- New Zealand

- /

- Food

- /

- NZSE:LIC

Investors Can Find Comfort In Livestock Improvement's (NZSE:LIC) Earnings Quality

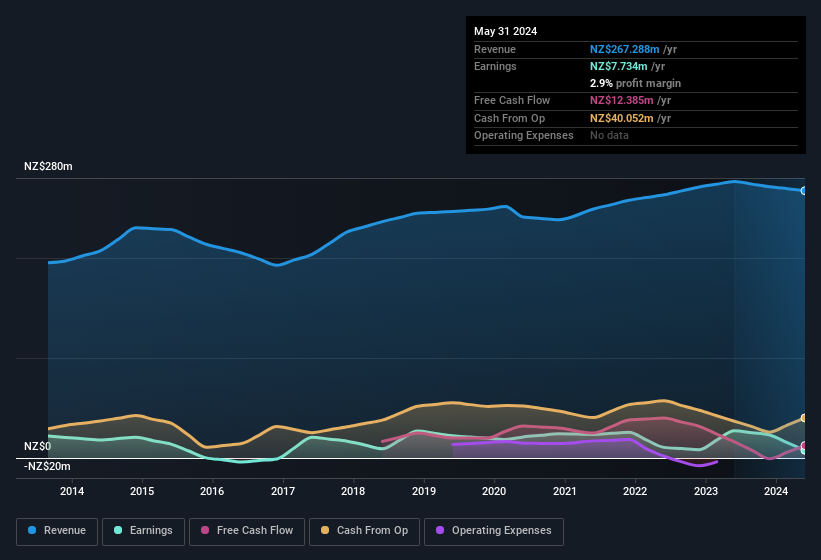

Shareholders appeared unconcerned with Livestock Improvement Corporation Limited's (NZSE:LIC) lackluster earnings report last week. We did some digging, and we believe the earnings are stronger than they seem.

View our latest analysis for Livestock Improvement

How Do Unusual Items Influence Profit?

For anyone who wants to understand Livestock Improvement's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by NZ$8.8m due to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Livestock Improvement took a rather significant hit from unusual items in the year to May 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Livestock Improvement.

Our Take On Livestock Improvement's Profit Performance

As we discussed above, we think the significant unusual expense will make Livestock Improvement's statutory profit lower than it would otherwise have been. Because of this, we think Livestock Improvement's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! Unfortunately, though, its earnings per share actually fell back over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For instance, we've identified 6 warning signs for Livestock Improvement (2 are a bit concerning) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Livestock Improvement's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:LIC

Livestock Improvement

Operates as an agri-tech and herd improvement co-operative in New Zealand, Australia, Ireland, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives