- New Zealand

- /

- REITS

- /

- NZSE:APL

Investors in Asset Plus (NZSE:APL) from five years ago are still down 51%, even after 16% gain this past week

While it may not be enough for some shareholders, we think it is good to see the Asset Plus Limited (NZSE:APL) share price up 19% in a single quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. Indeed, the share price is down 61% in the period. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

On a more encouraging note the company has added NZ$13m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for Asset Plus

Asset Plus wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Asset Plus reduced its trailing twelve month revenue by 19% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 10% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

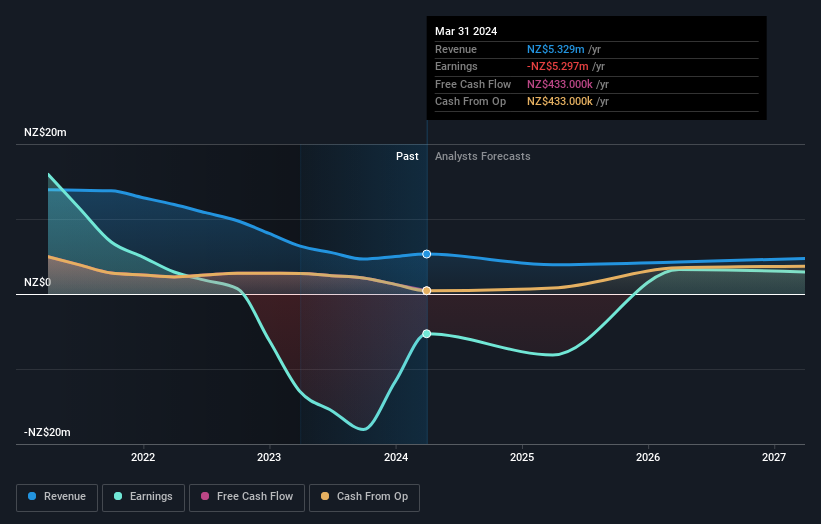

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Asset Plus' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Asset Plus' TSR of was a loss of 51% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Asset Plus shareholders are up 4.2% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 9% endured over half a decade. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Asset Plus you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on New Zealander exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:APL

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives