- New Zealand

- /

- Airlines

- /

- NZSE:AIR

Air New Zealand’s Projected Loss and Fuel Costs Might Change the Case For Investing In NZSE:AIR

Reviewed by Sasha Jovanovic

- On October 21, 2025, Air New Zealand reported a modest year-on-year increase in passenger volumes and capacity for September, but also issued earnings guidance forecasting a pre-tax loss of between $30 million and $55 million for the first half of fiscal 2026, assuming average jet fuel prices of US$85 per barrel.

- The airline highlighted that upcoming capacity expansion in the second half could significantly alter the full-year picture, cautioning investors against directly extrapolating first-half performance.

- We'll consider how Air New Zealand's projected first-half loss and the explained influence of jet fuel prices affect its investment outlook.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Air New Zealand Investment Narrative Recap

To hold Air New Zealand shares, investors need to believe in the airline's ability to overcome significant operating headwinds, such as capacity constraints and cost pressures, and unlock earnings recovery as planned capacity expands. The latest guidance for a first-half pre-tax loss, driven by high jet fuel prices, does not materially alter the near-term catalyst: restoring network capacity and improving margins remain central, while the most immediate risk continues to be persistent engine availability issues that restrict growth and efficiencies.

Of the recent announcements, the October 21, 2025 guidance confirming expected losses for the first half of FY 2026 is most relevant. This reiterates the ongoing challenge of managing volatile input costs and subdued demand, but Air New Zealand continues to flag capacity restoration in the second half as a key turning point for the underlying business, tying directly into its crucial catalyst of network and fleet optimization.

By contrast, investors should be especially alert to ongoing engine shortages and how prolonged constraints could further pressure capacity and earnings if recovery is delayed...

Read the full narrative on Air New Zealand (it's free!)

Air New Zealand's narrative projects NZ$7.8 billion revenue and NZ$239.0 million earnings by 2028. This requires 4.7% yearly revenue growth and a NZ$113 million earnings increase from current earnings of NZ$126.0 million.

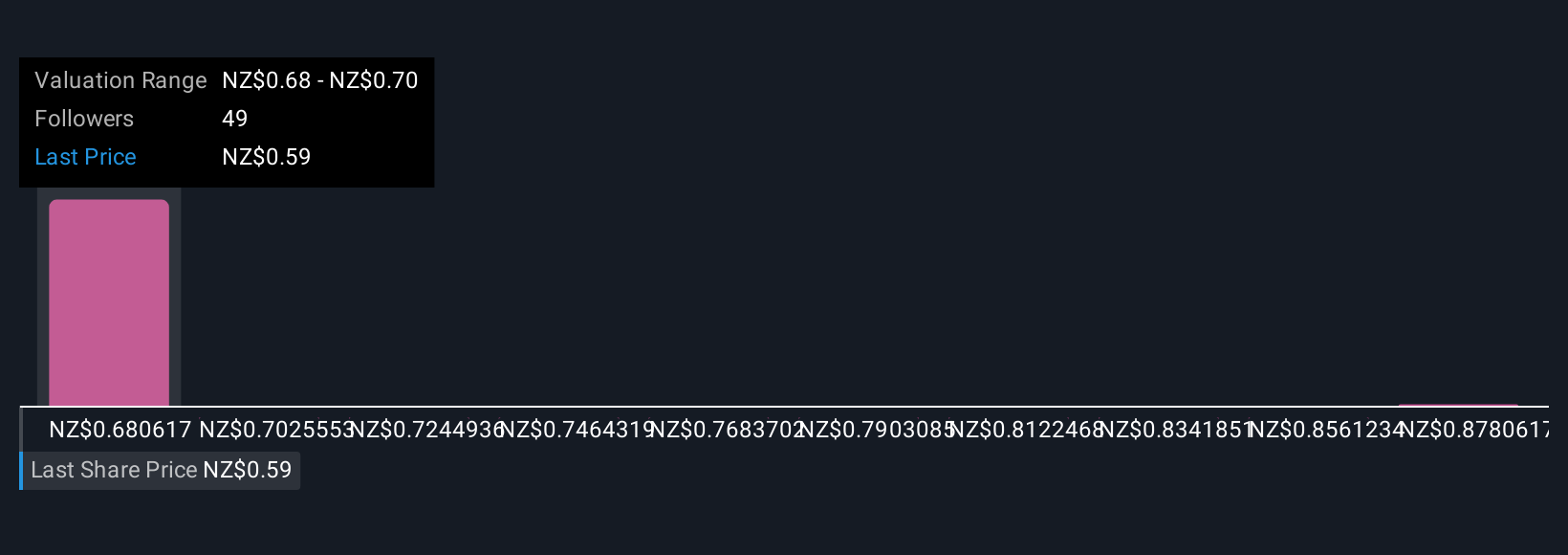

Uncover how Air New Zealand's forecasts yield a NZ$0.67 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value estimates for Air New Zealand from four Simply Wall St Community members range from NZ$0.60 to as high as NZ$0.90 per share. While expectations on valuation differ, ongoing engine constraints highlight the operational risks that could impact whether the company achieves its growth ambitions, explore how others interpret these risks and what that could mean for future performance.

Explore 4 other fair value estimates on Air New Zealand - why the stock might be worth as much as 53% more than the current price!

Build Your Own Air New Zealand Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air New Zealand research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Air New Zealand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air New Zealand's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives