- New Zealand

- /

- Building

- /

- NZSE:FBU

If You Had Bought Fletcher Building (NZSE:FBU) Stock Five Years Ago, You'd Be Sitting On A 39% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While not a mind-blowing move, it is good to see that the Fletcher Building Limited (NZSE:FBU) share price has gained 11% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 39% in that half decade.

See our latest analysis for Fletcher Building

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Fletcher Building became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

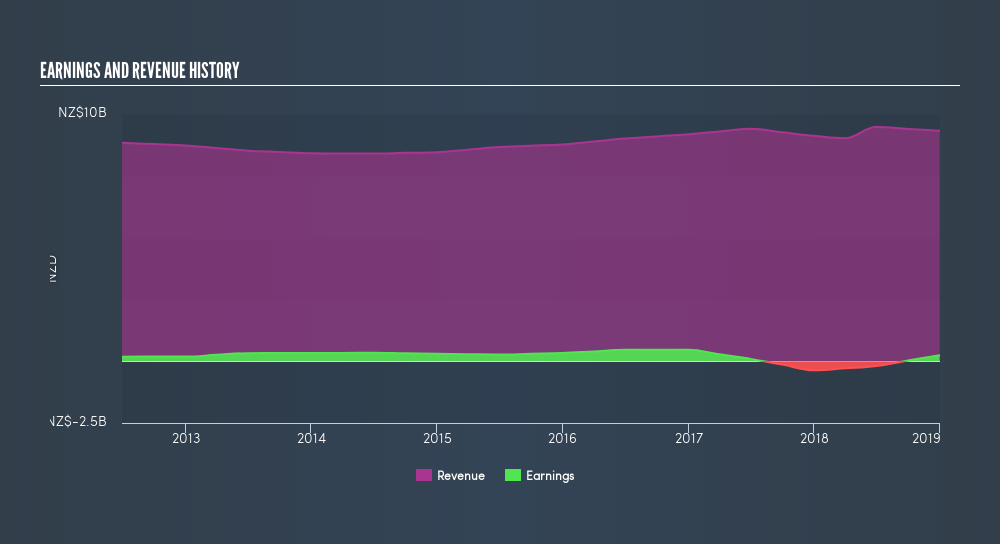

Revenue is actually up 2.6% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Fletcher Building is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Fletcher Building the TSR over the last 5 years was -22%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 14% in the last year, Fletcher Building shareholders lost 23% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is Fletcher Building cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Fletcher Building better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:FBU

Fletcher Building

Engages in the manufacture and distribution of building products in New Zealand, Australia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives