- New Zealand

- /

- Healthcare Services

- /

- NZSE:EBO

EBOS Group (NZSE:EBO) Valuation in Focus Following Full-Year Earnings Decline

Reviewed by Simply Wall St

Most Popular Narrative: 23% Undervalued

The most widely followed narrative sees EBOS Group as significantly undervalued, trading below what analysts consider to be its fair worth. Despite recent share price weakness and slower earnings growth, the consensus points to upside based on future earnings and margin improvements.

"EBOS' major multi-year distribution center renewal program is concluding in FY '26, creating a step change in logistics capacity, automation, and service efficiency. This is set to significantly lower operating costs and improve margins from FY '27 onwards as capital expenditures normalize and productivity benefits ramp up. (Likely impact: net margins, future earnings growth)"

Curious how analysts arrive at this bullish valuation? The narrative pivots on bold financial projections, including forecasts for robust revenue and earnings growth that outpace both historic performance and sector averages. Want to uncover the surprising assumptions about profit margins and future multiples that could justify such a dramatic re-rating? The underlying numbers may challenge your expectations of what’s really possible for EBOS.

Result: Fair Value of $37.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure or delays in realizing logistics savings could quickly undermine this optimistic outlook and cause further downside for EBOS shares.

Find out about the key risks to this EBOS Group narrative.Another View: Market Comparison Tells a Different Story

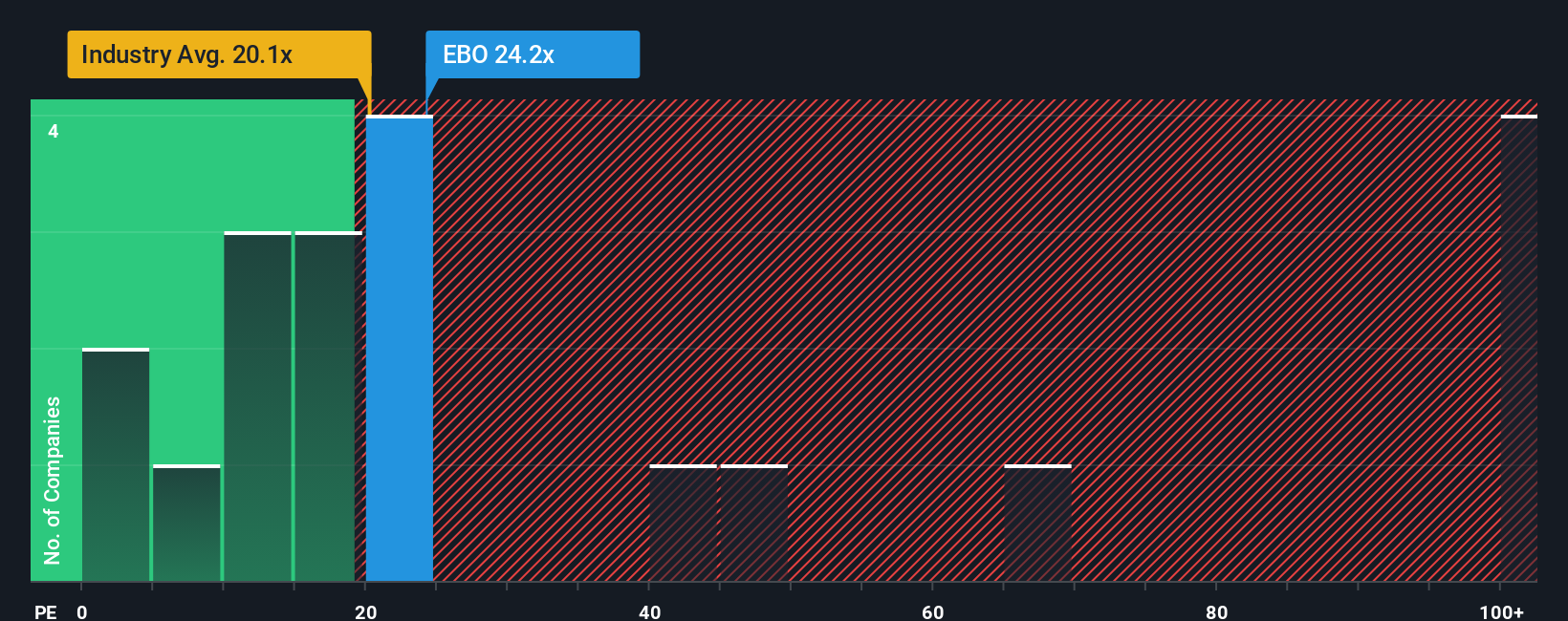

While some models highlight EBOS Group as undervalued, a different approach signals caution. Looking at the company’s valuation ratio against the global healthcare sector, EBOS appears expensive by this measure. Could the market be pricing in risks that the first method misses?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding EBOS Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own EBOS Group Narrative

If you think the story could go another way or want to run your own numbers, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your EBOS Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You never have to guess where the next big opportunity might be. Get ahead by using professional tools to reveal stocks with breakthrough potential. Don't let tomorrow's winners slip by unnoticed.

- Uncover hidden gems offering robust returns with undervalued stocks based on cash flows and see which companies may be trading below their real worth right now.

- Tap into the future of next-level technology breakthroughs. Start your search for innovators in quantum computing via quantum computing stocks.

- Grow your passive income stream by finding companies with reliable yields thanks to dividend stocks with yields > 3% and never miss a top-paying opportunity again.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EBOS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:EBO

EBOS Group

Engages in the marketing, wholesale, and distribution of healthcare, medical, pharmaceutical, and animal care products in Australia, Southeast Asia, and New Zealand.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives