- New Zealand

- /

- Specialty Stores

- /

- NZSE:HLG

Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed performances across major indices, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming against larger peers like the S&P 500. Despite this backdrop, the search for undiscovered gems within the small-cap sector remains compelling, as these companies often offer unique growth potential that can thrive amidst economic shifts and evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Lelon Electronics | 20.09% | 6.53% | 15.44% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| AzureWave Technologies | NA | 3.00% | 29.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hallenstein Glasson Holdings (NZSE:HLG)

Simply Wall St Value Rating: ★★★★★★

Overview: Hallenstein Glasson Holdings Limited, along with its subsidiaries, is a retailer specializing in men's and women's clothing across New Zealand and Australia, with a market capitalization of approximately NZ$462.88 million.

Operations: Hallenstein Glasson Holdings generates revenue primarily from its Hallensteins, Glassons Australia, and Glassons New Zealand segments, with the largest contribution coming from Glassons Australia at NZ$219.44 million. The company has a market capitalization of approximately NZ$462.88 million.

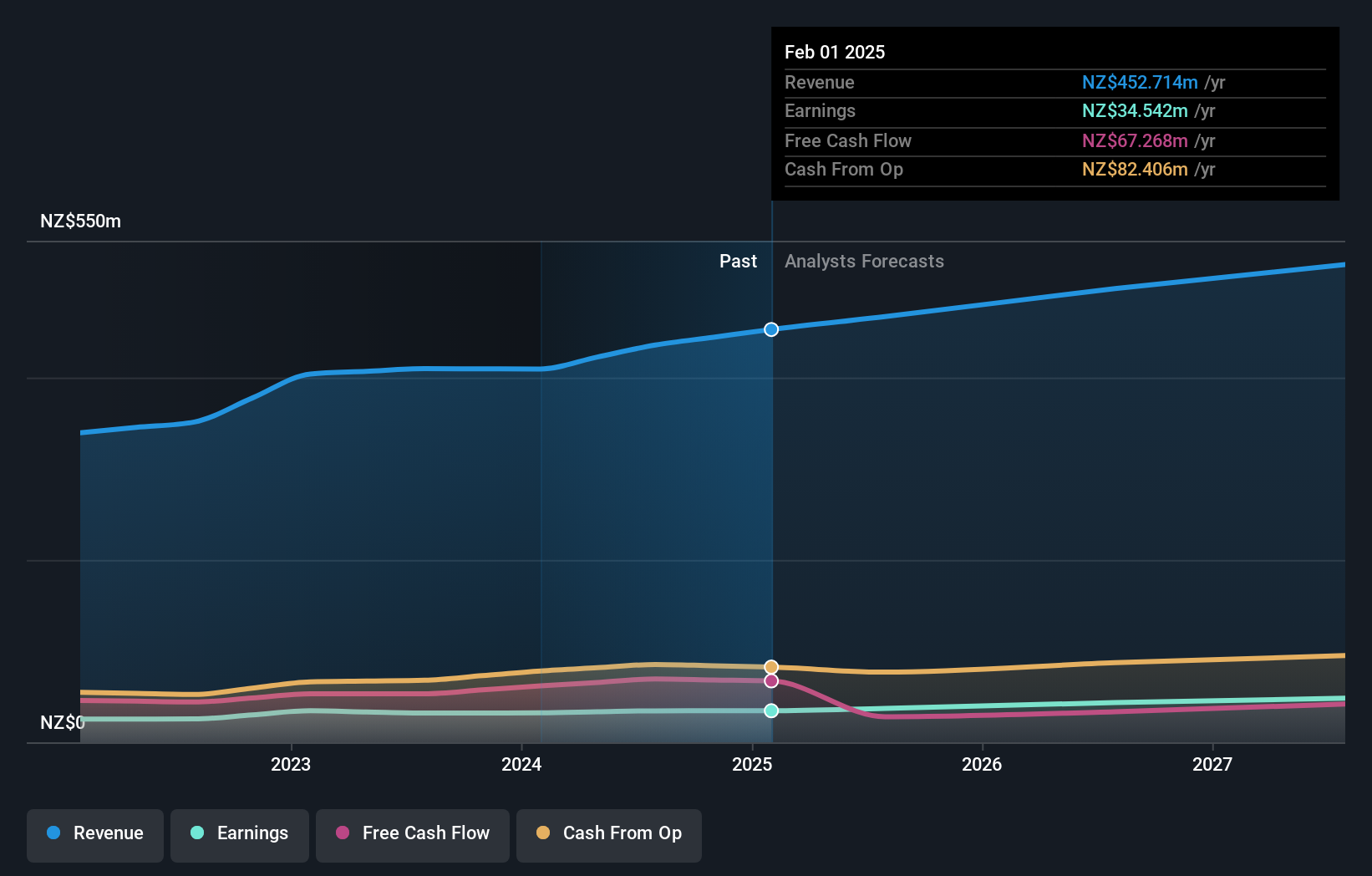

Hallenstein Glasson, a nimble player in the retail sector, has been showcasing robust financial health. Over the past year, earnings surged by 7.8%, surpassing the Specialty Retail industry average of -0.5%. The company is trading at a significant discount, approximately 65% below its fair value estimate, which could hint at potential upside for investors. With no debt on its books for five years and consistent free cash flow generation—reaching NZ$69.37 million recently—Hallenstein Glasson appears financially stable. Recent results reported sales of NZ$435.64 million and net income of NZ$34.49 million for the year ending August 2024, reflecting solid growth from previous figures.

Shanghai Research Institute of Building Sciences Group (SHSE:603153)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Research Institute of Building Sciences Group Co., Ltd. (SHSE:603153) operates in the building sciences sector and has a market cap of CN¥8.31 billion.

Operations: Shanghai Research Institute of Building Sciences Group generates revenue primarily from the building sciences sector. The company has a market capitalization of CN¥8.31 billion, indicating its significant presence in the industry.

