- Japan

- /

- Construction

- /

- TSE:1835

Uncovering None's Hidden Gems With Strong Potential

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming their larger counterparts, investor sentiment is buoyed by strong labor market indicators and stabilizing economic conditions. In this environment, identifying undiscovered gems—stocks that demonstrate strong fundamentals and potential for growth—can offer intriguing opportunities for investors seeking to capitalize on the positive momentum in small-cap sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Cosco Capital (PSE:COSCO)

Simply Wall St Value Rating: ★★★★★☆

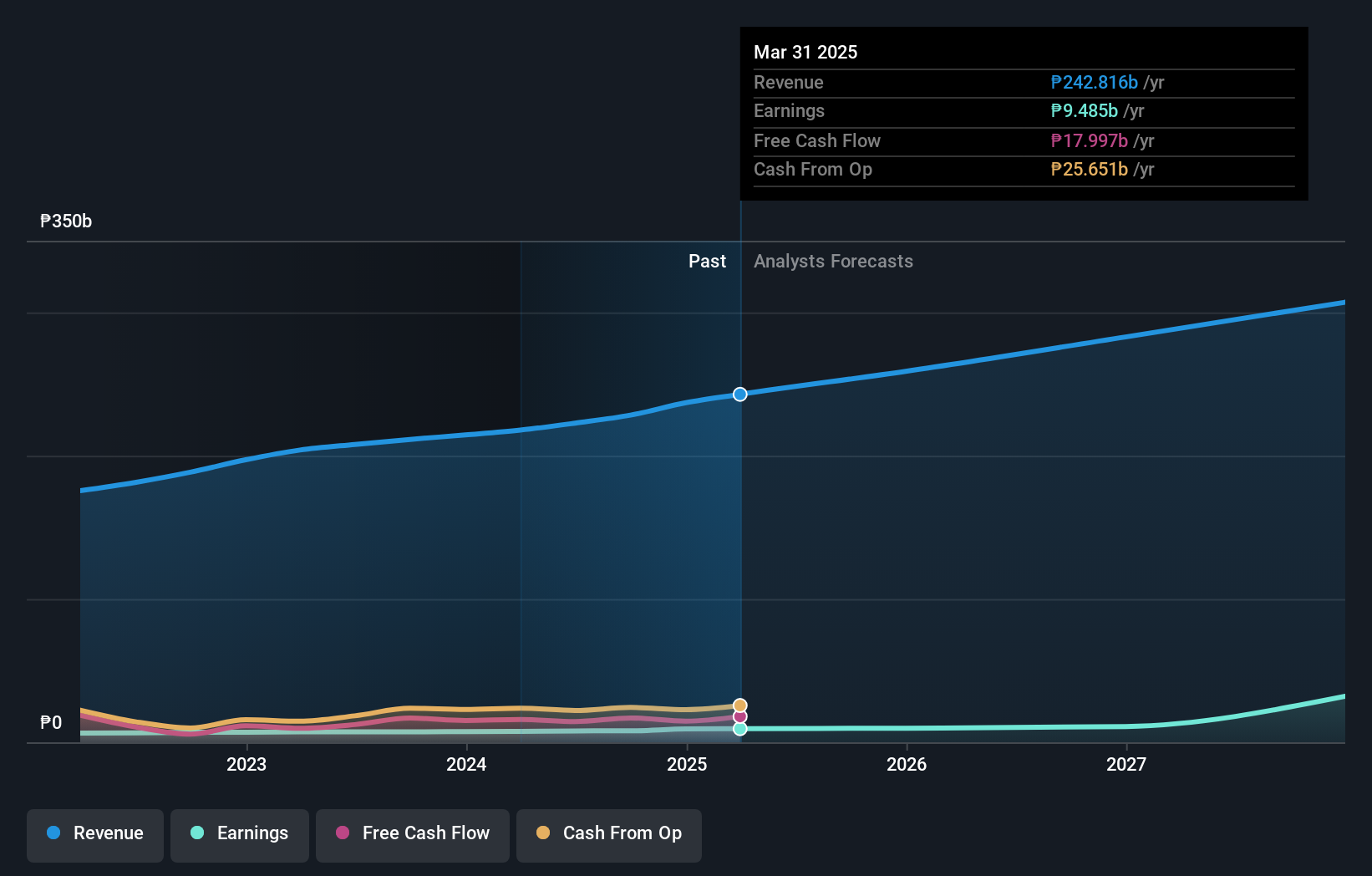

Overview: Cosco Capital, Inc. is a diversified conglomerate in the Philippines involved in retail, real estate, liquor distribution, oil and mineral exploration, and specialty retail businesses with a market capitalization of approximately ₱37.40 billion.

Operations: Cosco Capital's primary revenue stream is grocery retail, generating approximately ₱211.71 billion, followed by liquor distribution at ₱17.80 billion. Specialty retail and real estate contribute smaller portions to the total revenue with figures of around ₱2.10 billion each.

Cosco Capital seems to be a promising player in the consumer retailing sector, with its recent earnings report showing sales of PHP 164.06 billion and net income of PHP 10.04 billion for the first nine months of 2024, up from last year's figures. Despite an increase in debt-to-equity ratio from 5.9% to 11.9% over five years, Cosco's interest payments are well covered by EBIT at a robust 14x coverage. The company has also expanded its equity buyback plan by PHP 2 billion, signaling confidence in its valuation as it trades at an estimated value significantly below fair value estimates.

- Take a closer look at Cosco Capital's potential here in our health report.

Explore historical data to track Cosco Capital's performance over time in our Past section.

IMPACT Growth Real Estate Investment Trust (SET:IMPACT)

Simply Wall St Value Rating: ★★★★★☆

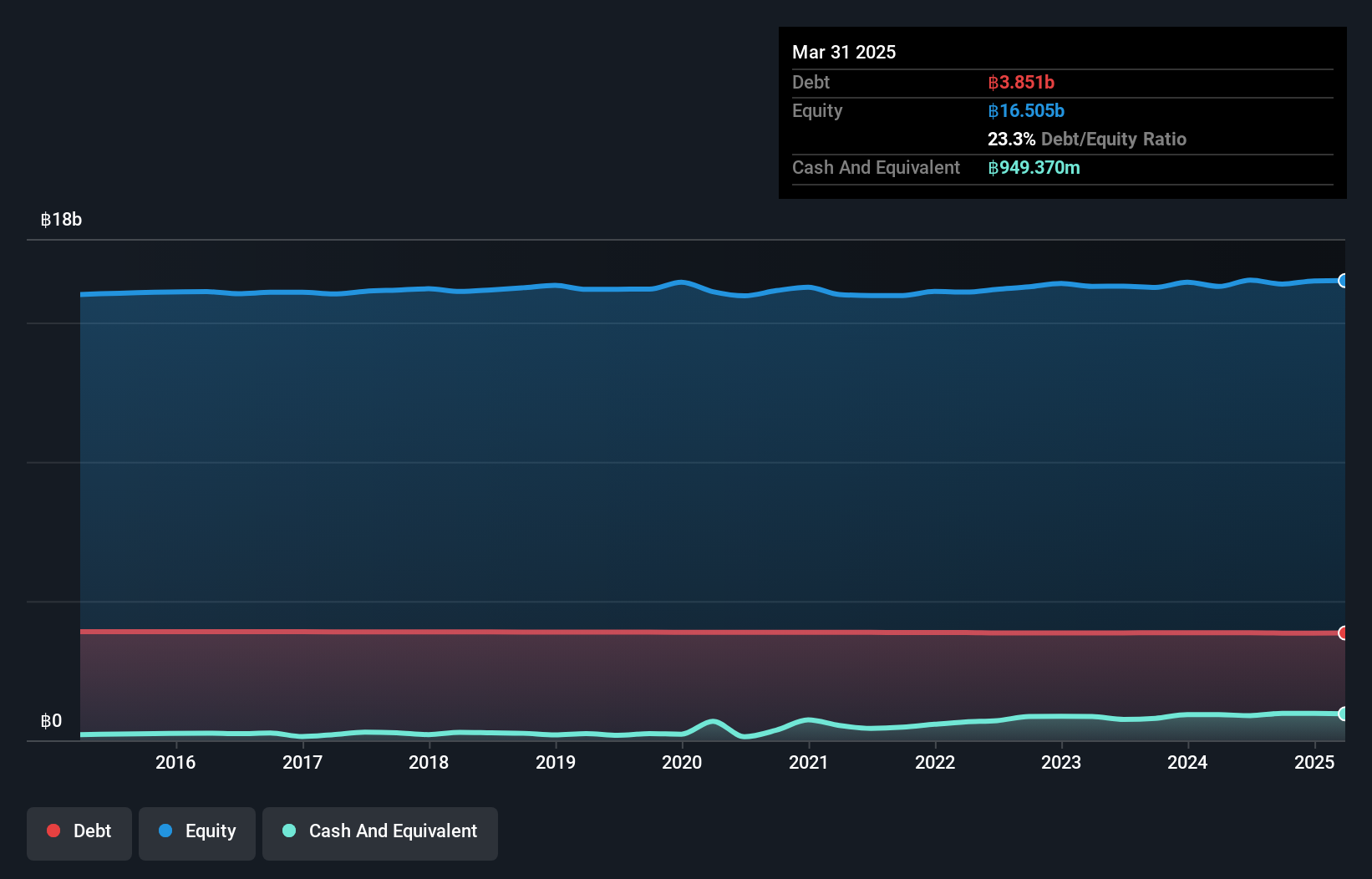

Overview: Impact Growth Real Estate Investment Trust is a real estate investment trust established under the Trust for Transaction in Capital Market Act, focusing on property investments and management, with a market capitalization of THB16.46 billion.

Operations: The Trust generates revenue primarily from providing services on properties in which it has invested, amounting to THB1.99 billion.

IMPACT Growth Real Estate Investment Trust, a smaller player in the REIT sector, displays strong financial health with earnings growing 11% last year, outpacing the industry average of 7.7%. Its debt to equity ratio has slightly improved from 24% to 23.5% over five years, reflecting prudent financial management. Trading at nearly half its estimated fair value suggests potential undervaluation. Recent earnings announcements show revenue of THB 413 million for Q2 and THB 1 billion for six months ending September, indicating solid performance compared to previous periods. With high-quality past earnings and satisfactory debt levels (17.6%), IMPACT seems poised for steady growth ahead.

Totetsu Kogyo (TSE:1835)

Simply Wall St Value Rating: ★★★★★★

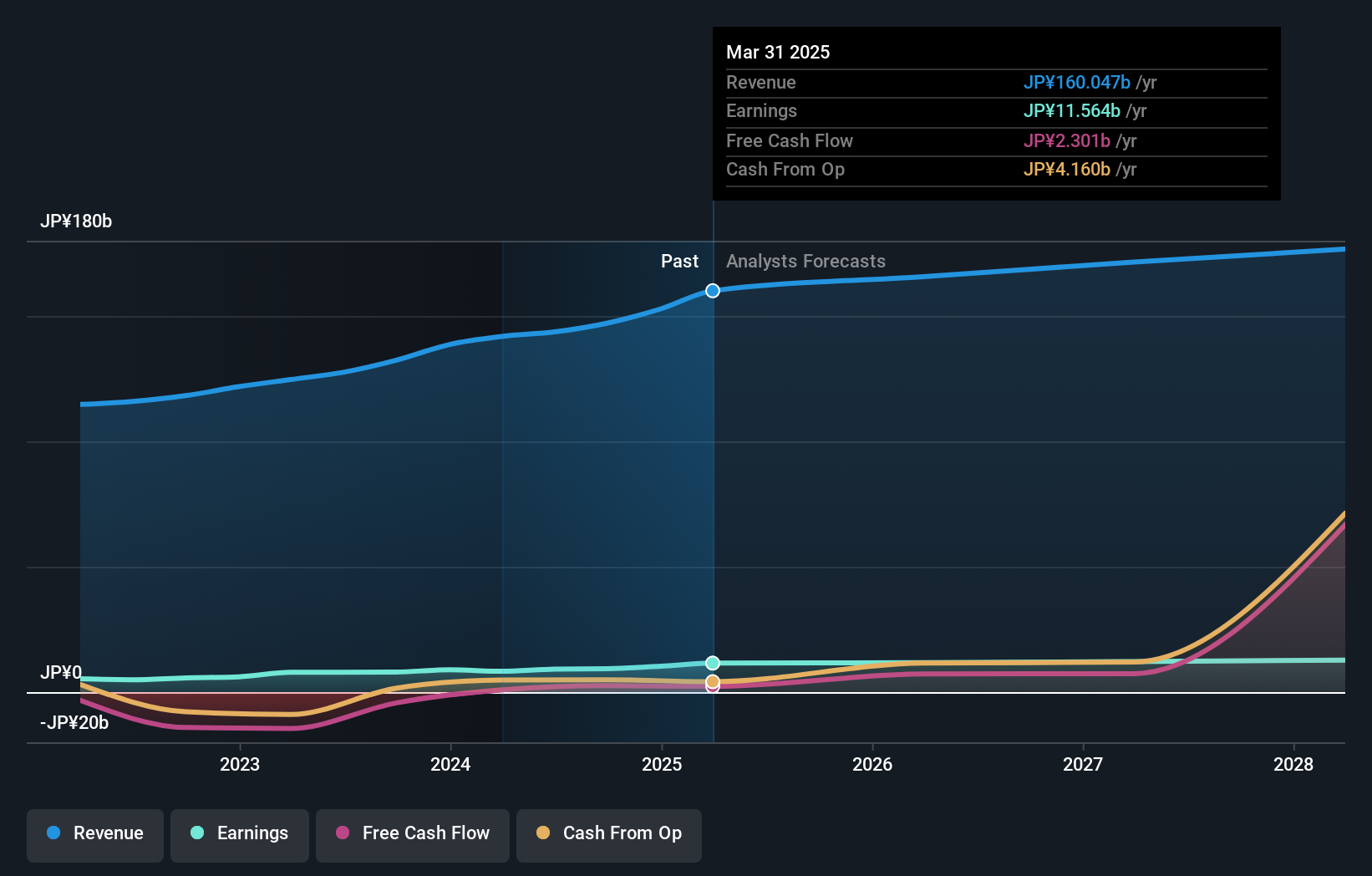

Overview: Totetsu Kogyo Co., Ltd. operates in Japan focusing on railway track maintenance, civil engineering, architectural, and environmental services with a market capitalization of ¥109.84 billion.

Operations: Totetsu Kogyo generates revenue primarily from its Civil Engineering Business, which accounts for ¥40.46 billion, and its Construction Business, contributing ¥17.42 billion. The company's financial performance is influenced by these key segments.

Totetsu Kogyo, a smaller player in the construction sector, trades at 48.3% under its estimated fair value, presenting potential for value seekers. Despite earnings growth of 16.8% last year falling short of the industry's 20.7%, its high-quality earnings and debt-free status bolster confidence in financial stability. The company is free cash flow positive and anticipates a steady annual earnings increase of about 5.27%. With no debt over the past five years, interest coverage isn't an issue, suggesting that Totetsu Kogyo is well-positioned for future opportunities without immediate financial pressures.

- Click to explore a detailed breakdown of our findings in Totetsu Kogyo's health report.

Assess Totetsu Kogyo's past performance with our detailed historical performance reports.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4636 more companies for you to explore.Click here to unveil our expertly curated list of 4639 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Totetsu Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1835

Totetsu Kogyo

Engages in the railway track maintenance, civil engineering, architectural, and environmental businesses in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives