- New Zealand

- /

- Logistics

- /

- NZSE:MFT

Does Mainfreight's (NZSE:MFT) Margin Pressure Hint at a Shift in Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Mainfreight Limited recently released its half-year results, reporting sales of NZ$2.61 billion and net income of NZ$93.38 million, down from the prior year, along with an interim dividend of 85 cents per share approved by the board.

- The results highlight that while Mainfreight achieved increased revenue, profitability was pressured, indicating the company faced higher costs or margin challenges during the period.

- We’ll look at how Mainfreight’s earnings growth challenge may shape its investment narrative moving forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Mainfreight's Investment Narrative?

For Mainfreight shareholders, the key belief is in the company’s ability to translate its robust revenue base into sustainable profit growth, particularly as logistics demand ebbs and flows. The latest half-year result offered a reminder that top-line gains don’t always lead to bottom-line strength, with net income declining year-on-year despite slightly higher sales. This result does affect the short-term picture, as it suggests increased cost pressures or margin squeeze could remain a headwind, shifting the conversation around catalysts like volume recoveries or improved efficiency to the forefront. Risks such as evolving board composition and competitive pricing pressure continue to matter, but this profit setback places extra scrutiny on how quickly Mainfreight can stabilize or expand its earnings. The approved 85 cent dividend shows confidence but doesn’t distract from earnings volatility now being front and center.

On the other hand, ongoing cost pressures could impact Mainfreight's near-term margin recovery and growth.

Exploring Other Perspectives

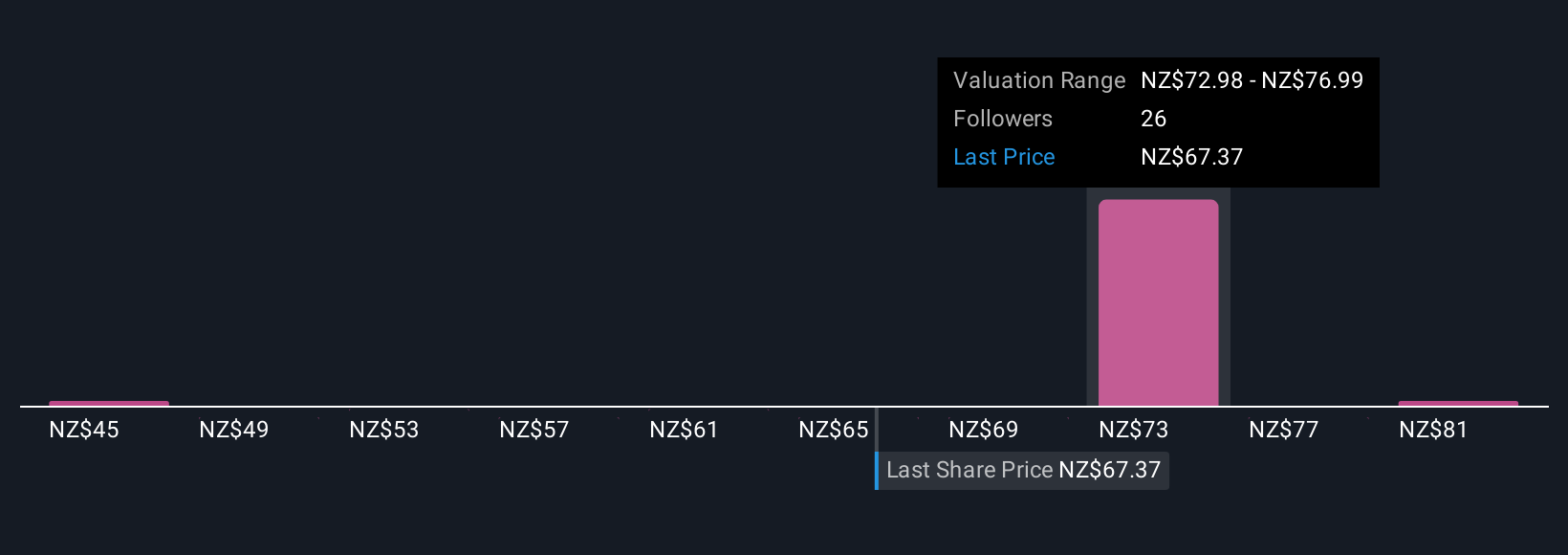

Explore 9 other fair value estimates on Mainfreight - why the stock might be worth 32% less than the current price!

Build Your Own Mainfreight Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mainfreight research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Mainfreight research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mainfreight's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:MFT

Mainfreight

Provides supply chain logistics services in New Zealand, Australia, the Americas, Europe, and Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives