- Philippines

- /

- Hospitality

- /

- PSE:PLUS

DigiPlus Interactive (PSE:PLUS) Expands Into South Africa's Online Gambling Market

Reviewed by Simply Wall St

DigiPlus Interactive (PSE:PLUS) recently amended its By-Laws and announced the initiation of its expansion into South Africa's online gambling market. However, despite these developments, the company's share price declined by 19% over the past month. This move contrasts with the broader market trends, where major indices experienced a downturn due to macroeconomic factors like renewed tariff concerns. Although DigiPlus's planned business expansion and share buyback initiatives might have been expected to bolster investor sentiment, they seemingly added more weight to the bearish market pressures reflected in the company's declining share price.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past five years, DigiPlus Interactive (PSE:PLUS) has achieved a very large total return of 1839.35%, a testament to its long-term growth despite the recent share price decline. In the past year, DigiPlus has outperformed the Philippine hospitality industry, which posted a 2.4% decline, indicating a strong relative performance in the short term. This contrast highlights the company's resilience in weathering broader market pressures.

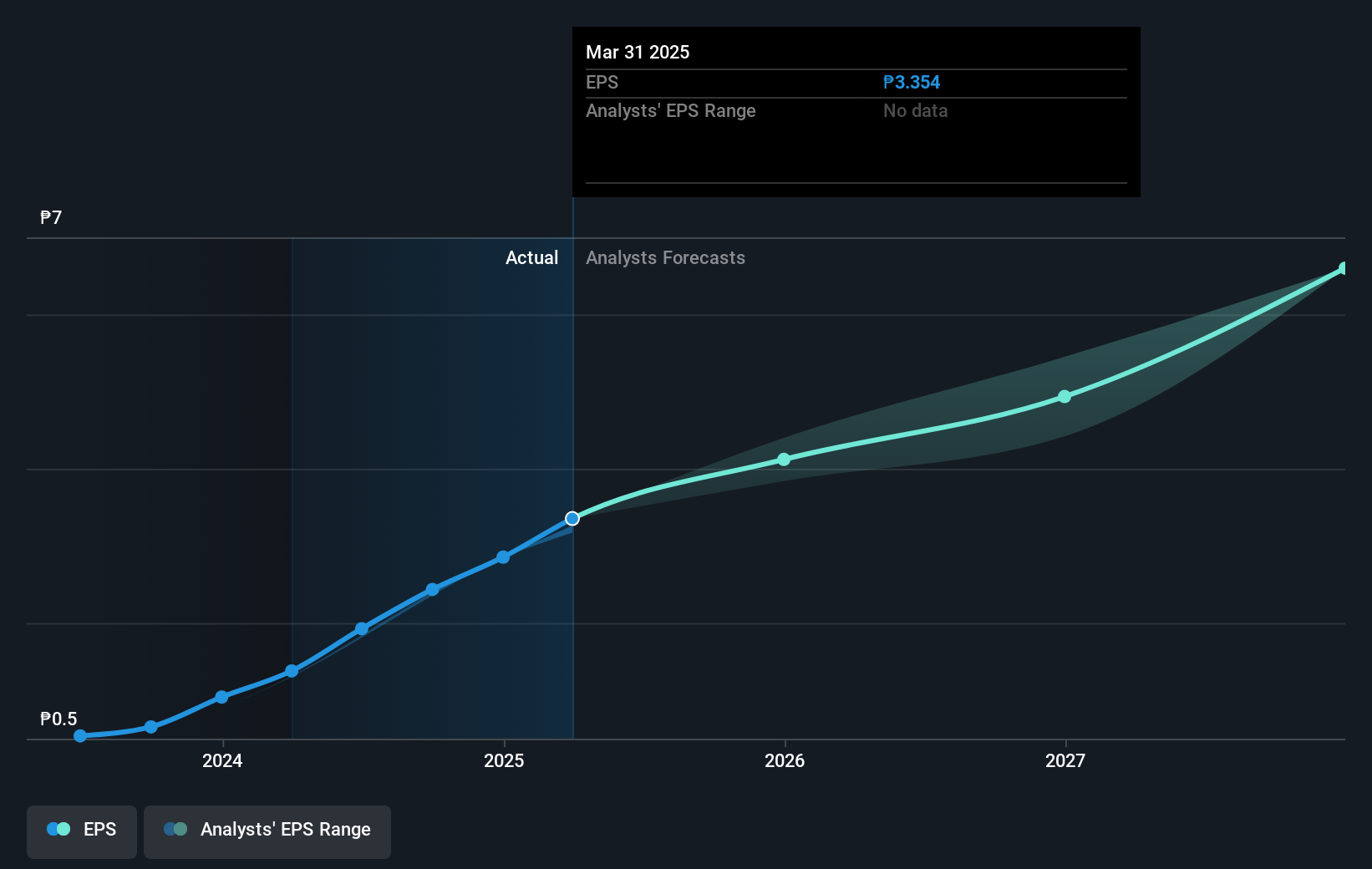

The company's entry into new markets such as South Africa and Brazil, as well as the recent by-law amendments, are expected to influence revenue and earnings growth forecasts positively. Analysts predict DigiPlus's earnings to grow at 18.9% per year, supported by the upcoming geographical expansions. Despite the recent share price dip to ₱23.90, the significant gap between the current price and the consensus price target of ₱64.77 suggests considerable potential for future appreciation. While the share buyback plan might initially weigh on the stock due to market volatility, it demonstrates management's confidence in the company's underlying value and growth prospects.

Learn about DigiPlus Interactive's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives