- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3622

NZX And 2 Other Small Caps Backed By Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a mixed performance, with the S&P 500 and Nasdaq Composite marking significant gains over the past year despite recent volatility, small-cap stocks continue to capture investor interest amid fluctuating economic indicators such as the Chicago PMI and GDP forecasts. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth; characteristics include robust financial health, competitive positioning in their respective industries, and resilience in challenging market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

NZX (NZSE:NZX)

Simply Wall St Value Rating: ★★★★★★

Overview: NZX Limited operates a stock exchange in New Zealand and has a market capitalization of NZ$480.72 million.

Operations: NZX Limited's primary revenue streams include Funds Services at NZ$40.27 million, Secondary Markets at NZ$24.75 million, and Information Services at NZ$19.57 million. Capital Markets Origination contributes NZ$15.74 million to the revenue, followed by Wealth Tech with NZ$8.01 million and Regulation with NZ$3.89 million, while Corporate Services adds a smaller amount of NZ$0.10 million.

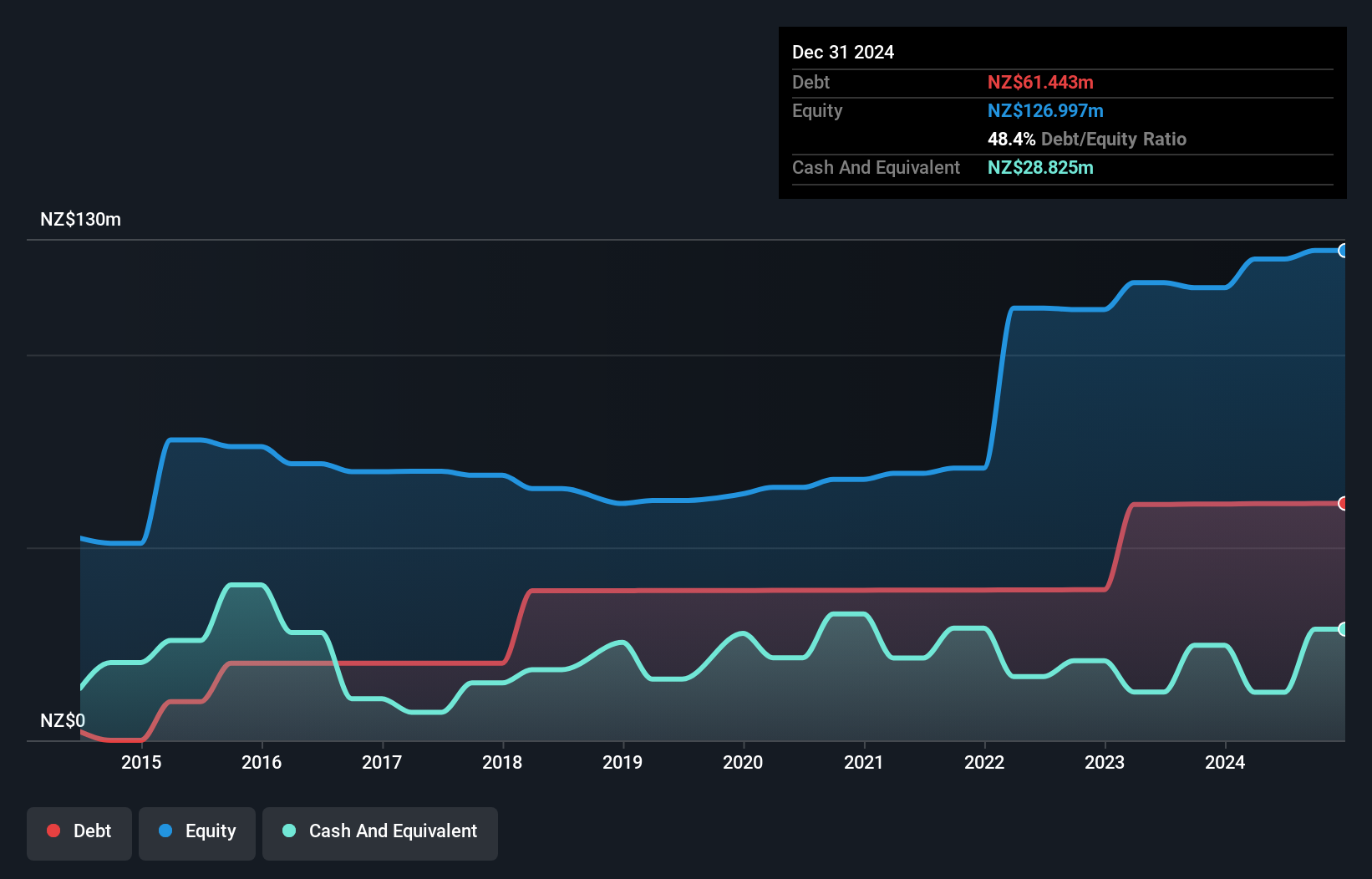

NZX has demonstrated notable financial resilience and growth, with its debt to equity ratio improving from 62.5% to 49.2% over the last five years, and a net debt to equity ratio at a satisfactory 39.2%. The company's earnings soared by 58.9% in the past year, outpacing the industry average of 17.2%, although this includes a one-off gain of NZ$6 million impacting recent results. Earnings guidance for fiscal year 2024 was raised to NZ$45-49 million due to robust capital raising activities and increased trading volumes, suggesting positive momentum in its operations despite potential market uncertainties ahead.

- Unlock comprehensive insights into our analysis of NZX stock in this health report.

Gain insights into NZX's past trends and performance with our Past report.

Medprin Regenerative Medical Technologies (SZSE:301033)

Simply Wall St Value Rating: ★★★★★☆

Overview: Medprin Regenerative Medical Technologies Co., Ltd. operates in the field of regenerative medical solutions and has a market cap of CN¥2.83 billion.

Operations: Medprin generates revenue primarily through its regenerative medical solutions. The company's net profit margin has shown a notable trend, with the latest figure recorded at 15.23%.

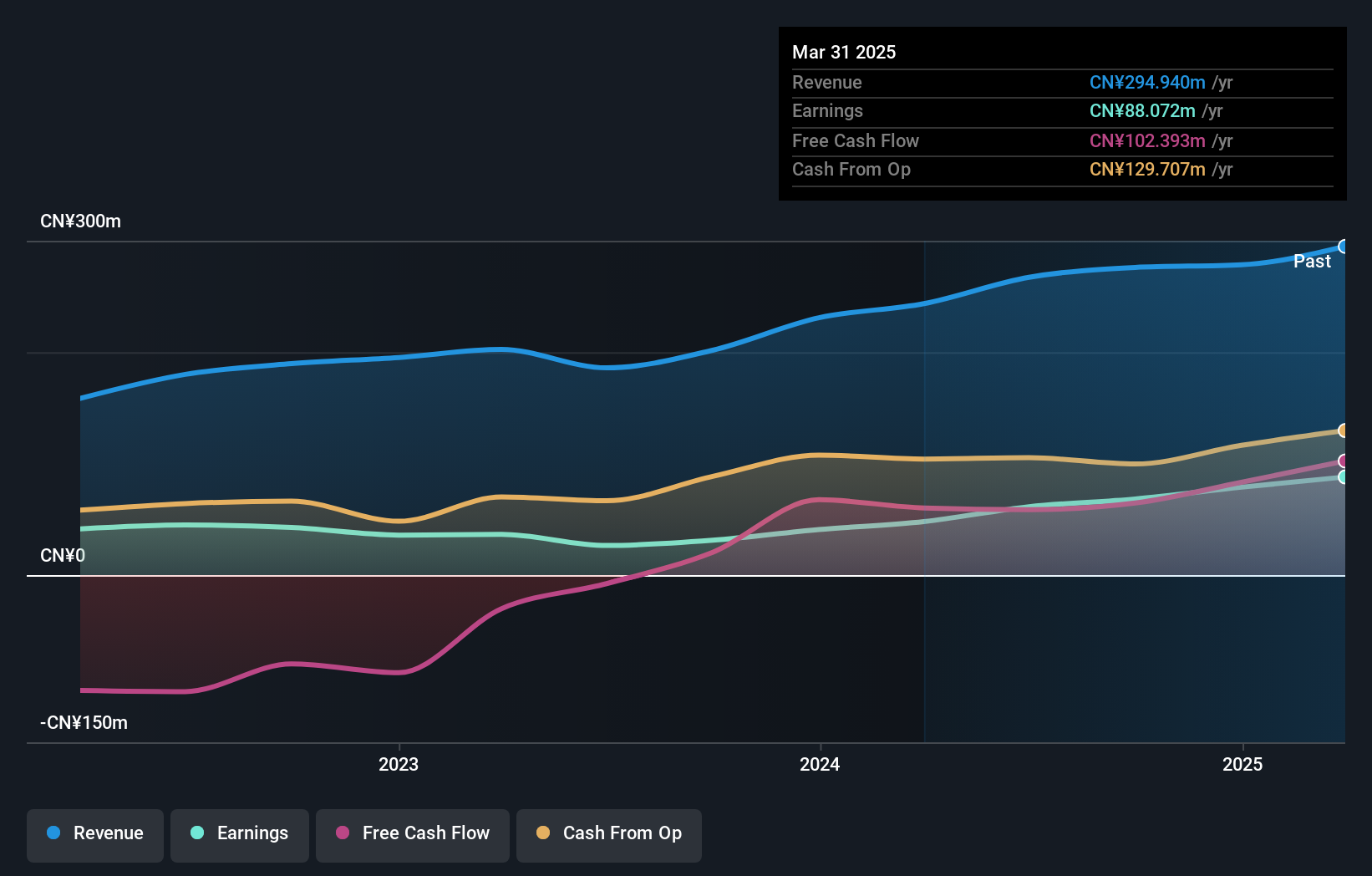

Medprin Regenerative Medical Technologies, a dynamic player in the medical equipment sector, reported impressive earnings growth of 118.2% over the past year, outpacing the industry’s -8.8%. The company's net income for the nine months ended September 2024 was CNY 52.8 million, up from CNY 25.42 million in the previous year, with basic earnings per share doubling to CNY 0.8. Despite a slight increase in its debt-to-equity ratio to 0.2% over five years, Medprin maintains more cash than total debt and positive free cash flow of CNY 64.65 million as of September 2024 suggests robust financial health and potential for further growth.

Young Fast Optoelectronics (TWSE:3622)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Fast Optoelectronics Co., Ltd. specializes in the research, development, manufacture, and sale of touch panels for PDA devices across Taiwan, the rest of Asia, and the Americas with a market cap of NT$9.38 billion.

Operations: Young Fast Optoelectronics generates revenue primarily from its Electromechanical Business Group, contributing NT$1.39 billion, while the Optoelectronic Business Group adds NT$334.56 million.

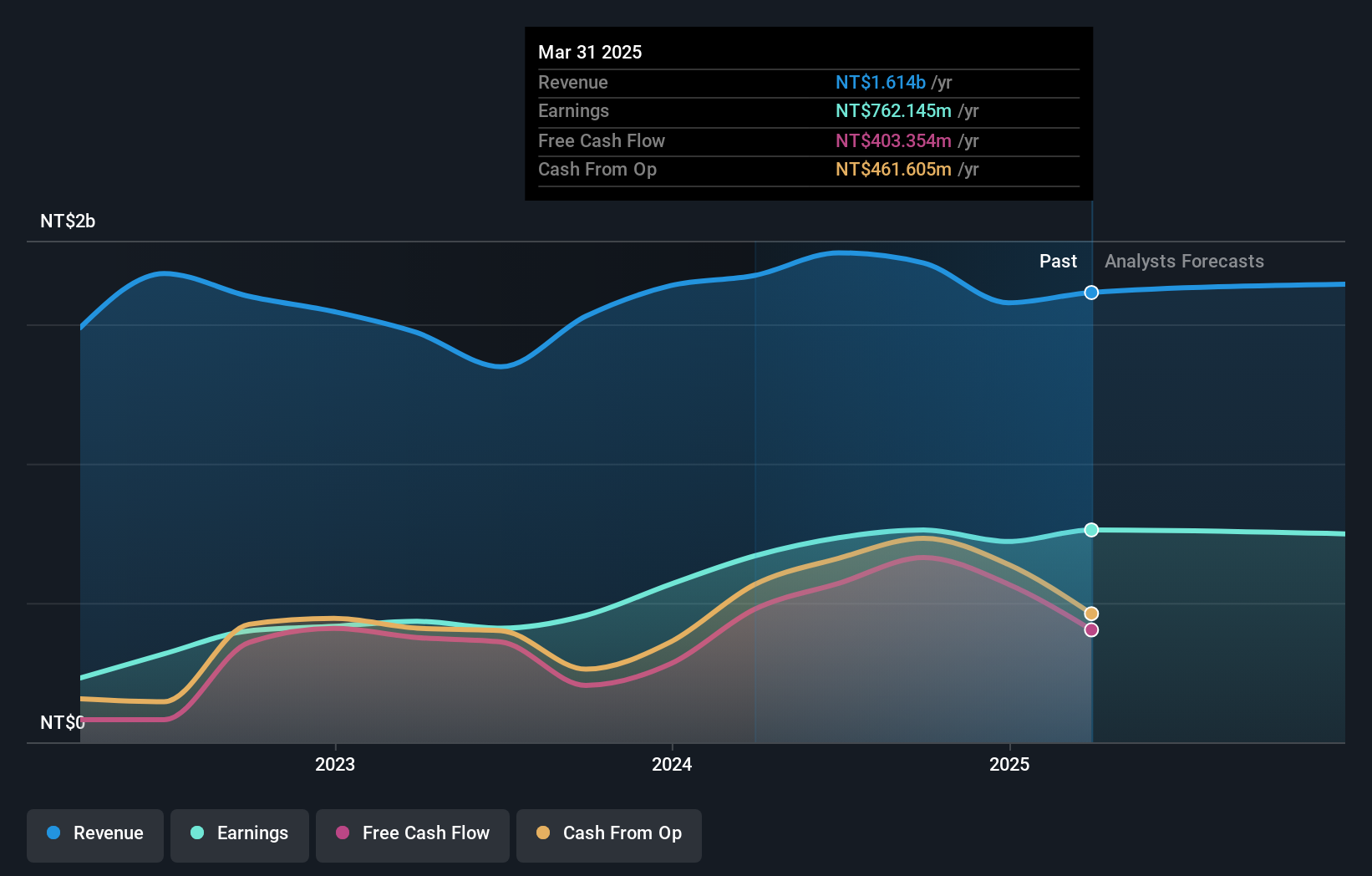

Young Fast Optoelectronics showcases a compelling profile with its earnings growth of 67.3% over the past year, significantly outpacing the Electronic industry’s 6.6%. The company trades at 63.3% below its estimated fair value, suggesting potential undervaluation compared to peers and industry standards. Recent financials reveal net income for Q3 2024 at TWD 306.57 million, up from TWD 279.09 million a year prior, with basic EPS rising to TWD 2.02 from TWD 1.85 in the same period last year. Despite executive changes in late December, Young Fast maintains high-quality earnings and an appropriate debt level with more cash than total debt, reducing its debt-to-equity ratio from 1.3 to 0.5 over five years.

Seize The Opportunity

- Dive into all 4659 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3622

Young Fast Optoelectronics

Engages in the research, development, manufacture, and sale of various touch panels for PDA devices in Taiwan, rest of Asia, and the Americas.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives