- New Zealand

- /

- Machinery

- /

- NZSE:SCT

Scott Technology (NZSE:SCT) Net Profit Margin Expands, Reinforcing Bullish Narratives on Earnings Quality

Reviewed by Simply Wall St

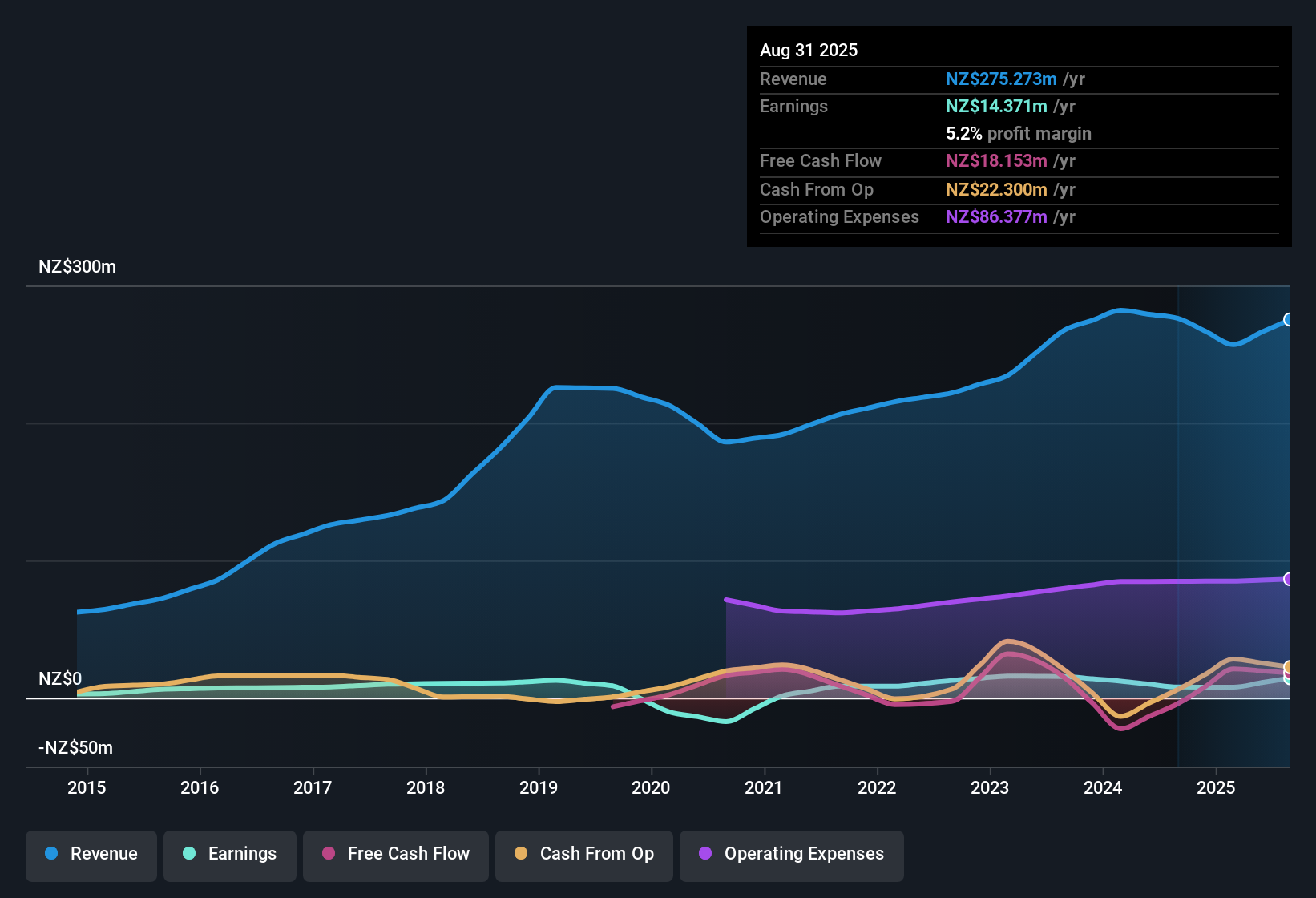

Scott Technology (NZSE:SCT) has posted strong results, recording net profit margins of 5.2% this year, up from 2.8% last year, and delivering an impressive 83% annual earnings growth compared to its five-year average of 28.7% per annum. Earnings are forecast to keep rising at 20.9% per year, with revenue growth expectations of 11.5% annually, outpacing the New Zealand market average of 3.9%. Overall, robust profitability and sustained growth are fueling positive sentiment, though investors remain alert to recent share price volatility.

See our full analysis for Scott Technology.Next, we will see how the latest numbers compare with the main narratives tracked by the market. Sometimes the data backs up prevailing views; other times it puts them to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Valuation Discount Narrows the Gap

- Scott Technology’s share price of NZ$2.96 currently sits 31% below its DCF fair value estimate of NZ$4.32, highlighting a significant disconnect between price and underlying fundamentals.

- This supports optimism around value upside as prevailing market analysis points to robust operational momentum outpacing recent share price moves.

- This valuation discount stands out when considering the company’s sustained profit margins of 5.2%, which exceed the peer group average.

- Market watchers note that such a sizable gap to intrinsic value is rare among New Zealand industrials with similar growth outlooks.

Profit Margin Recovery Signals Improved Efficiency

- Net profit margins advanced from 2.8% last year to 5.2% this year, continuing a multi-year trend of earnings quality improvement that exceeds the company’s own five-year average.

- What is notable is that, despite ongoing supply chain and sector cost headwinds, operational execution has mitigated margin pressure, reflecting positively on management’s adaptability.

- This multi-year margin expansion aligns with steady contract wins and repeat business in international markets.

- Prevailing market view notes that few industry peers have managed such resilience, further reinforcing investor confidence in SCT's ability to navigate macroeconomic challenges.

Peer Comparison Paints a Mixed Valuation Picture

- With a price-to-earnings ratio of 17.1x, Scott Technology trades attractively relative to the global machinery industry average of 24.6x, though still at a premium to local peers averaging 15.3x.

- Prevailing market view emphasizes that, while global valuation compares favorably, the local peer premium calls for ongoing monitoring as sector multiples evolve.

- This premium positioning is partially justified by Scott Technology’s higher forecast earnings growth rate of 20.9% per year, outpacing both the sector and market averages.

- Yet, it also introduces the risk that local investors may hesitate if the company’s rapid growth trajectory slows, underscoring the need to watch for any future guidance updates.

Have a read of the narrative in full and understand what's behind the forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Scott Technology's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Scott Technology’s global valuation may seem attractive, its premium to local peers could become a concern if future earnings growth slows.

If you prefer companies with more predictable expansion, focus your search on steady performers. Use our stable growth stocks screener (2087 results) to identify businesses with a proven track record of consistent revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SCT

Scott Technology

Engages in the design, manufacture, sale, and servicing of automated and robotic production lines and processes for various industries in New Zealand and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives