- New Zealand

- /

- Diversified Financial

- /

- NZSE:IFT

Profit Rebound and Dividend Increase Might Change the Case for Investing in Infratil (NZSE:IFT)

Reviewed by Sasha Jovanovic

- Earlier this month, Infratil reported its half-year earnings for the period ended September 30, 2025, highlighting revenue growth to NZ$1.99 billion, a return to net profit of NZ$605.7 million, and an increased interim dividend of NZ$0.08044 per share.

- This turnaround from a net loss a year earlier not only reflects improved business performance but also a boost to shareholder returns through a higher dividend payout.

- We'll now examine how this substantial return to profitability may shape Infratil's investment outlook and future growth expectations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Infratil Investment Narrative Recap

To be a shareholder in Infratil, you need to believe in the group’s ability to generate growth from its portfolio of infrastructure assets, particularly in renewables, digital infrastructure, and essential services, while managing evolving risks. The recent swing back to profitability is a boost, but it does not meaningfully change the most important short term catalyst, which remains CDC’s ability to sign new customer contracts and bring fresh data centre capacity online; risks like merger approval delays and U.S. green policy uncertainty remain front of mind.

Among the latest announcements, the declaration of a higher interim dividend, up to NZ$0.08044 per share, stands out in the context of the improved half-year results. This supports the narrative that Infratil is focused on delivering shareholder returns even as it works through critical business developments, though these dividend increases do not directly impact the major catalysts such as CDC’s customer negotiations or One NZ’s revenue recovery.

But, for all this optimism, investors should stay attentive to the potential consequences if the Manawa and Contact merger...

Read the full narrative on Infratil (it's free!)

Infratil's outlook anticipates NZ$4.1 billion in revenue and NZ$300.1 million in earnings by 2028. This is based on a projected 4.4% annual revenue growth rate and a NZ$808.4 million increase in earnings from the current NZ$-508.3 million level.

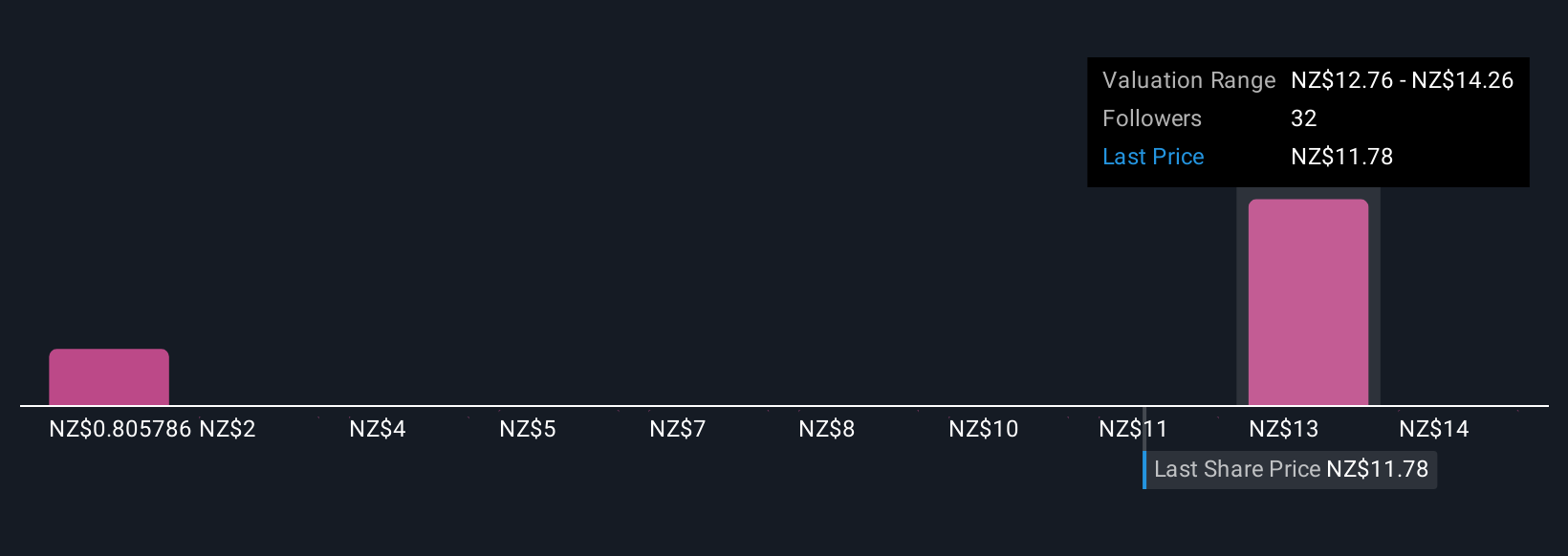

Uncover how Infratil's forecasts yield a NZ$13.72 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community estimate Infratil’s fair value anywhere from NZ$0.51 to NZ$15.75 per share. As CDC signs new contracts, a current catalyst, these differing views remind you that market opinions can vary widely, so take the opportunity to review several perspectives before forming an outlook.

Explore 7 other fair value estimates on Infratil - why the stock might be worth less than half the current price!

Build Your Own Infratil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infratil research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Infratil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infratil's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:IFT

Infratil

An infrastructure investment firm specializing in digital Infrastructure, renewables, and social infrastructure.

Low risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success