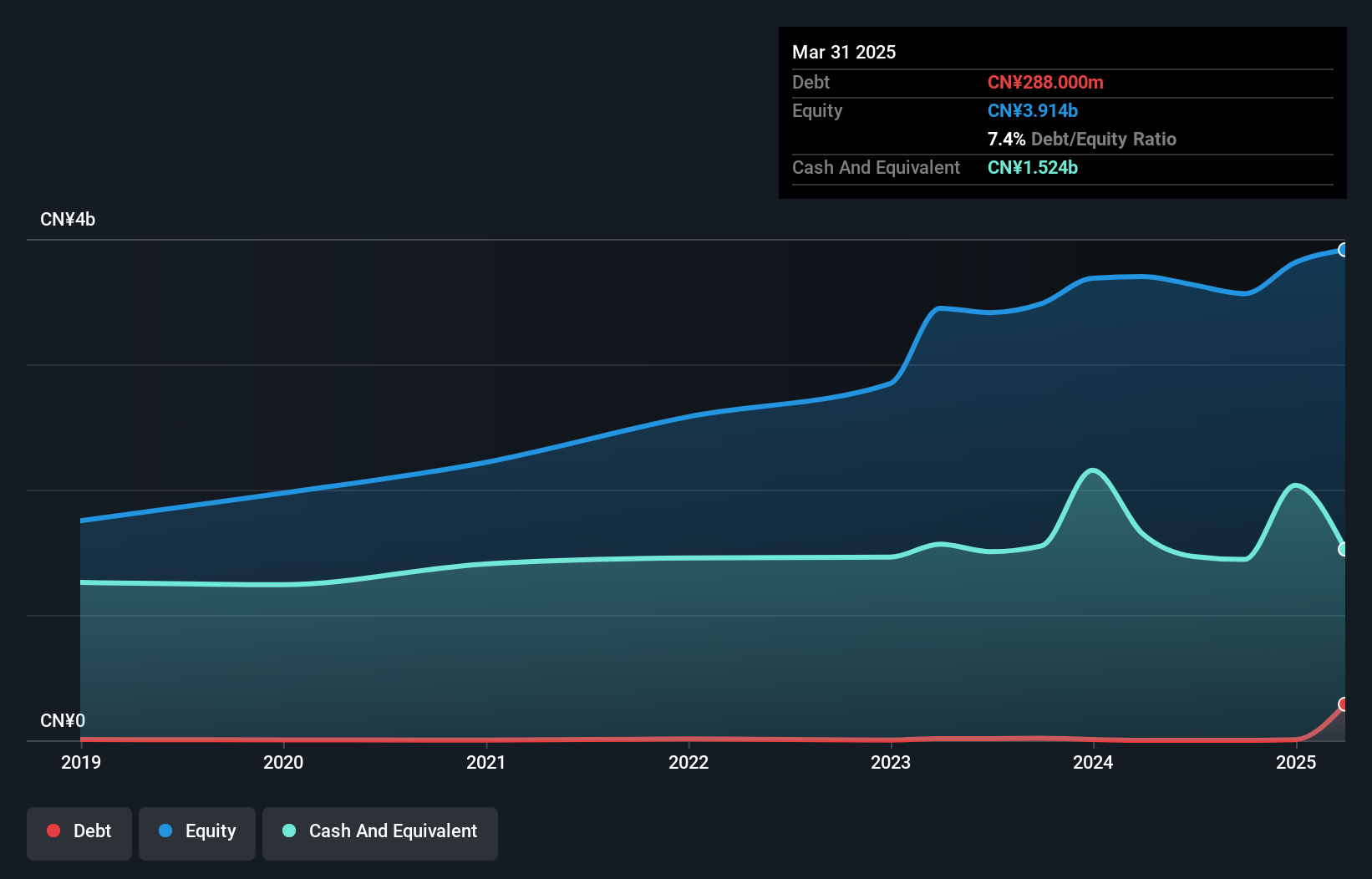

Shanghai Research Institute of Building Sciences Group, a smaller entity in the construction sector, has been making strides with notable financial performance. The company reported sales of CN¥2.59 billion for the nine months ending September 2024, up from CN¥2.52 billion the previous year. Net income rose to CN¥142.84 million from CN¥130.72 million, reflecting solid growth despite industry challenges. Trading at 25% below its estimated fair value suggests potential undervaluation for investors seeking opportunities in this space. Additionally, it repurchased 5,802,710 shares worth CN¥94.97 million by September 2024 under its buyback program announced earlier that year.

Hennge K.K (TSE:4475)

Simply Wall St Value Rating: ★★★★★★

Overview: Hennge K.K. offers cloud security services globally and has a market capitalization of ¥46.24 billion.

Operations: Hennge K.K. generates revenue primarily from its security software and services, amounting to ¥8.36 billion.

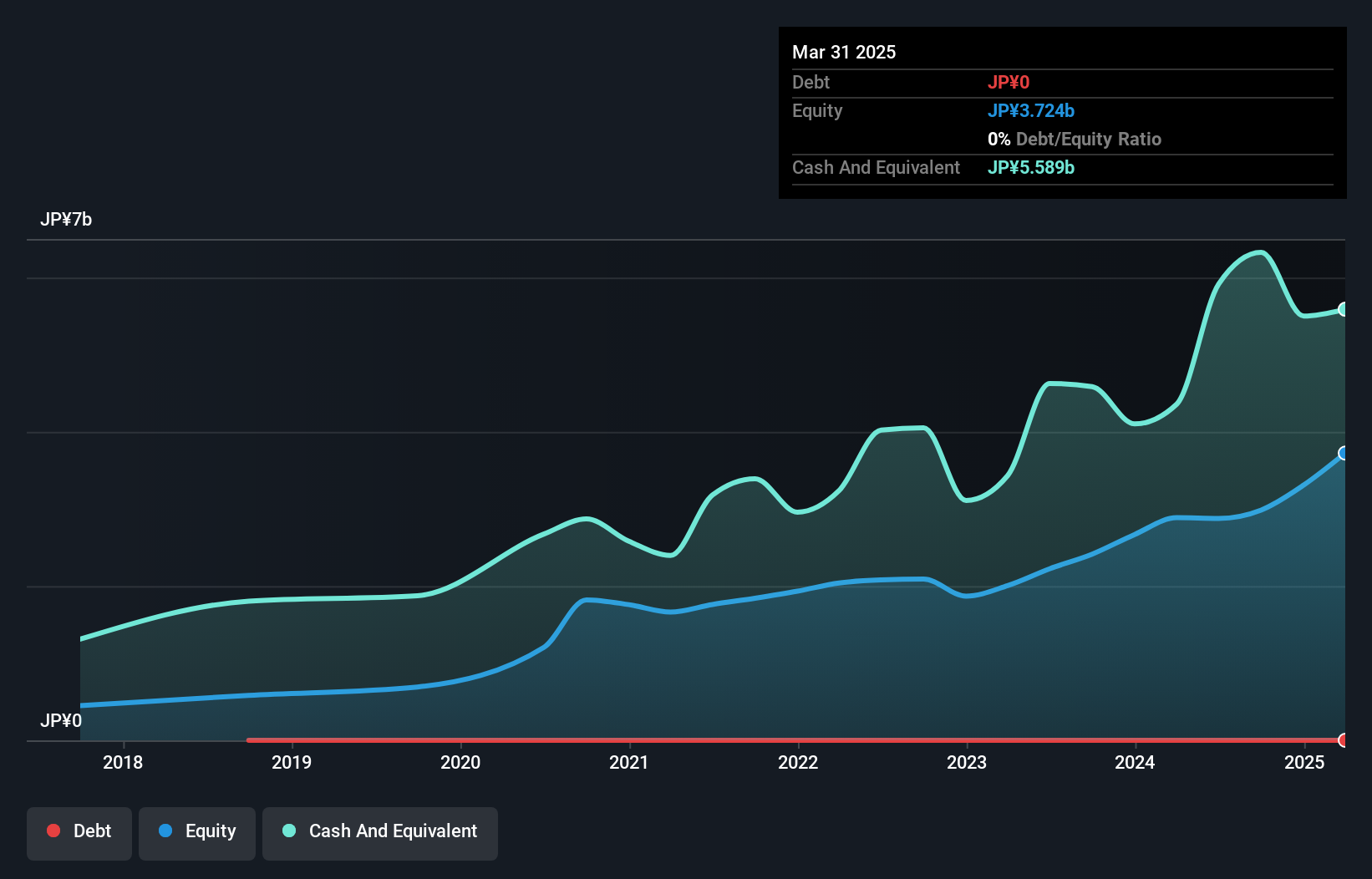

Hennge K.K. stands out with its debt-free status, highlighting financial prudence over the past five years. The company recently projected net sales of ¥10.44 billion and operating profit of ¥1.57 billion for fiscal 2025, indicating robust growth expectations. Earnings surged by 62.9% last year, surpassing the IT industry's average growth rate of 10.3%, showcasing its competitive edge in a dynamic sector. Despite a volatile share price recently, Hennge trades at about 35.9% below estimated fair value, suggesting potential undervaluation in the market's eyes while maintaining high-quality earnings and positive free cash flow signals operational efficiency and profitability stability.

- Take a closer look at Hennge K.K's potential here in our health report.

Examine Hennge K.K's past performance report to understand how it has performed in the past.

Key Takeaways

- Unlock our comprehensive list of 4626 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hallenstein Glasson Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:HLG

Hallenstein Glasson Holdings

Operates as a retailer of men’s and women’s clothing in New Zealand and Australia.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives