Market Participants Recognise ikeGPS Group Limited's (NZSE:IKE) Revenues Pushing Shares 34% Higher

The ikeGPS Group Limited (NZSE:IKE) share price has done very well over the last month, posting an excellent gain of 34%. The last month tops off a massive increase of 117% in the last year.

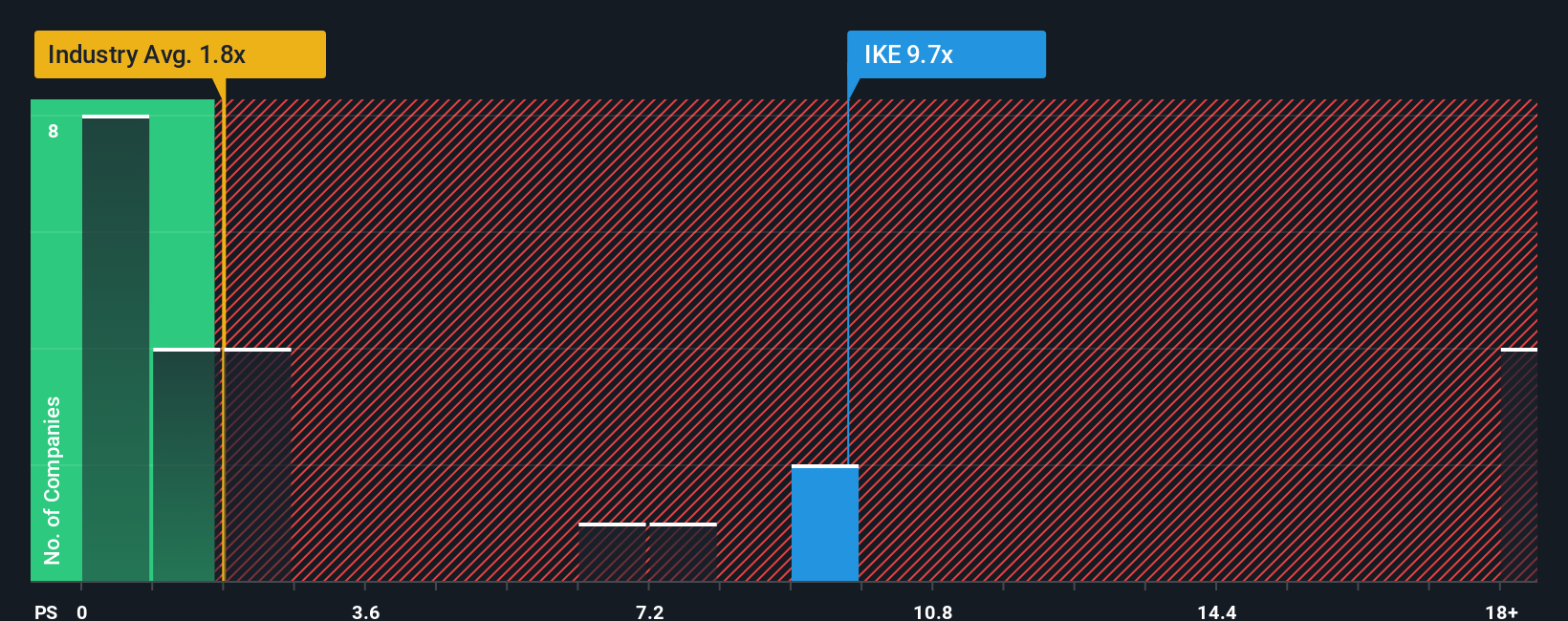

After such a large jump in price, when almost half of the companies in New Zealand's Electronic industry have price-to-sales ratios (or "P/S") below 2x, you may consider ikeGPS Group as a stock not worth researching with its 9.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ikeGPS Group

How Has ikeGPS Group Performed Recently?

ikeGPS Group could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ikeGPS Group.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, ikeGPS Group would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow revenue by 58% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 22% each year as estimated by the four analysts watching the company. With the industry only predicted to deliver 15% per year, the company is positioned for a stronger revenue result.

With this information, we can see why ikeGPS Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does ikeGPS Group's P/S Mean For Investors?

The strong share price surge has lead to ikeGPS Group's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that ikeGPS Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - ikeGPS Group has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ikeGPS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:IKE

ikeGPS Group

Engages in the design, sale, and delivery of a solution for the collection, analysis, and management of distribution assets for electric utilities and communications companies in the United States.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion