- New Zealand

- /

- Diversified Financial

- /

- NZSE:SPY

Global Penny Stocks To Consider In June 2025

Reviewed by Simply Wall St

Global markets are navigating a complex landscape, with the Federal Reserve maintaining interest rates and geopolitical tensions influencing stock performance. Amid these conditions, smaller-cap indexes have shown resilience, highlighting potential opportunities in less traditional investment areas. Penny stocks, often associated with smaller or newer companies, remain a relevant investment avenue; when these stocks possess strong financial health and fundamentals, they can offer growth potential at accessible price points.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.23 | HK$782.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.035 | £453.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.77 | SEK282.69M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$3.26 | A$753.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.25 | A$156.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,634 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Smartpay Holdings (NZSE:SPY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Smartpay Holdings Limited is a merchant service provider operating in New Zealand and Australia, with a market capitalization of NZ$243.15 million.

Operations: The company generates revenue of NZ$104.72 million by providing technology solutions through various product lines.

Market Cap: NZ$243.15M

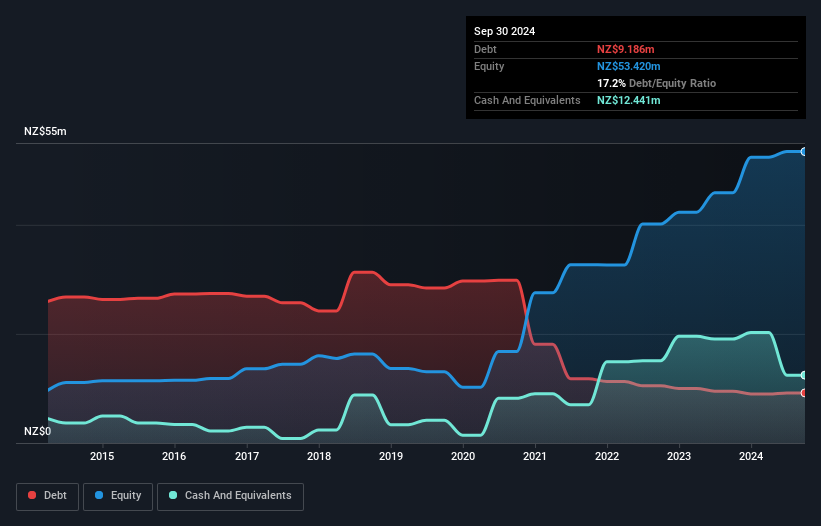

Smartpay Holdings Limited, with a market cap of NZ$243.15 million, is currently navigating financial challenges despite generating NZ$104.72 million in revenue. The company reported a net loss of NZ$0.723 million for the year ending March 2025, contrasting with a profit from the previous year. Its debt management has improved significantly over five years, with net debt to equity at a satisfactory 5.3%. However, Smartpay's interest coverage remains weak at 1.6x EBIT, and its short-term liabilities exceed assets by NZ$10.1M. Recently announced acquisition plans by Shift4 Payments could impact future prospects if approved by shareholders and regulators.

- Unlock comprehensive insights into our analysis of Smartpay Holdings stock in this financial health report.

- Examine Smartpay Holdings' earnings growth report to understand how analysts expect it to perform.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co. Ltd specializes in providing anti-intrusion detection systems in China and has a market capitalization of CN¥7.99 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥7.99B

Fujian Start Group Co. Ltd, with a market cap of CN¥7.99 billion, has shown significant revenue growth in the first quarter of 2025, reporting CN¥41.51 million compared to CN¥4.27 million a year ago, though it remains unprofitable with a net loss of CN¥19.63 million for the same period. The company has improved its financial position over five years by transitioning from negative to positive shareholder equity and maintaining more cash than total debt. Despite these improvements, its earnings per share have declined compared to last year, and it faces challenges in achieving profitability amidst stable weekly volatility.

- Dive into the specifics of Fujian Start GroupLtd here with our thorough balance sheet health report.

- Assess Fujian Start GroupLtd's previous results with our detailed historical performance reports.

Kingland TechnologyLtd (SZSE:000711)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingland Technology Co., Ltd. offers ecological environment solutions in China and has a market cap of CN¥4.89 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥498.10 million.

Market Cap: CN¥4.89B

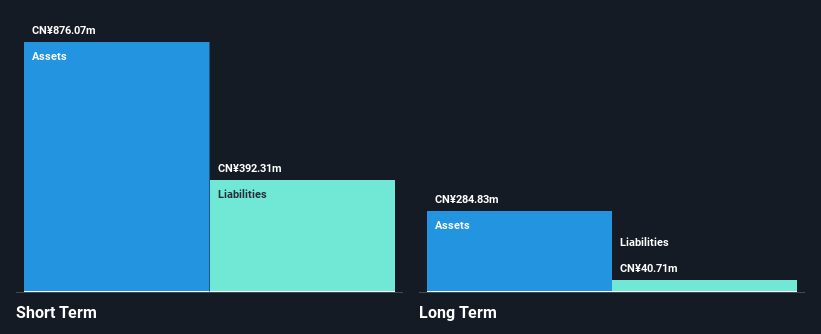

Kingland Technology Co., Ltd. has made strides in revenue growth, reporting CN¥126.33 million for Q1 2025, a significant increase from CN¥6.08 million the previous year, though it remains unprofitable with a net loss of CN¥12.95 million for the same period. The company has reduced its debt to equity ratio significantly over five years and maintains short-term assets exceeding both short- and long-term liabilities, indicating financial stability despite less than a year's cash runway if current free cash flow trends persist. Recent shareholder meetings have focused on strategic agreements and financing guarantees for subsidiaries, highlighting active management efforts amidst an inexperienced leadership team.

- Take a closer look at Kingland TechnologyLtd's potential here in our financial health report.

- Evaluate Kingland TechnologyLtd's historical performance by accessing our past performance report.

Next Steps

- Dive into all 5,634 of the Global Penny Stocks we have identified here.

- Contemplating Other Strategies? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SPY

Smartpay Holdings

Operates as a merchant service provider in New Zealand and Australia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives