- Philippines

- /

- Consumer Services

- /

- PSE:FEU

Top Global Dividend Stocks With Up To 5.6% Yield

Reviewed by Simply Wall St

Amidst global economic uncertainty and inflation concerns, investors are navigating a challenging landscape with U.S. stocks experiencing declines due to trade policy uncertainties and growth worries. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking for reliable returns amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.18% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 4.09% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.78% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.21% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

Click here to see the full list of 1527 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

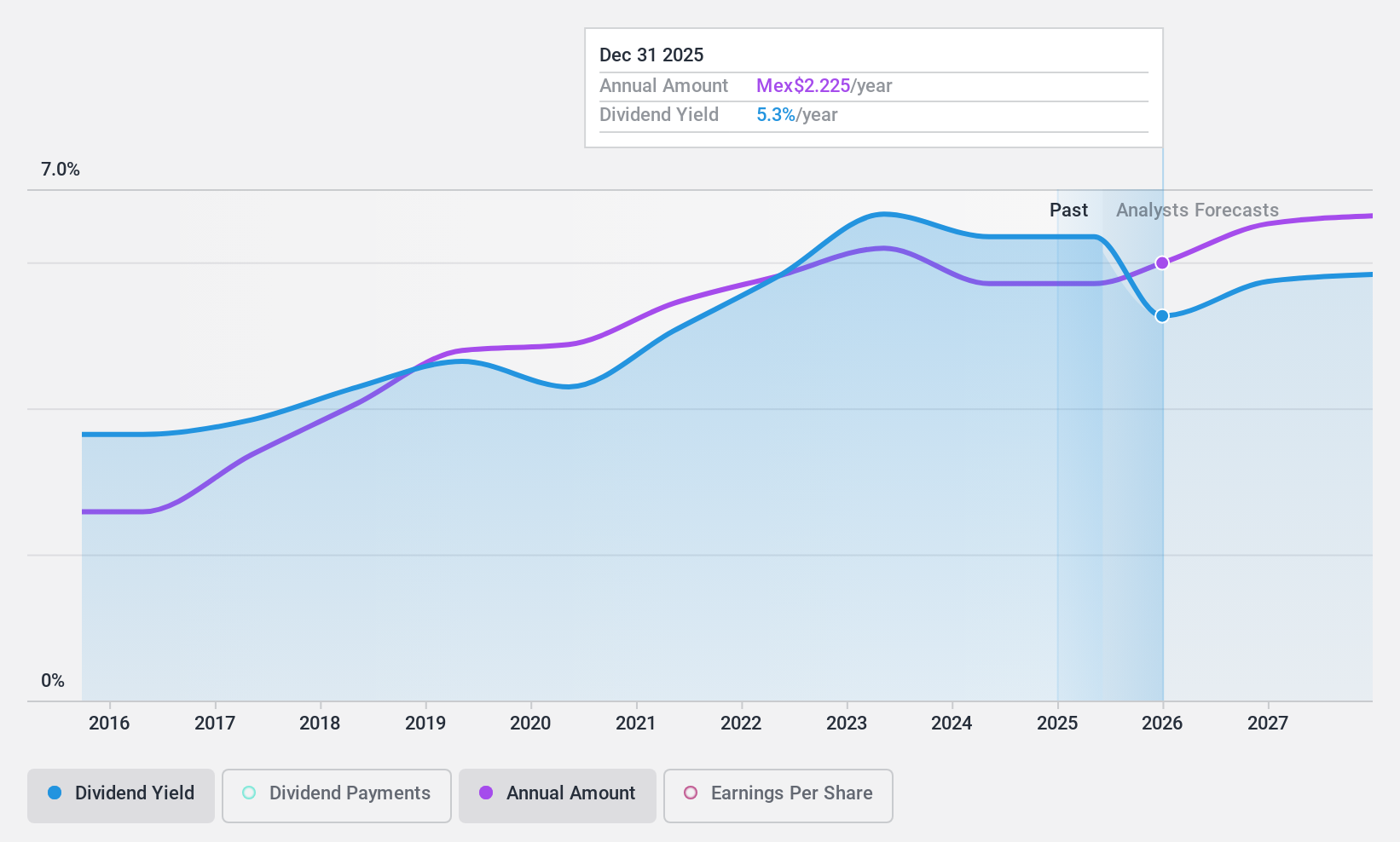

Bolsa Mexicana de Valores. de (BMV:BOLSA A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bolsa Mexicana de Valores, S.A.B. de C.V. operates as the primary stock exchange in Mexico with a market capitalization of MX$21.05 billion.

Operations: Bolsa Mexicana de Valores, S.A.B. de C.V. generates revenue through several segments, including Capital (MX$506.79 million), Derivatives (MX$254.64 million), OTC (SIF ICAP) (MX$694.84 million), Capital Formation (MX$518.51 million), Information Services (MX$735.27 million), and Central Securities Depository (Indeval) with MX$1.21 billion in revenue.

Dividend Yield: 5.6%

Bolsa Mexicana de Valores offers a reliable dividend yield of 5.64%, though slightly below the top 25% in Mexico's market. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 80.4% and 62.6%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and consistently growing, supported by an annual earnings growth of 8.5%. Recent financials show increased sales to MX$4.17 billion and net income to MX$1.64 billion for 2024.

- Get an in-depth perspective on Bolsa Mexicana de Valores. de's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Bolsa Mexicana de Valores. de is priced higher than what may be justified by its financials.

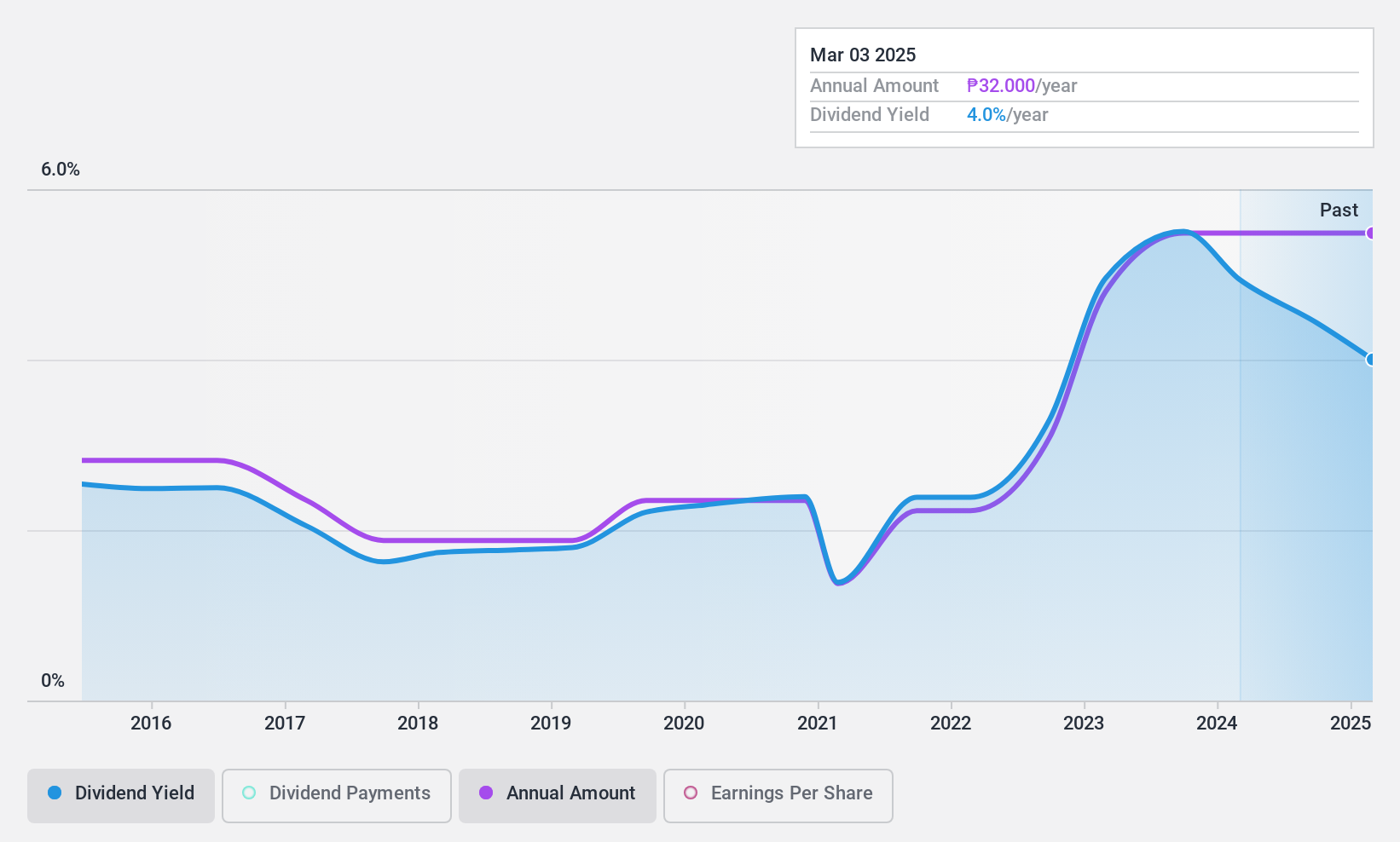

Far Eastern University (PSE:FEU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Far Eastern University, Incorporated operates an educational institution in Manila, the Philippines, with a market cap of ₱18.22 billion.

Operations: Far Eastern University, Incorporated generates revenue from its main campus (₱2.91 billion), other schools (₱907.22 million), and trimestral schools (₱1.80 billion).

Dividend Yield: 3.4%

Far Eastern University offers a dividend yield of 3.38%, lower than the top 25% in the Philippines market. While dividends are well-covered by earnings and cash flows, with payout ratios of 38.7% and 52.9%, their track record is unstable, showing volatility over the past decade despite some growth. Recent earnings reports highlight increased revenue to PHP 2.33 billion and net income to PHP 629.82 million for six months ending November 2024, supporting dividend payments declared at PHP 16 per share for March 2025 distribution.

- Click here and access our complete dividend analysis report to understand the dynamics of Far Eastern University.

- Our valuation report here indicates Far Eastern University may be overvalued.

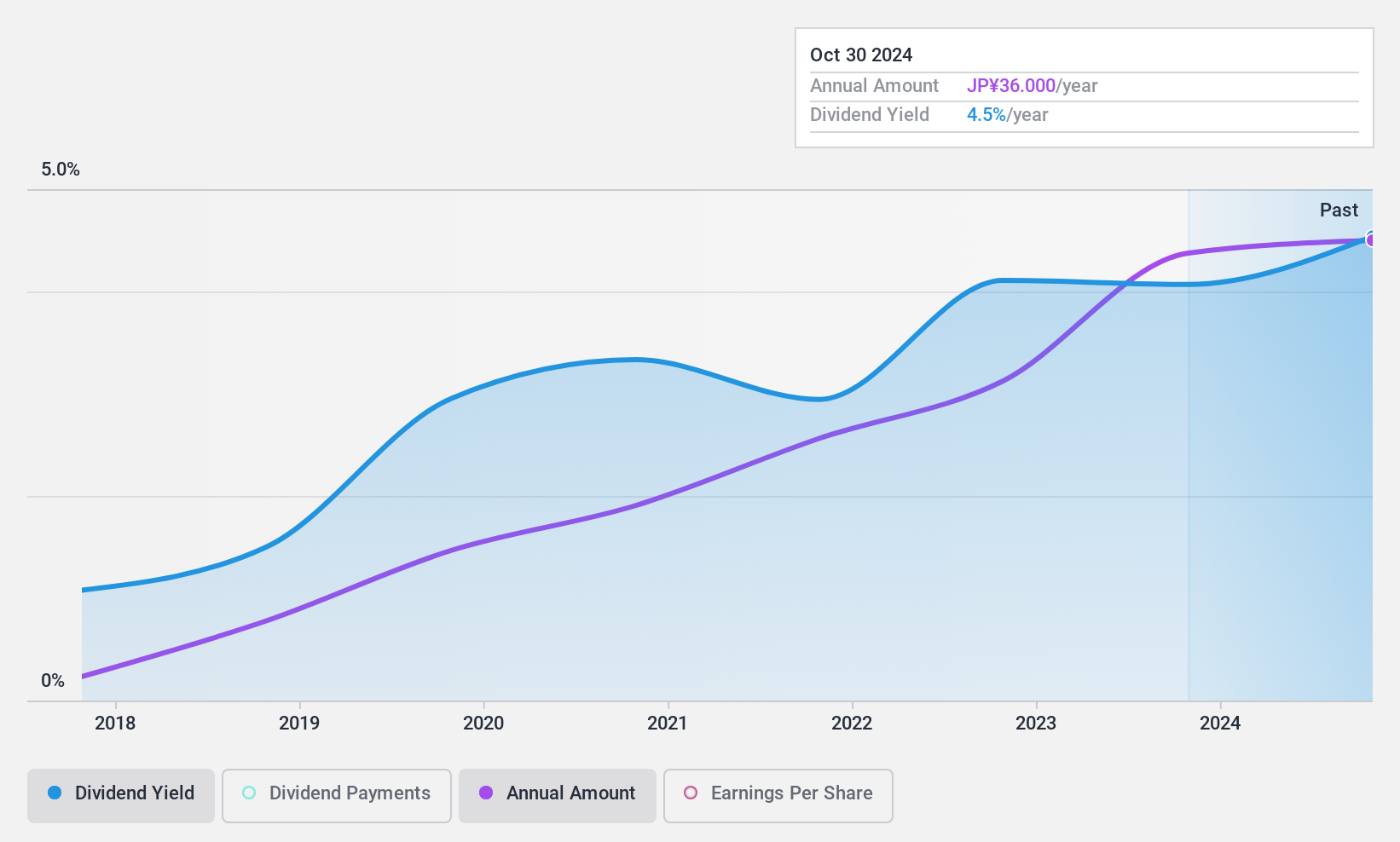

Good Com Asset (TSE:3475)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Good Com Asset Co., Ltd. plans, develops, and sells residential condominiums and lots under the GENOVIA brand in Japan and internationally, with a market cap of ¥22.14 billion.

Operations: Good Com Asset Co., Ltd.'s revenue is derived from wholesale operations at ¥44.26 billion, retail sales totaling ¥12.57 billion, and real estate management contributing ¥2.47 billion.

Dividend Yield: 4.8%

Good Com Asset's dividend yield of 4.82% ranks in the top 25% of JP market payers and is well-supported by a low payout ratio of 36.4% and cash payout ratio of 4.9%. Despite only eight years of consistent dividends, recent earnings growth at ¥451.74 million supports sustainability. The company completed a share buyback, acquiring 537,000 shares for ¥451.74 million, enhancing shareholder value amidst discussions on new shareholder benefits following its Fukuoka Stock Exchange listing.

- Take a closer look at Good Com Asset's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Good Com Asset is priced lower than what may be justified by its financials.

Summing It All Up

- Navigate through the entire inventory of 1527 Top Global Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:FEU

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives