- Philippines

- /

- Banks

- /

- PSE:PNB

Undervalued Asian Small Caps With Insider Action To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed performances and economic shifts, the Asian small-cap sector presents intriguing opportunities amidst broader market sentiment. With recent developments such as the temporary U.S.-China trade truce providing a boost to investor confidence, identifying stocks with strong fundamentals and insider activity can be key in enhancing portfolio resilience during these dynamic times.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 22.47% | ★★★★★★ |

| Domino's Pizza Enterprises | NA | 0.8x | 26.03% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 19.25% | ★★★★☆☆ |

| Eureka Group Holdings | 11.3x | 4.9x | 22.85% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.71% | ★★★★☆☆ |

| BWP Trust | 10.3x | 13.5x | 12.26% | ★★★★☆☆ |

| Bumitama Agri | 11.8x | 1.7x | 44.26% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.5x | 0.4x | -422.71% | ★★★☆☆☆ |

| Chinasoft International | 24.5x | 0.8x | -1371.75% | ★★★☆☆☆ |

| Far East Orchard | 10.1x | 3.3x | 10.31% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

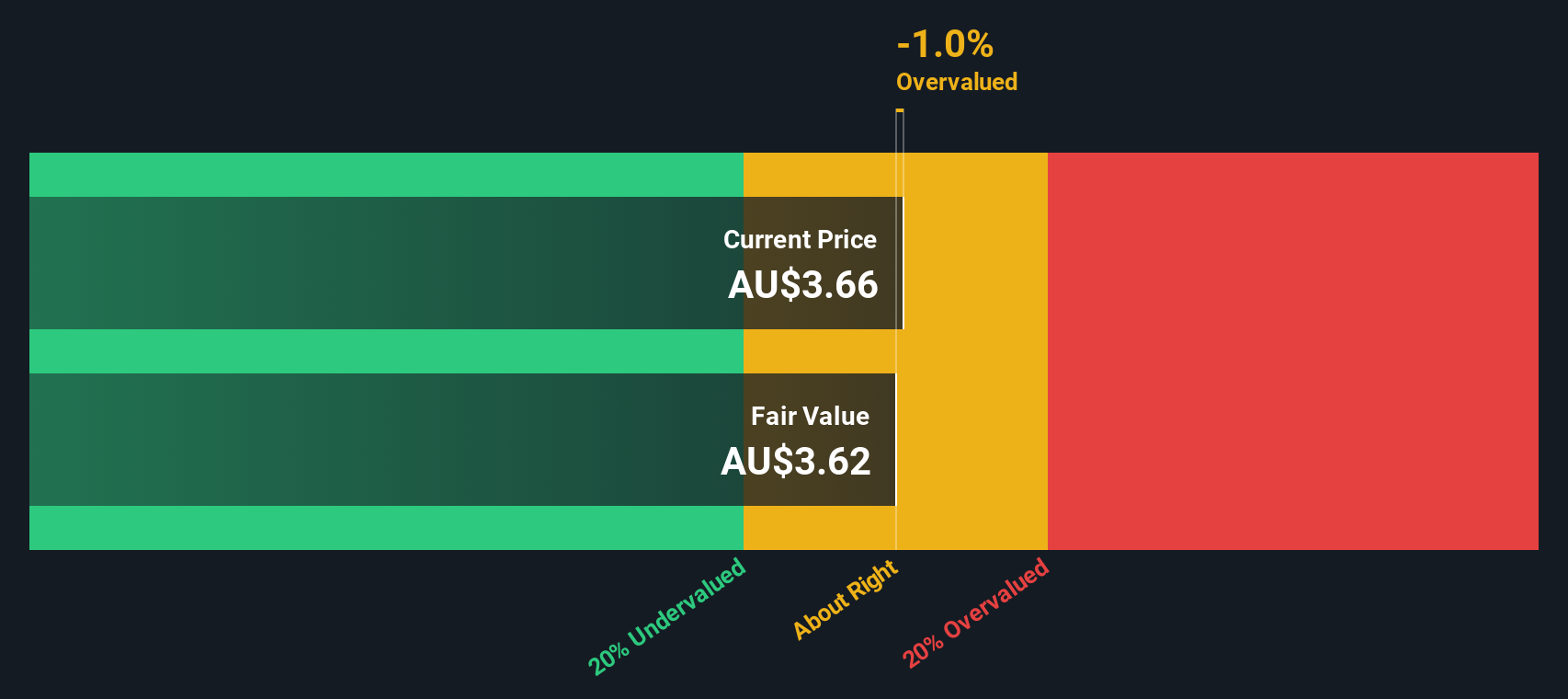

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Deterra Royalties is a company focused on managing and acquiring royalty interests in the mining sector, with a market cap of A$2.56 billion.

Operations: The company's primary revenue streams are derived from Bulk and Precious segments, contributing A$241.15 million and A$21.80 million respectively. Over recent periods, the gross profit margin has shown a decreasing trend, moving from 97.12% to 95.40%. Cost of goods sold (COGS) have increased alongside operating expenses, impacting net income margins which have also seen a decline from 67.30% to 59.10%.

PE: 13.9x

Deterra Royalties, a smaller player in the Asian market, has shown consistent earnings with A$155.7 million net income for the year ending June 2025, slightly up from A$154.89 million previously. Despite high debt levels and reliance on external borrowing, insider confidence is evident with recent director appointments in October 2025. The company’s participation in industry conferences highlights its active engagement within the sector. However, projected earnings decline poses challenges for future growth prospects amidst these dynamics.

- Click here and access our complete valuation analysis report to understand the dynamics of Deterra Royalties.

Explore historical data to track Deterra Royalties' performance over time in our Past section.

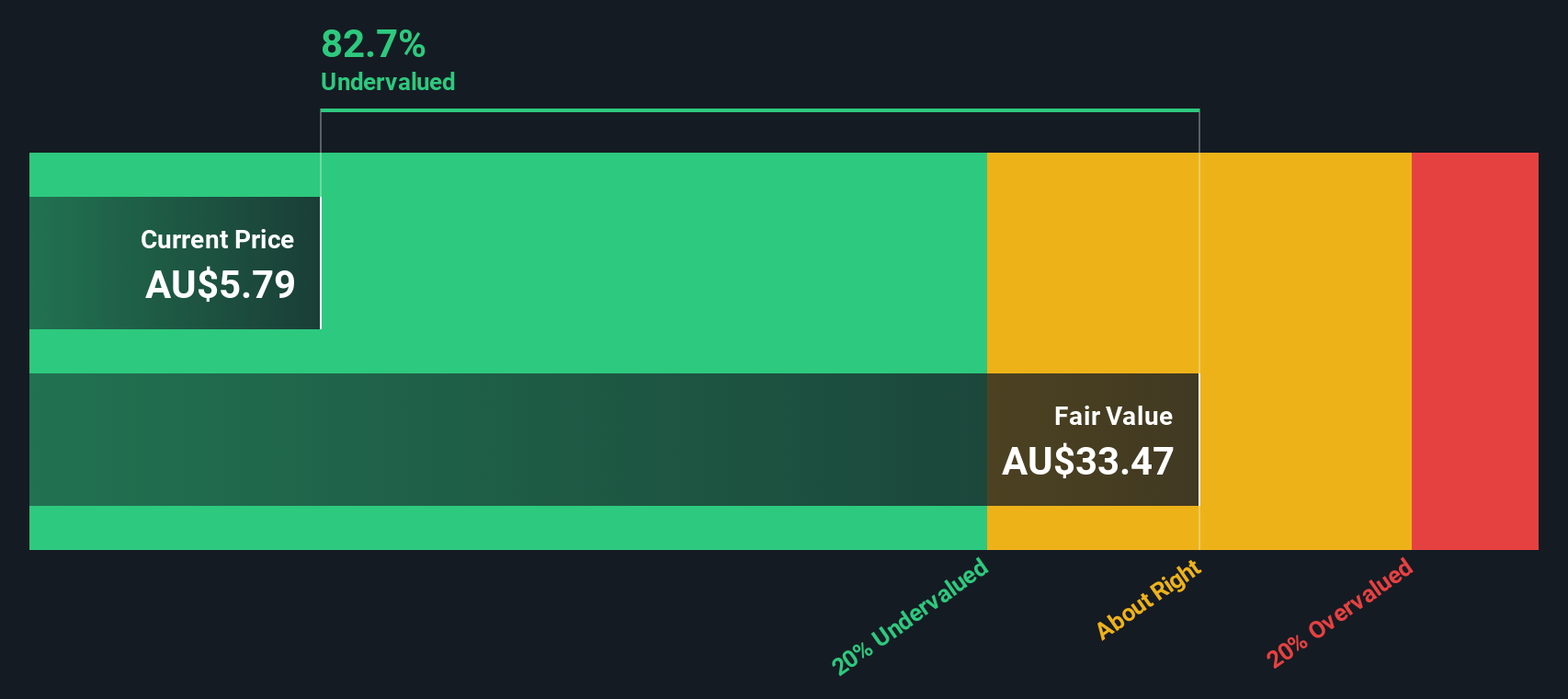

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp is a provider of premium serviced office spaces and virtual office solutions, with a market capitalization of A$0.39 billion.

Operations: Servcorp generates revenue primarily through its real estate rental segment, with a recent quarterly revenue of A$349.86 million. The company has experienced fluctuations in its gross profit margin, which reached 64.44% in the latest period. Operating expenses are significant, with general and administrative costs and sales & marketing expenses comprising notable portions of these expenditures.

PE: 13.8x

