- New Zealand

- /

- Machinery

- /

- NZSE:SCT

Slowing Rates Of Return At Scott Technology (NZSE:SCT) Leave Little Room For Excitement

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at Scott Technology (NZSE:SCT) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Scott Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = NZ$21m ÷ (NZ$253m - NZ$117m) (Based on the trailing twelve months to August 2023).

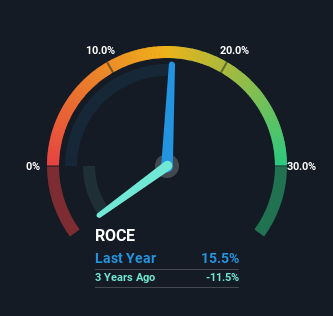

So, Scott Technology has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 13% generated by the Machinery industry.

See our latest analysis for Scott Technology

Above you can see how the current ROCE for Scott Technology compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Scott Technology.

What Can We Tell From Scott Technology's ROCE Trend?

Over the past five years, Scott Technology's ROCE and capital employed have both remained mostly flat. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. With that in mind, unless investment picks up again in the future, we wouldn't expect Scott Technology to be a multi-bagger going forward. This probably explains why Scott Technology is paying out 42% of its income to shareholders in the form of dividends. Unless businesses have highly compelling growth opportunities, they'll typically return some money to shareholders.

On a side note, Scott Technology's current liabilities are still rather high at 46% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

What We Can Learn From Scott Technology's ROCE

In summary, Scott Technology isn't compounding its earnings but is generating stable returns on the same amount of capital employed. Unsurprisingly, the stock has only gained 40% over the last five years, which potentially indicates that investors are accounting for this going forward. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

While Scott Technology doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation on our platform.

While Scott Technology may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:SCT

Scott Technology

Engages in the design, manufacture, sale, and servicing of automated and robotic production lines and processes for various industries in New Zealand and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives