- New Zealand

- /

- Pharma

- /

- NZSE:AFT

Should AFT Pharmaceuticals (NZSE:AFT) Be Disappointed With Their 89% Profit?

AFT Pharmaceuticals Limited (NZSE:AFT) shareholders have seen the share price descend 11% over the month. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 89% during that period.

Check out our latest analysis for AFT Pharmaceuticals

While AFT Pharmaceuticals made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years AFT Pharmaceuticals has grown its revenue at 12% annually. That's pretty nice growth. While the share price has done well, compounding at 24% yearly, over three years, that move doesn't seem over the top. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

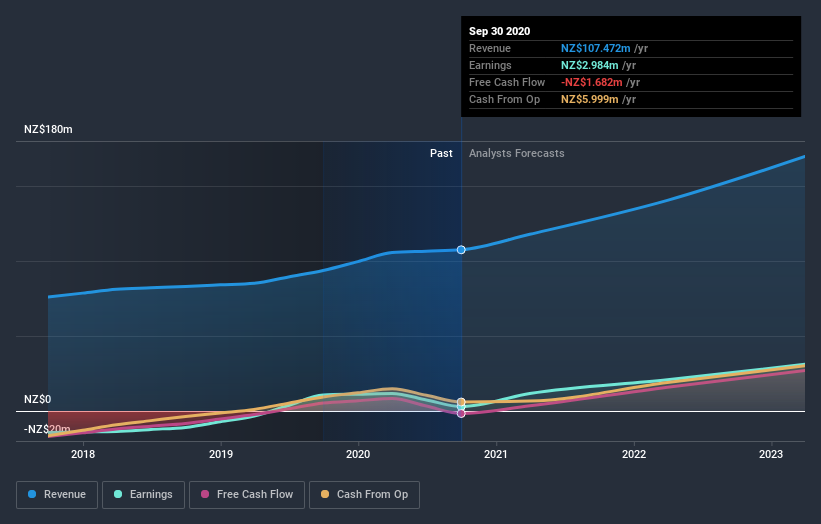

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think AFT Pharmaceuticals will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that AFT Pharmaceuticals rewarded shareholders with a total shareholder return of 35% over the last year. That's better than the annualized TSR of 24% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that AFT Pharmaceuticals is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

AFT Pharmaceuticals is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

If you decide to trade AFT Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NZSE:AFT

AFT Pharmaceuticals

Develops, markets, and distributes pharmaceutical products in New Zealand, Australia, Asia, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives