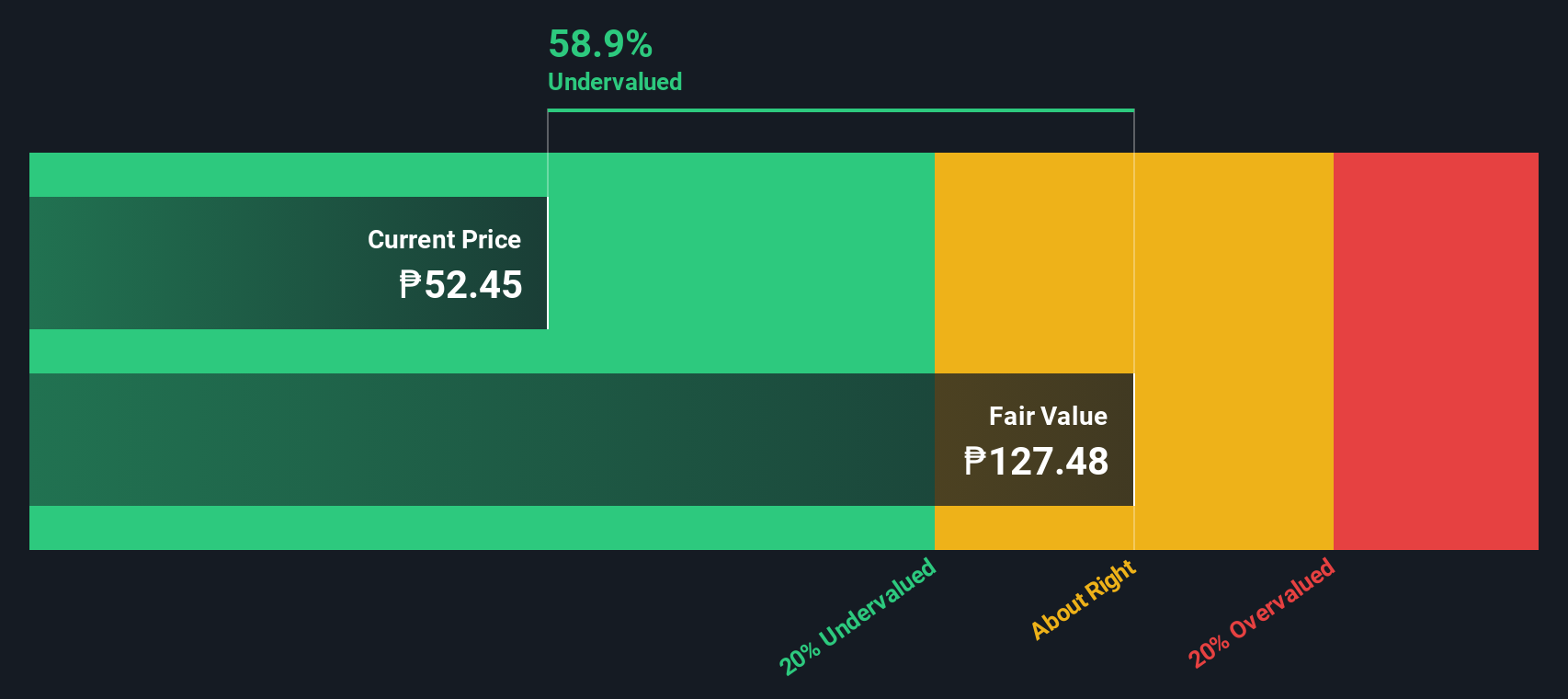

What is catching investors’ attention is not just momentum. The real conversation is around FB’s valuation. Analysts are noting that the stock trades at around a 65% discount to both analyst price targets and intrinsic value estimates, which is substantial in any market. When we break it down across different valuation metrics, FB scores a 4 out of 6 on our undervaluation checks. This is a signal that there is value still to be unlocked, though it is not without its risks and caveats.

So, how do we get a clearer view of whether San Miguel Food and Beverage is truly undervalued? Up next, let us walk through the specific valuation approaches used to score FB and see where it shines, where it falls short, and, if you stick around, the best way to synthesize all of these methods for a more informed investing decision.

San Miguel Food and Beverage delivered 15.0% returns over the last year. See how this stacks up to the rest of the Food industry.Approach 1: San Miguel Food and Beverage Cash Flows

The Discounted Cash Flow (DCF) model is a classic valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. Essentially, it asks: if San Miguel Food and Beverage kept growing at realistic rates, what should its shares be worth right now?

Currently, San Miguel Food and Beverage is generating robust Free Cash Flow of about ₱38.9 billion. Analysts forecast healthy annual growth, with FCF projections rising from ₱44.3 billion in 2026 to an estimated ₱85.8 billion by 2035. When applying the 2 Stage Free Cash Flow to Equity approach, these future cash flows translate into a discounted present value of ₱154.60 per share.

Compared to the latest closing price of ₱53.60, the DCF suggests the stock is about 65.3% undervalued. This sizable gap points to a potentially significant opportunity for investors looking for value in the Food sector.

Result: UNDERVALUED

Approach 2: San Miguel Food and Beverage Price vs Earnings

The Price-to-Earnings (PE) ratio is a long-standing tool for evaluating profitable companies like San Miguel Food and Beverage. It serves to benchmark how much investors are willing to pay for each peso of the company’s earnings. For businesses with steady profits and visibility into future growth, the PE ratio offers a straightforward snapshot of market expectations.

Growth prospects and perceived risks play a key role in determining what is considered a "normal" or "fair" PE ratio. Fast-growing or lower-risk companies often command higher PE multiples, while slower growth or higher uncertainty tend to push valuations lower. Investors often compare these benchmarks against industry peers to assess relative value.

Currently, San Miguel Food and Beverage trades at a PE ratio of 11.19x. In comparison, the average PE for the Food industry stands at 16.36x, while direct peers average around 53.02x. This suggests the market is pricing in more modest growth or a higher level of risk for FB relative to its sector and peers.

Simply Wall St’s proprietary Fair Ratio takes several factors into account, including growth forecasts, profit margins, industry dynamics, and company-specific risks. By considering these elements together, the Fair Ratio provides a tailored benchmark for what the PE multiple should reasonably be for FB. Comparing this figure to the company’s current PE offers insight into possible under- or overvaluation based on multiple dimensions.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your San Miguel Food and Beverage Narrative

While traditional ratios and models offer valuable data, Narratives are a smarter, more powerful way to shape your investment decisions. A Narrative is your story behind the numbers, capturing your own assumptions and perspectives on a company’s future performance, such as your expectations for San Miguel Food and Beverage’s revenue growth or profit margins, then using those views to create a fair value estimate.

With Narratives on Simply Wall St, millions of investors build and share their investment stories simply by linking company outlooks to concrete financial forecasts and valuations. This approach helps you clearly see when to buy or sell by comparing your Narrative's fair value to the current market price, making decision-making more straightforward and personal.

What makes Narratives truly dynamic is that they automatically update as new information, such as earnings announcements or market-moving news, flows in. This allows your investment outlook to evolve alongside real-world events. For instance, some investors see San Miguel Food and Beverage’s fair value as being on the high end due to aggressive future growth expectations, while others adopt a more conservative view with lower fair value estimates.

Do you think there's more to the story for San Miguel Food and Beverage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:FB

San Miguel Food and Beverage

Manufactures and markets processed meat products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success