Servcorp, a company with a market capitalization that positions it within the smaller spectrum of Asian stocks, showcases potential for growth amidst its challenges. Despite relying entirely on external borrowing for funding, which carries higher risk than customer deposits, they have demonstrated financial resilience. Earnings are projected to grow by 11.77% annually. Recent earnings results reveal an increase in net income to A$53 million from A$39 million the previous year, alongside a rise in revenue to A$352 million from A$317 million. Dividends are expected not to fall below 30 cents per share in 2026, reflecting confidence in their cash flow stability and future prospects.

- Take a closer look at Servcorp's potential here in our valuation report.

Assess Servcorp's past performance with our detailed historical performance reports.

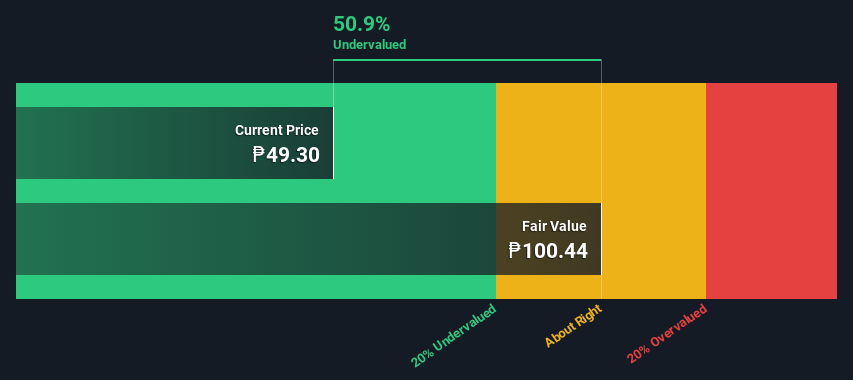

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine National Bank is a financial institution that provides a range of banking services including retail and corporate banking, treasury operations, and other financial services, with a market cap of ₱56.45 billion.

Operations: The company generates revenue primarily from retail banking, corporate banking, and treasury activities, with retail banking being the largest contributor at ₱36.72 billion. Operating expenses are significant, with general and administrative expenses consistently comprising a substantial portion of these costs. Notably, the net income margin has shown an upward trend in recent periods, reaching 38.24% by mid-2025.

PE: 3.4x

Philippine National Bank, a smaller player in Asia's financial sector, shows potential for growth with a forecasted revenue increase of 7.63% annually. Despite facing challenges like a high bad loans ratio of 6.7%, insider confidence is evident as Executive VP & CFO Francis Albalate acquired 260,000 shares valued at PHP 13.5 million in recent months. Recent leadership changes and inclusion in the S&P Global BMI Index further position PNB for strategic shifts and broader market recognition.

Summing It All Up

- Take a closer look at our Undervalued Asian Small Caps With Insider Buying list of 38 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PNB

Philippine National Bank

Provides various banking and financial products and services.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives