- Philippines

- /

- Industrials

- /

- PSE:AGI

Discovering Undiscovered Gems in December 2024

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have experienced notable declines, reflecting broader investor concerns. Amid this backdrop, the search for undiscovered gems becomes increasingly appealing to investors seeking opportunities within a volatile environment. Identifying a good stock often involves looking for companies with strong fundamentals and growth potential that can thrive despite market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Miwon Specialty Chemical (KOSE:A268280)

Simply Wall St Value Rating: ★★★★★☆

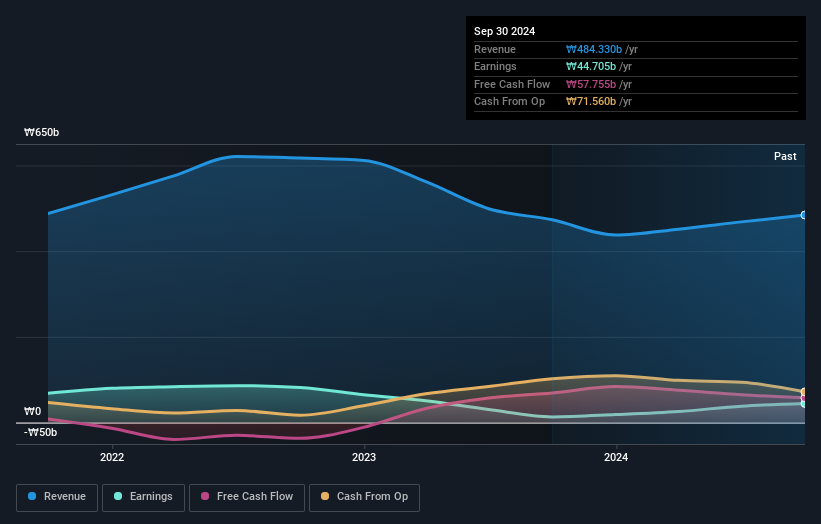

Overview: Miwon Specialty Chemical Co., Ltd. produces and supplies basic raw materials for UV/EB curing systems both in Korea and internationally, with a market cap of approximately ₩717.82 billion.

Operations: The primary revenue stream for Miwon Specialty Chemical comes from the manufacture and sale of energy curable resins, generating approximately ₩484.33 billion.

Miwon Specialty Chemical, a company with promising potential, has seen its earnings grow by 237% over the past year, outpacing the broader Chemicals industry growth of 21%. The firm is not only profitable but also boasts high-quality earnings. Despite this impressive performance, Miwon's debt-to-equity ratio has increased from 5% to nearly 8% over five years. Encouragingly, it plans to repurchase up to 20,000 shares by January 2025 to enhance shareholder value and stabilize stock prices. With more cash than total debt and positive free cash flow, Miwon seems well-positioned for future endeavors in its niche market.

Alliance Global Group (PSE:AGI)

Simply Wall St Value Rating: ★★★★☆☆

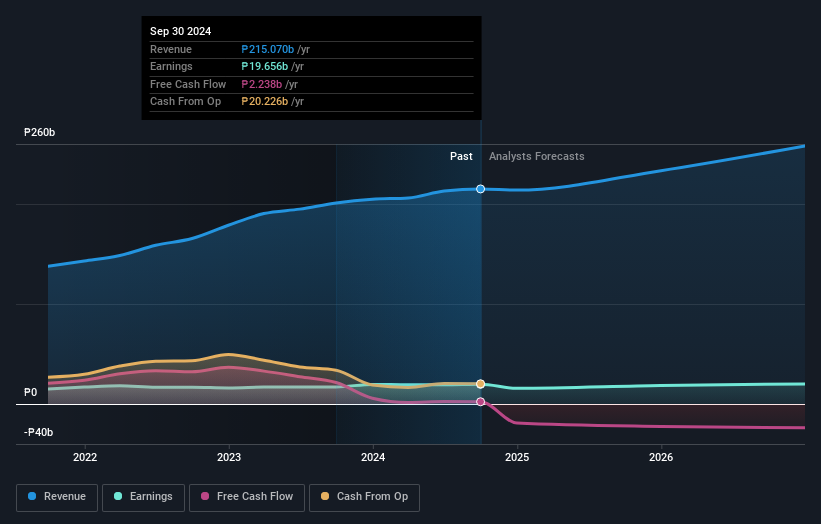

Overview: Alliance Global Group, Inc. operates in real estate development, tourism-entertainment and gaming, food and beverage, quick-service restaurants, and integrated tourism and infrastructure development both in the Philippines and internationally, with a market cap of approximately ₱80.85 billion.

Operations: AGI's primary revenue streams are derived from Megaworld at ₱76.31 billion, Emperador at ₱60.80 billion, and GADC at ₱46.69 billion, with Travellers contributing ₱31.36 billion.

Alliance Global Group, a relatively small player in its industry, has shown robust financial performance with earnings growing by 14.8% over the past year, outpacing the Industrials sector's growth of 10.7%. The company trades at a price-to-earnings ratio of 4.1x, significantly below the Philippine market average of 9.2x, indicating potential undervaluation. Over five years, AGI reduced its debt to equity ratio from 71% to 57%, though its net debt to equity still stands at a high level of 40.3%. Recent earnings reports reveal increased revenue and net income for Q3 compared to last year, suggesting steady progress despite a slight dividend decrease announcement recently.

- Click to explore a detailed breakdown of our findings in Alliance Global Group's health report.

Gain insights into Alliance Global Group's past trends and performance with our Past report.

TTW (SET:TTW)

Simply Wall St Value Rating: ★★★★★★

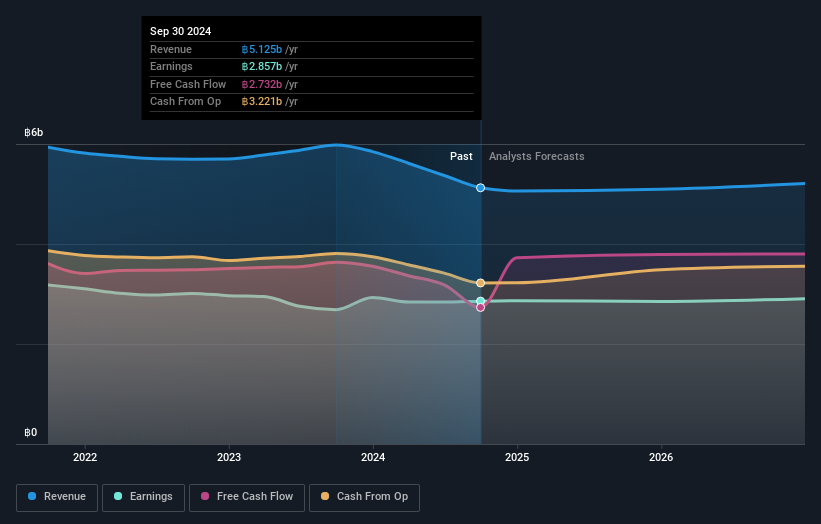

Overview: TTW Public Company Limited, along with its subsidiaries, operates in the production and sale of treated water in Thailand and has a market capitalization of THB36.11 billion.

Operations: TTW generates revenue primarily from the production and sale of treated water, amounting to THB5.12 billion.

TTW, a notable player in the water utilities sector, has shown resilience despite industry challenges. Over the past year, earnings grew 6.3%, outpacing the industry's -2.2% performance. The company trades at a significant discount of 51.5% below its estimated fair value, highlighting potential undervaluation. TTW's debt management is commendable with a reduction in debt to equity from 76.6% to 25.2% over five years and an interest coverage ratio of 31x by EBIT, indicating strong financial health and high-quality earnings capacity. Recent board changes may influence strategic direction as Mr.Hisao Morioka joins as a director post-December resignation announcements.

- Click here to discover the nuances of TTW with our detailed analytical health report.

Assess TTW's past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4629 more companies for you to explore.Click here to unveil our expertly curated list of 4632 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:AGI

Alliance Global Group

Engages in real estate development, tourism-entertainment and gaming, food and beverage, quick-service restaurant, and integrated tourism and infrastructure development businesses in the Philippines and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives