- New Zealand

- /

- Professional Services

- /

- NZSE:AGL

Risks Still Elevated At These Prices As Accordant Group Limited (NZSE:AGL) Shares Dive 27%

The Accordant Group Limited (NZSE:AGL) share price has fared very poorly over the last month, falling by a substantial 27%. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

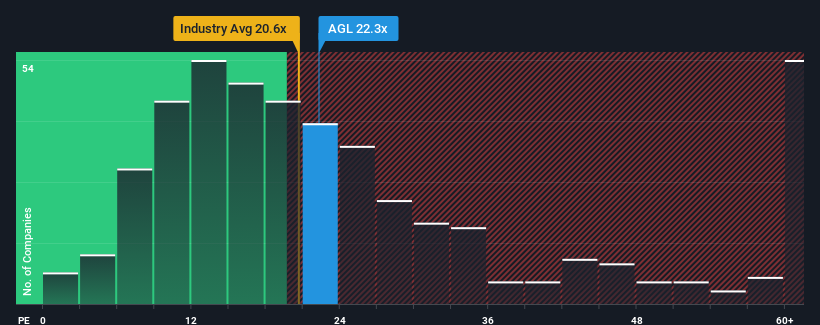

Although its price has dipped substantially, Accordant Group's price-to-earnings (or "P/E") ratio of 22.3x might still make it look like a sell right now compared to the market in New Zealand, where around half of the companies have P/E ratios below 16x and even P/E's below 10x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, Accordant Group's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Accordant Group

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Accordant Group would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 71% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 79% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this information, we find it concerning that Accordant Group is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Despite the recent share price weakness, Accordant Group's P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Accordant Group currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 6 warning signs for Accordant Group (3 make us uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Accordant Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:AGL

Accordant Group

Provides recruitment and staffing services in New Zealand.

Slight and slightly overvalued.

Market Insights

Community Narratives