- New Zealand

- /

- Healthcare Services

- /

- NZSE:TAH

Has Third Age Health Services Limited's (NZSE:TAH) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Most readers would already be aware that Third Age Health Services' (NZSE:TAH) stock increased significantly by 22% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to Third Age Health Services' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Third Age Health Services

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Third Age Health Services is:

47% = NZ$1.4m ÷ NZ$2.9m (Based on the trailing twelve months to March 2024).

The 'return' is the yearly profit. So, this means that for every NZ$1 of its shareholder's investments, the company generates a profit of NZ$0.47.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Third Age Health Services' Earnings Growth And 47% ROE

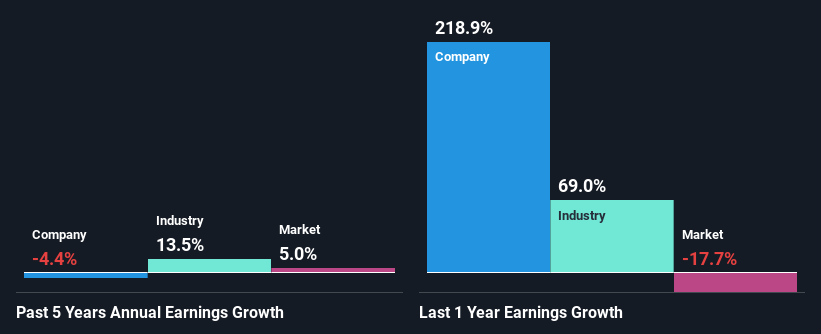

First thing first, we like that Third Age Health Services has an impressive ROE. Second, a comparison with the average ROE reported by the industry of 9.2% also doesn't go unnoticed by us. Needless to say, we are quite surprised to see that Third Age Health Services' net income shrunk at a rate of 4.4% over the past five years. So, there might be some other aspects that could explain this. These include low earnings retention or poor allocation of capital.

So, as a next step, we compared Third Age Health Services' performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 14% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Third Age Health Services fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Third Age Health Services Making Efficient Use Of Its Profits?

Third Age Health Services' declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 78% (or a retention ratio of 22%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. You can see the 3 risks we have identified for Third Age Health Services by visiting our risks dashboard for free on our platform here.

In addition, Third Age Health Services has been paying dividends over a period of three years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Summary

Overall, we feel that Third Age Health Services certainly does have some positive factors to consider. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return. Investors could have benefitted from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Third Age Health Services' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Valuation is complex, but we're here to simplify it.

Discover if Third Age Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:TAH

Third Age Health Services

Provides general practice health care services for older people living in retirement villages, private hospitals, and secure dementia units in New Zealand.

Outstanding track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026