- Philippines

- /

- Hospitality

- /

- PSE:PLUS

Global Market's Top 3 Stocks That Might Be Undervalued In May 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by trade negotiations and cautious monetary policies, investors are keenly observing the mixed performance of major indices like the S&P 500 and Nasdaq Composite. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential value amid economic uncertainties and shifting trade dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DigiPlus Interactive (PSE:PLUS) | ₱45.50 | ₱89.70 | 49.3% |

| Maire (BIT:MAIRE) | €9.875 | €19.55 | 49.5% |

| Sword Group (ENXTPA:SWP) | €31.40 | €62.63 | 49.9% |

| Hunan SUND Technological (SZSE:301548) | CN¥48.09 | CN¥95.24 | 49.5% |

| Benefit Systems (WSE:BFT) | PLN3500.00 | PLN6989.78 | 49.9% |

| Sanil Electric (KOSE:A062040) | ₩60800.00 | ₩119176.92 | 49% |

| Newborn Town (SEHK:9911) | HK$8.42 | HK$16.55 | 49.1% |

| Dive (TSE:151A) | ¥946.00 | ¥1852.06 | 48.9% |

| dormakaba Holding (SWX:DOKA) | CHF711.00 | CHF1399.70 | 49.2% |

| Northern Data (DB:NB2) | €24.96 | €49.78 | 49.9% |

Here's a peek at a few of the choices from the screener.

DigiPlus Interactive (PSE:PLUS)

Overview: DigiPlus Interactive Corp., with a market cap of ₱195.55 billion, operates as a digital entertainment company in the Philippines through its subsidiaries.

Operations: DigiPlus Interactive Corp. generates revenue through its subsidiaries in the digital entertainment sector within the Philippines.

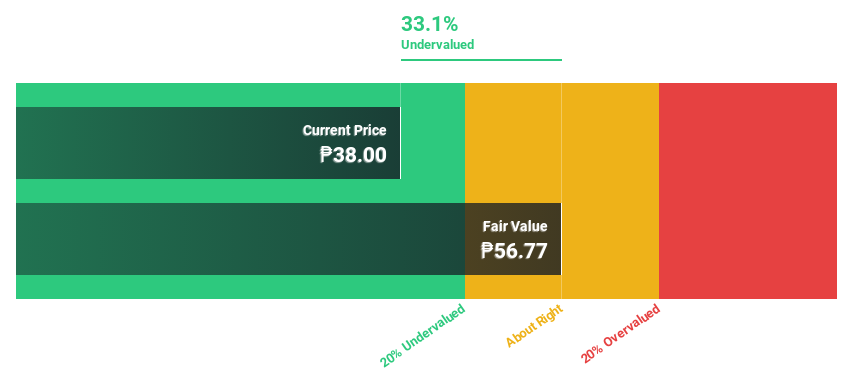

Estimated Discount To Fair Value: 49.3%

DigiPlus Interactive is trading significantly below its estimated fair value, presenting a potentially undervalued opportunity based on cash flows. Despite substantial insider selling, the company's earnings grew by 161.7% over the past year and are expected to continue growing at 23.2% annually, outpacing the Philippine market. Recent Q1 results showed strong performance with net income reaching ₱4.20 billion compared to ₱1.99 billion last year, supporting its growth trajectory amidst international expansion efforts in Singapore.

- Our earnings growth report unveils the potential for significant increases in DigiPlus Interactive's future results.

- Take a closer look at DigiPlus Interactive's balance sheet health here in our report.

Sahara International Petrochemical (SASE:2310)

Overview: Sahara International Petrochemical Company is involved in the ownership, establishment, operation, and management of industrial projects within the chemical and petrochemical sectors in Saudi Arabia, with a market cap of SAR13.80 billion.

Operations: The company's revenue segments include Polymers at SAR2.26 billion, Marketing at SAR4.85 billion, Basic Chemicals at SAR2.22 billion, and Intermediate Chemicals at SAR2.15 billion.

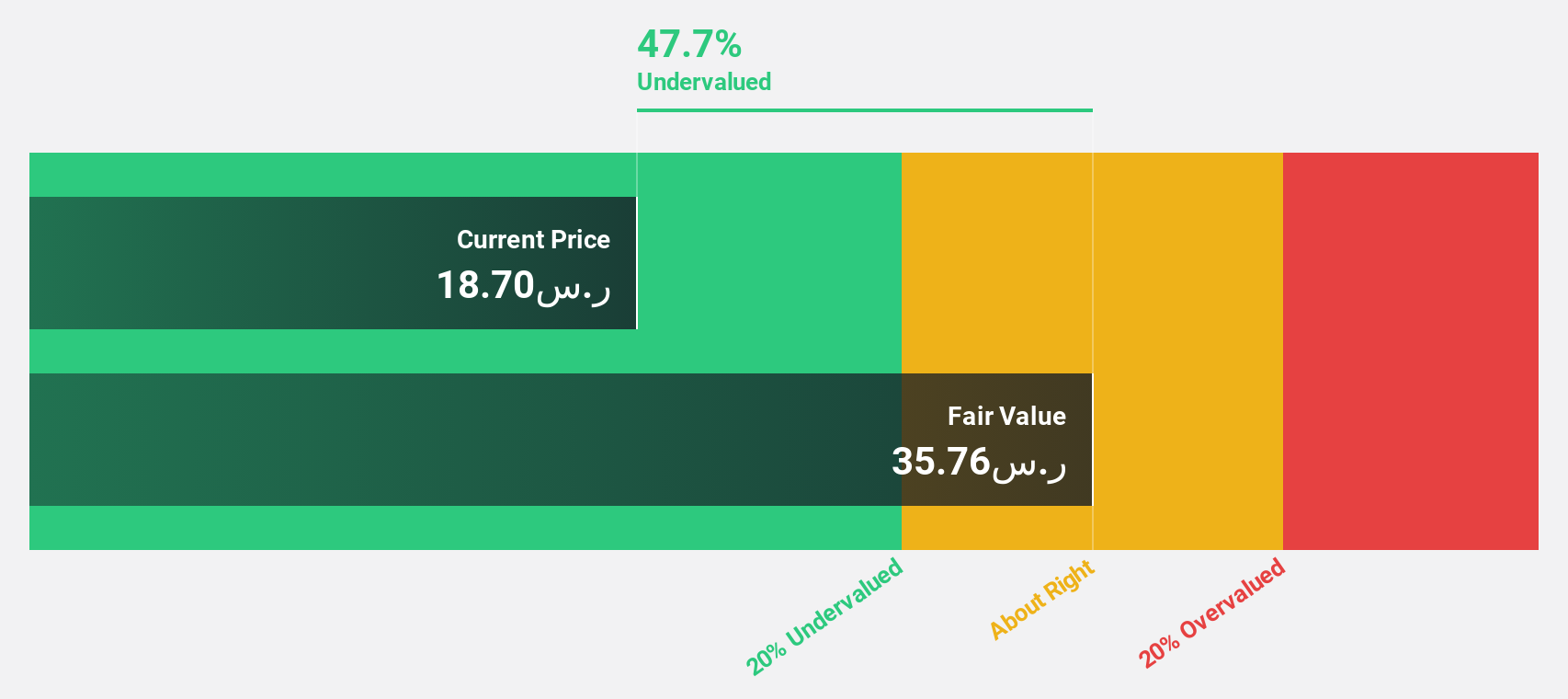

Estimated Discount To Fair Value: 15.4%

Sahara International Petrochemical is trading at SAR19.1, below its estimated fair value of SAR22.58, suggesting it may be undervalued based on cash flows. Earnings are expected to grow significantly at 35.61% annually over the next three years, outpacing the SA market. However, profit margins have declined from 15.4% to 6%, and the dividend yield of 5.24% is not well covered by earnings or free cash flows, indicating potential financial pressures despite growth prospects.

- Insights from our recent growth report point to a promising forecast for Sahara International Petrochemical's business outlook.

- Get an in-depth perspective on Sahara International Petrochemical's balance sheet by reading our health report here.

Acom (TSE:8572)

Overview: Acom Co., Ltd. provides loans, credit cards, and loan guarantee services both in Japan and internationally, with a market cap of ¥657.35 billion.

Operations: Acom generates revenue through its offerings in loans, credit cards, and loan guarantee services across domestic and international markets.

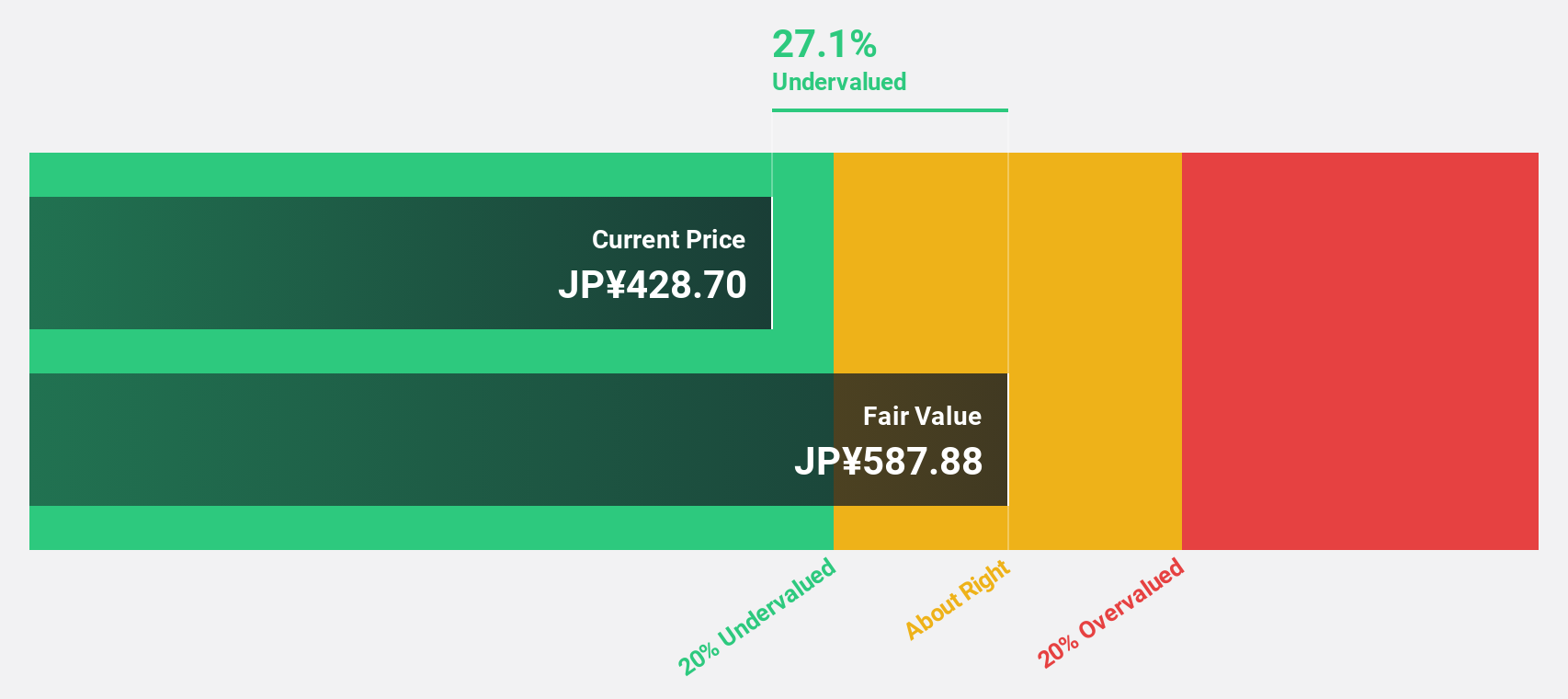

Estimated Discount To Fair Value: 30.2%

Acom is trading at ¥417.9, below its estimated fair value of ¥598.46, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 35% annually, surpassing the JP market's growth rate. However, profit margins have decreased from 18% to 10.1%, and dividends remain inadequately covered by free cash flows despite recent increases in dividend payouts per share for the upcoming fiscal year ending March 2026.

- In light of our recent growth report, it seems possible that Acom's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Acom.

Next Steps

- Dive into all 465 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives