Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies. Scott Technology Limited (NZSE:SCT) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Scott Technology

How Much Debt Does Scott Technology Carry?

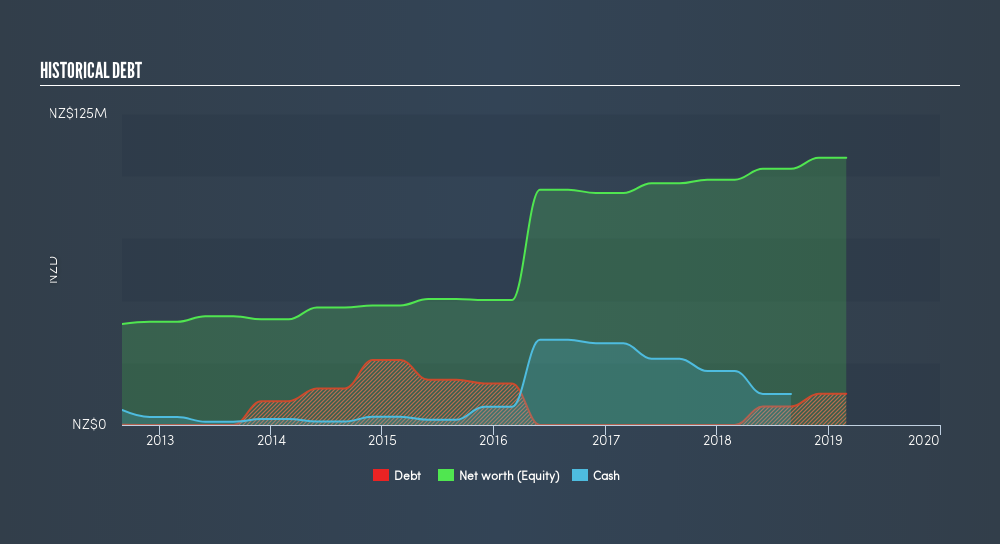

You can click the graphic below for the historical numbers, but it shows that as of February 2019 Scott Technology had NZ$12.9m of debt, an increase on NZ$39.0k, over one year. However, it also had NZ$12.5m in cash, and so its net debt is NZ$383.0k.

A Look At Scott Technology's Liabilities

Zooming in on the latest balance sheet data, we can see that Scott Technology had liabilities of NZ$48.5m due within 12 months and liabilities of NZ$5.84m due beyond that. On the other hand, it had cash of NZ$12.5m and NZ$51.3m worth of receivables due within a year. So it can boast NZ$9.43m more liquid assets than total liabilities.

This surplus suggests that Scott Technology has a conservative balance sheet, and could probably eliminate its debt without much difficulty. But either way, Scott Technology has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Scott Technology has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.018 and EBIT of 25.9 times the interest expense. So relative to past earnings, the debt load seems trivial. Also positive, Scott Technology grew its EBIT by 20% in the last year, and that should make it easier to pay down debt, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is Scott Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Scott Technology burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Happily, Scott Technology's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that Scott Technology can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Given Scott Technology has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:SCT

Scott Technology

Engages in the design, manufacture, sale, and servicing of automated and robotic production lines and processes for various industries in New Zealand and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives