- New Zealand

- /

- Software

- /

- NZSE:SDL

Solution Dynamics (NZSE:SDL) Will Pay A Smaller Dividend Than Last Year

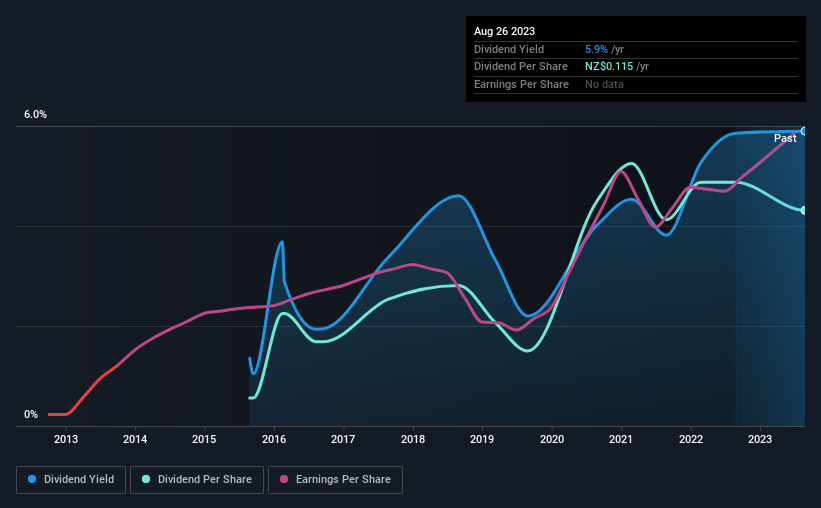

Solution Dynamics Limited (NZSE:SDL) is reducing its dividend from last year's comparable payment to NZ$0.015 on the 22nd of September. The yield is still above the industry average at 5.9%.

View our latest analysis for Solution Dynamics

Solution Dynamics' Earnings Easily Cover The Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Solution Dynamics' dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

If the trend of the last few years continues, EPS will grow by 20.1% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 48% by next year, which is in a pretty sustainable range.

Solution Dynamics' Dividend Has Lacked Consistency

Solution Dynamics has been paying dividends for a while, but the track record isn't stellar. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2015, the annual payment back then was NZ$0.015, compared to the most recent full-year payment of NZ$0.115. This works out to be a compound annual growth rate (CAGR) of approximately 29% a year over that time. Solution Dynamics has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Solution Dynamics has grown earnings per share at 20% per year over the past five years. The company doesn't have any problems growing, despite returning a lot of capital to shareholders, which is a very nice combination for a dividend stock to have.

We Really Like Solution Dynamics' Dividend

It is generally not great to see the dividend being cut, but we don't think this should happen much if at all in the future given that Solution Dynamics has the makings of a solid income stock moving forward. Reducing the amount it is paying as a dividend can protect the company's balance sheet, keeping the dividend sustainable for longer. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Solution Dynamics that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:SDL

Solution Dynamics

Provides customer communication solutions in New Zealand, Australia, the United States, and Europe.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion