3 Global Growth Stocks With Insider Ownership Expecting Up To 45% Revenue Growth

Reviewed by Simply Wall St

In the midst of a turbulent global market, characterized by U.S. stock declines amid Treasury market volatility and renewed tariff threats, investors are increasingly seeking stability and growth potential in their portfolios. As major indices like the S&P 500 and Nasdaq Composite face downward pressure, companies with strong insider ownership and promising revenue growth forecasts can offer a compelling opportunity for those looking to navigate these challenging conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| Laopu Gold (SEHK:6181) | 22% | 40.6% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| Elliptic Laboratories (OB:ELABS) | 25.8% | 79% |

Here we highlight a subset of our preferred stocks from the screener.

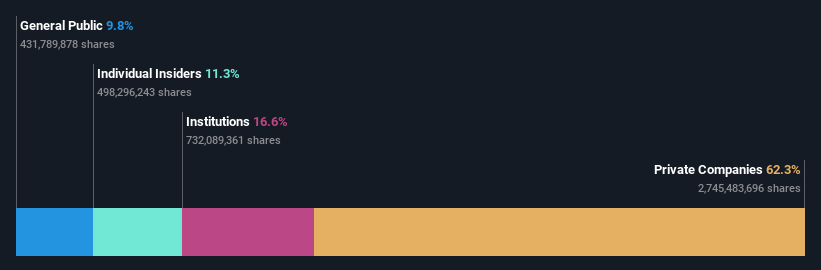

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DigiPlus Interactive Corp., with a market cap of ₱226.24 billion, operates as a digital entertainment company in the Philippines through its subsidiaries.

Operations: The company generates revenue through its Casino Group (₱503.77 million), Retail Group (₱83.81 billion), and Network and License Group (₱414.68 million) segments in the Philippines.

Insider Ownership: 11.3%

Revenue Growth Forecast: 18.5% p.a.

DigiPlus Interactive has demonstrated robust growth, with earnings increasing by 161.7% over the past year and forecasted to grow faster than the Philippine market at 23.2% annually. Despite substantial insider selling recently, the company is trading at a favorable value, 40.4% below its estimated fair value. The recent incorporation of DigiPlus Global in Singapore aims to bolster international expansion and enhance digital platform innovations like BingoPlus and ArenaPlus.

- Click to explore a detailed breakdown of our findings in DigiPlus Interactive's earnings growth report.

- In light of our recent valuation report, it seems possible that DigiPlus Interactive is trading behind its estimated value.

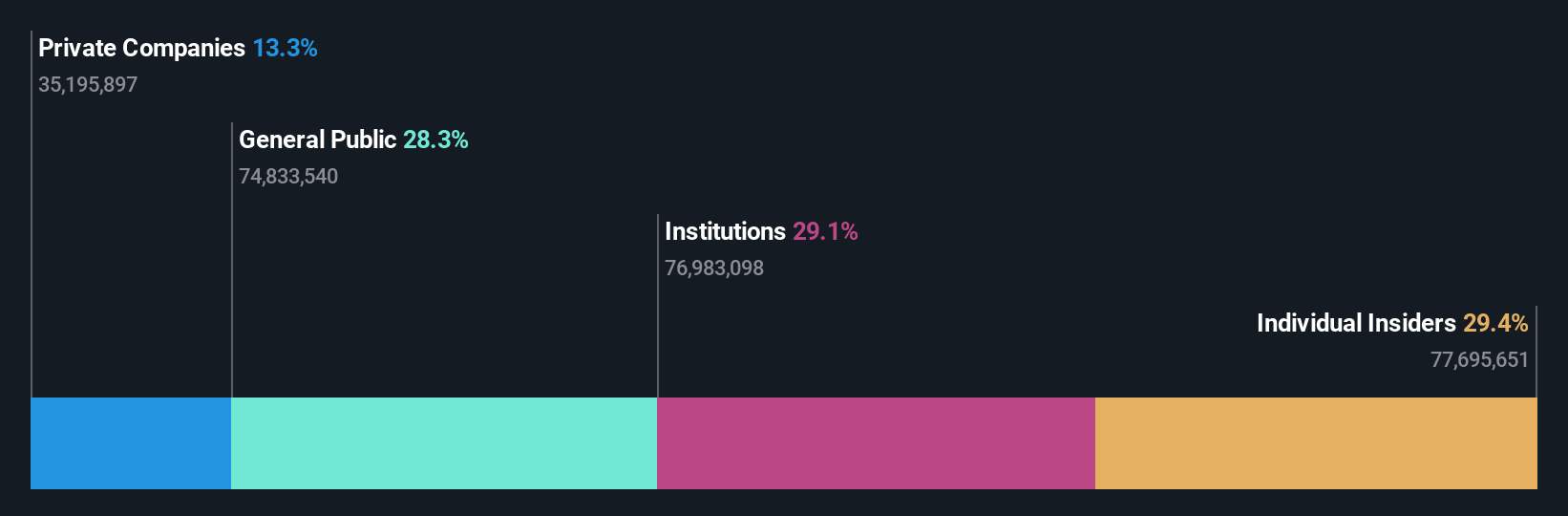

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company focused on the research, development, and commercialization of innovative drugs, with a market cap of CN¥28.42 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling CN¥592.35 million.

Insider Ownership: 29.4%

Revenue Growth Forecast: 45.4% p.a.

Suzhou Zelgen Biopharmaceuticals is experiencing significant growth, with revenue increasing to CNY 167.64 million in Q1 2025 from CNY 108.24 million the previous year, and a reduced net loss of CNY 28.26 million. The company is trading at a considerable discount to its estimated fair value and anticipates revenue growth of over 45% annually, outpacing the Chinese market's average. Despite high share price volatility, profitability is expected within three years.

- Take a closer look at Suzhou Zelgen BiopharmaceuticalsLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Suzhou Zelgen BiopharmaceuticalsLtd's shares may be trading at a premium.

Semitronix (SZSE:301095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semitronix Corporation offers characterization and yield improvement solutions for the semiconductor industry both in China and internationally, with a market cap of CN¥11.18 billion.

Operations: Revenue Segments (in millions of CN¥): Characterization solutions: 1,200; Yield improvement solutions: 950.

Insider Ownership: 34.3%

Revenue Growth Forecast: 23.8% p.a.

Semitronix exhibits promising growth potential, with revenue forecast to grow 23.8% annually, surpassing the Chinese market average. Earnings are expected to increase significantly at 30.6% per year. Despite a volatile share price and low future return on equity of 5.2%, recent earnings reports show improved financials, reducing net loss from CNY 22.9 million to CNY 13.71 million in Q1 2025 compared to the previous year, reflecting operational improvements amidst high insider ownership dynamics.

- Get an in-depth perspective on Semitronix's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Semitronix implies its share price may be too high.

Where To Now?

- Explore the 846 names from our Fast Growing Global Companies With High Insider Ownership screener here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301095

Semitronix

Provides characterization and yield improvement solutions for the semiconductor industry in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion