- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:CNU

Chorus (NZSE:CNU) Hasn't Managed To Accelerate Its Returns

There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Chorus (NZSE:CNU) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Chorus is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.046 = NZ$249m ÷ (NZ$6.0b - NZ$540m) (Based on the trailing twelve months to June 2024).

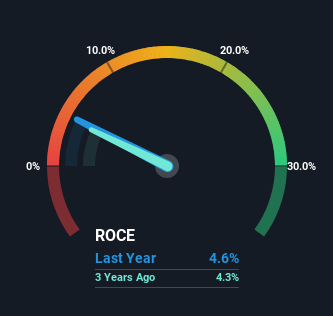

Therefore, Chorus has an ROCE of 4.6%. Ultimately, that's a low return and it under-performs the Telecom industry average of 10%.

View our latest analysis for Chorus

In the above chart we have measured Chorus' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Chorus .

The Trend Of ROCE

The returns on capital haven't changed much for Chorus in recent years. The company has employed 21% more capital in the last five years, and the returns on that capital have remained stable at 4.6%. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

On a side note, Chorus has done well to reduce current liabilities to 9.0% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

In Conclusion...

As we've seen above, Chorus' returns on capital haven't increased but it is reinvesting in the business. Yet to long term shareholders the stock has gifted them an incredible 114% return in the last five years, so the market appears to be rosy about its future. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

If you'd like to know about the risks facing Chorus, we've discovered 2 warning signs that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CNU

Chorus

Engages in the provision of fixed line communications infrastructure services in New Zealand.

High growth potential average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026