- New Zealand

- /

- Specialty Stores

- /

- NZSE:KMD

KMD Brands' (NZSE:KMD) earnings trajectory could turn positive as the stock soars 12% this past week

KMD Brands Limited (NZSE:KMD) shareholders should be happy to see the share price up 19% in the last month. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In fact, the share price has declined rather badly, down some 81% in that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the last five years has been tough for KMD Brands shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for KMD Brands

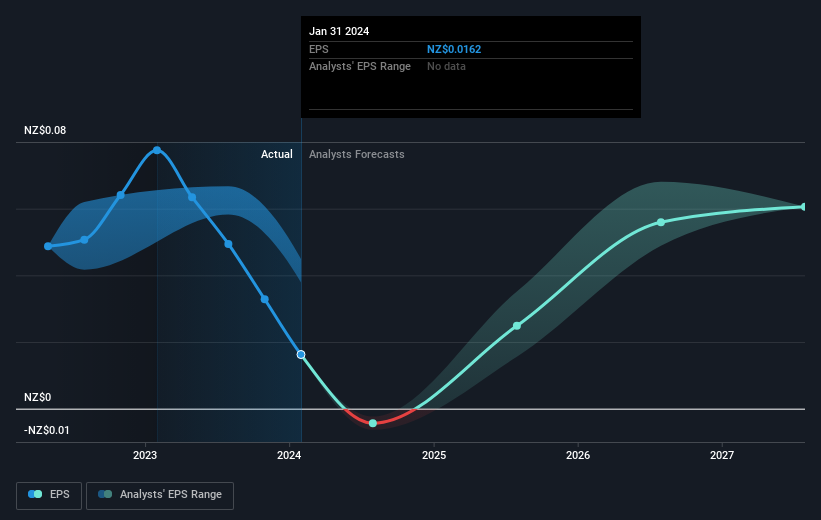

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, KMD Brands' earnings per share (EPS) dropped by 41% each year. The share price decline of 29% per year isn't as bad as the EPS decline. The relatively muted share price reaction might be because the market expects the business to turn around.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of KMD Brands' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between KMD Brands' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that KMD Brands' TSR, which was a 65% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 3.3% in the last year, KMD Brands shareholders lost 46%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand KMD Brands better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for KMD Brands you should know about.

KMD Brands is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on New Zealander exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KMD Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:KMD

KMD Brands

Designs, markets, wholesales, and retails apparel, footwear, and equipment for surfing and the outdoors under the Kathmandu, Rip Curl, and Oboz brands in New Zealand, Australia, North America, Europe, Southeast Asia, and Brazil.

Excellent balance sheet with moderate growth potential.