- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A068930

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by China's economic slowdown and Japan's cautious monetary policy, investors are increasingly looking for stability in the form of dividend stocks. In this environment, selecting stocks that offer consistent dividends can provide a reliable income stream while potentially mitigating market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.80% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.37% | ★★★★★★ |

| NCD (TSE:4783) | 4.58% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.66% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.84% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1057 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

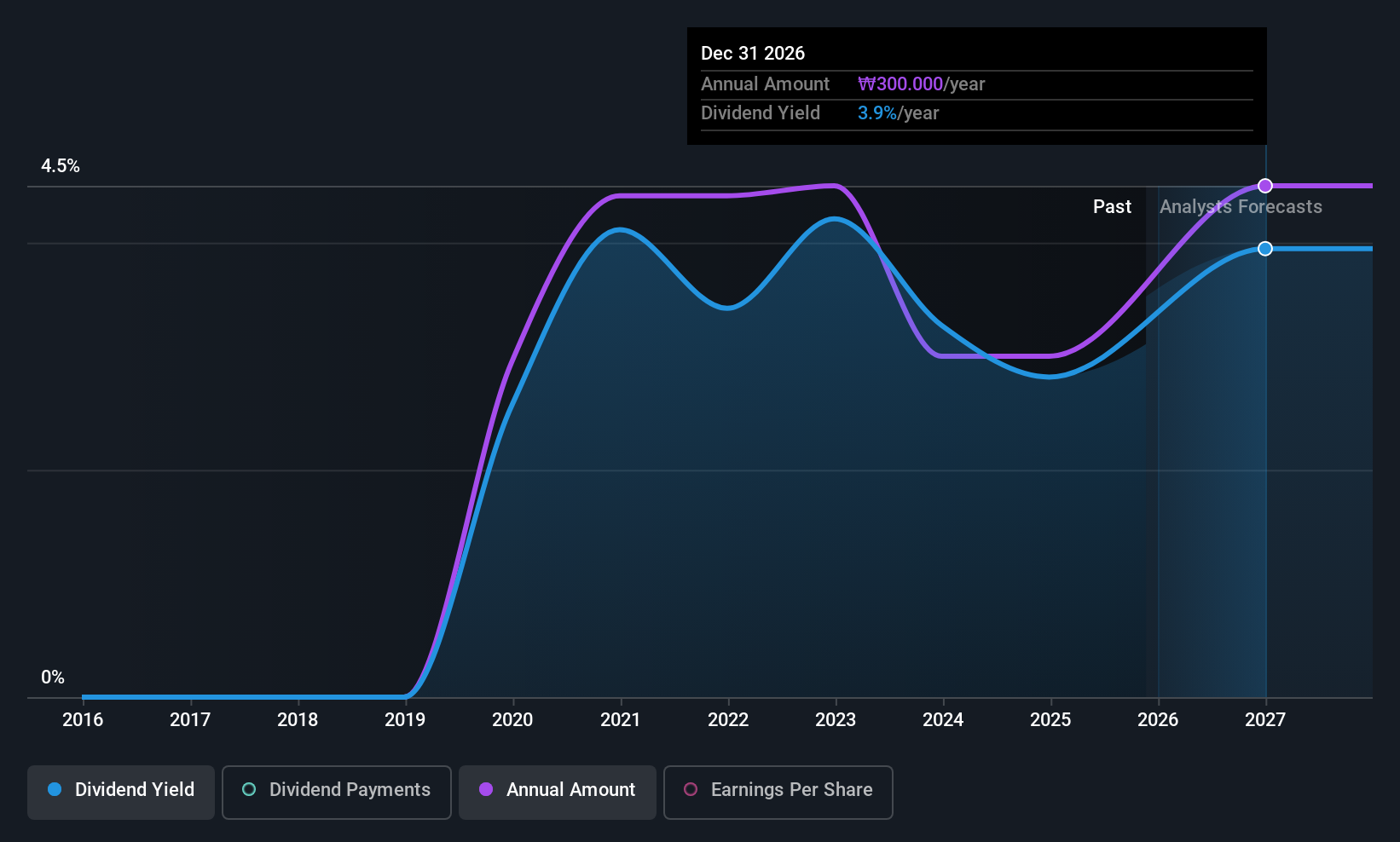

Digital Daesung (KOSDAQ:A068930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Digital Daesung Co., Ltd. offers online and offline educational services both in South Korea and internationally, with a market cap of approximately ₩202.82 billion.

Operations: Digital Daesung Co., Ltd. generates revenue through its provision of educational services across both digital platforms and physical locations, catering to markets within South Korea and abroad.

Dividend Yield: 6.5%

Digital Daesung's dividend yield of 6.46% ranks in the top 25% of KR market payers, supported by a reasonable payout ratio (63.4%) and cash flow coverage (32.7%). However, its dividend history is less stable, with volatility and unreliability over six years. Despite this, the company trades at a good value compared to peers and plans to repurchase up to ₩5 billion in shares by May 2026, potentially enhancing shareholder value amidst recent earnings growth.

- Click here to discover the nuances of Digital Daesung with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Digital Daesung shares in the market.

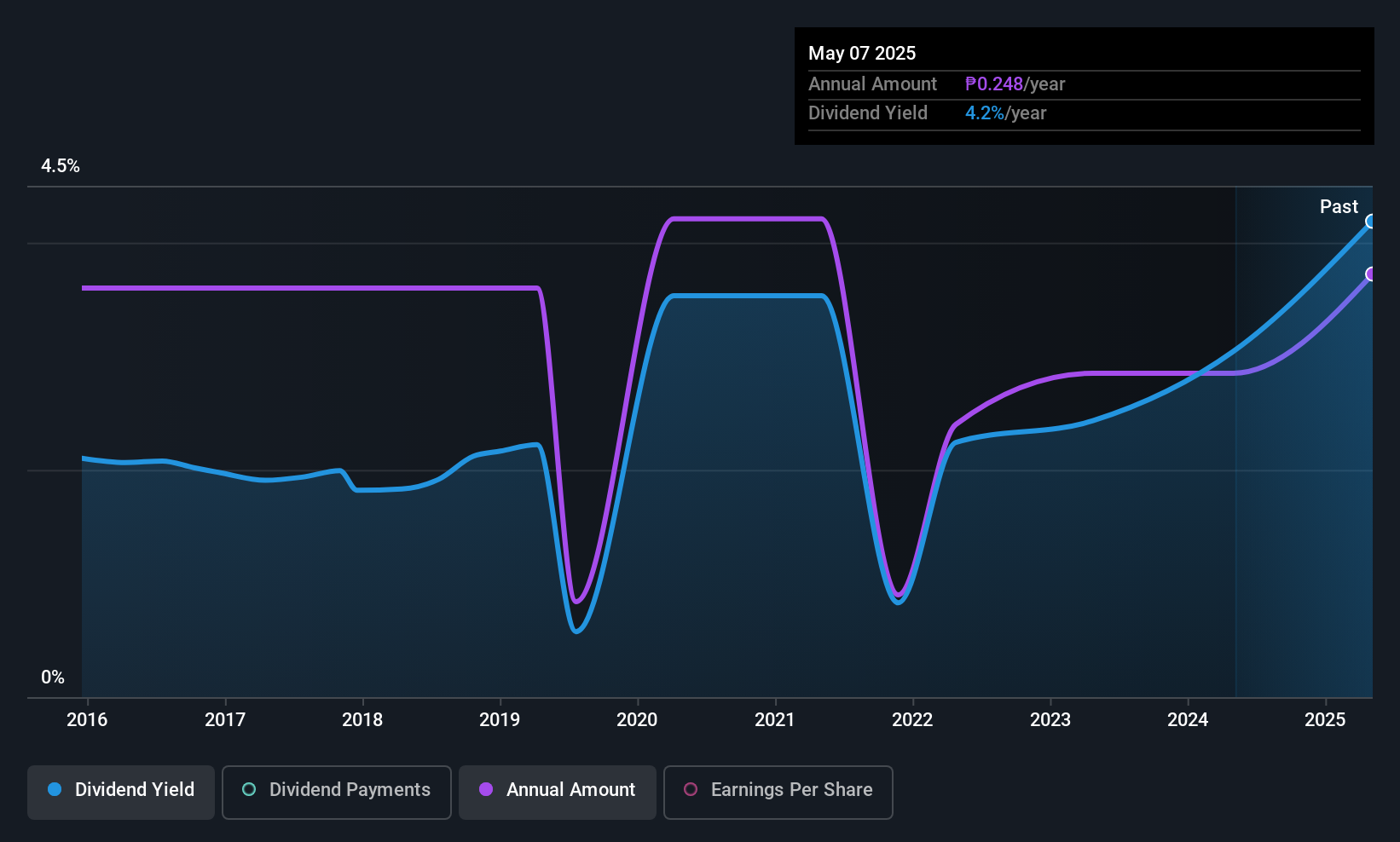

iPeople (PSE:IPO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: iPeople, Inc., along with its subsidiaries, operates in the education sector in the Philippines and has a market capitalization of approximately ₱6.46 billion.

Operations: iPeople, Inc., through its subsidiaries, generates revenue of ₱5.97 billion primarily from its operations in the education sector in the Philippines.

Dividend Yield: 4%

iPeople's dividend payments have grown over the past decade and are well covered by cash flows, with a low cash payout ratio of 17.7% and an earnings payout ratio of 24.9%. However, dividends have been volatile and unreliable, with significant annual drops exceeding 20%. Despite trading at a substantial discount to its estimated fair value, iPeople's dividend yield of 4.01% is below the top tier in the PH market. Recent earnings growth may provide some optimism for future stability.

- Unlock comprehensive insights into our analysis of iPeople stock in this dividend report.

- Our valuation report unveils the possibility iPeople's shares may be trading at a discount.

Jiin Yeeh Ding Enterprises (TPEX:8390)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiin Yeeh Ding Enterprises Corp. is a professional electronic waste recycling and treatment company offering e-waste disposal services to technology companies in Taiwan, with a market cap of NT$7.43 billion.

Operations: Jiin Yeeh Ding Enterprises Corp. generates revenue of NT$4.63 billion from its waste management segment, focusing on electronic waste recycling and treatment services for technology companies in Taiwan.

Dividend Yield: 3.2%

Jiin Yeeh Ding Enterprises' dividends are well-covered with a payout ratio of 50.9% and a cash payout ratio of 35.5%. The company has delivered reliable and stable dividend growth over the past decade, although its yield of 3.23% is below the top tier in Taiwan's market. Recent earnings growth of 44.4% highlights strong financial performance, despite a drop in sales to TWD 990.31 million for Q3 2025 from TWD 1,440.8 million last year.

- Get an in-depth perspective on Jiin Yeeh Ding Enterprises' performance by reading our dividend report here.

- According our valuation report, there's an indication that Jiin Yeeh Ding Enterprises' share price might be on the cheaper side.

Make It Happen

- Investigate our full lineup of 1057 Top Asian Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A068930

Digital Daesung

Provides online and offline educational services in South Korea and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives