- New Zealand

- /

- Software

- /

- NZSE:SDL

How Does Solution Dynamics' (NZSE:SDL) CEO Pay Compare With Company Performance?

This article will reflect on the compensation paid to Siva Sivasubramaniam who has served as CEO of Solution Dynamics Limited (NZSE:SDL) since 2006. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Solution Dynamics.

See our latest analysis for Solution Dynamics

How Does Total Compensation For Siva Sivasubramaniam Compare With Other Companies In The Industry?

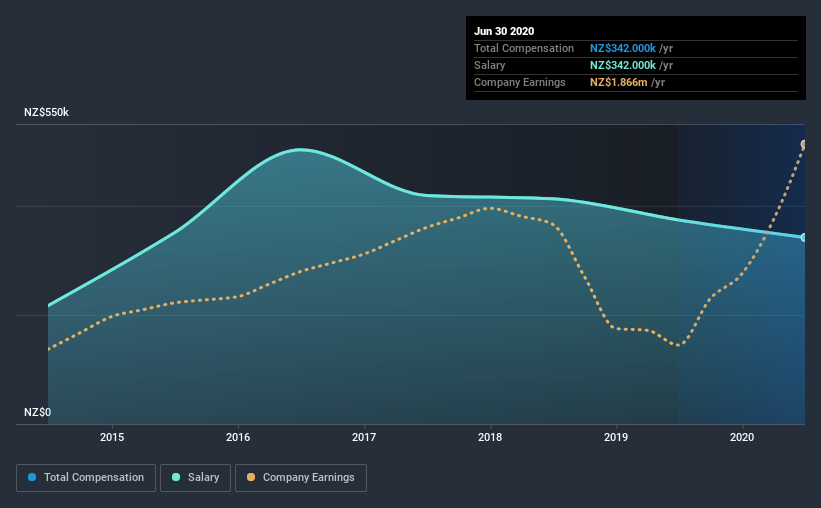

Our data indicates that Solution Dynamics Limited has a market capitalization of NZ$45m, and total annual CEO compensation was reported as NZ$342k for the year to June 2020. We note that's a decrease of 8.6% compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth NZ$342k.

In comparison with other companies in the industry with market capitalizations under NZ$274m, the reported median total CEO compensation was NZ$428k. This suggests that Solution Dynamics remunerates its CEO largely in line with the industry average. What's more, Siva Sivasubramaniam holds NZ$2.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | NZ$342k | NZ$374k | 100% |

| Other | - | - | - |

| Total Compensation | NZ$342k | NZ$374k | 100% |

Talking in terms of the industry, salary represented approximately 46% of total compensation out of all the companies we analyzed, while other remuneration made up 54% of the pie. Speaking on a company level, Solution Dynamics prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Solution Dynamics Limited's Growth

Over the past three years, Solution Dynamics Limited has seen its earnings per share (EPS) grow by 11% per year. Its revenue is up 29% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Solution Dynamics Limited Been A Good Investment?

Boasting a total shareholder return of 68% over three years, Solution Dynamics Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Solution Dynamics rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we touched on above, Solution Dynamics Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Investors would surely be happy to see that returns have been great, and that EPS is up. Indeed, many might consider that Siva is compensated rather modestly, given the solid company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Solution Dynamics that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Solution Dynamics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:SDL

Solution Dynamics

Provides customer communication solutions in New Zealand, Australia, the United States, and Europe.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion