- Norway

- /

- Electric Utilities

- /

- OB:SKAND

Market Might Still Lack Some Conviction On Skandia GreenPower AS (OB:SKAND) Even After 42% Share Price Boost

Skandia GreenPower AS (OB:SKAND) shares have continued their recent momentum with a 42% gain in the last month alone. The annual gain comes to 229% following the latest surge, making investors sit up and take notice.

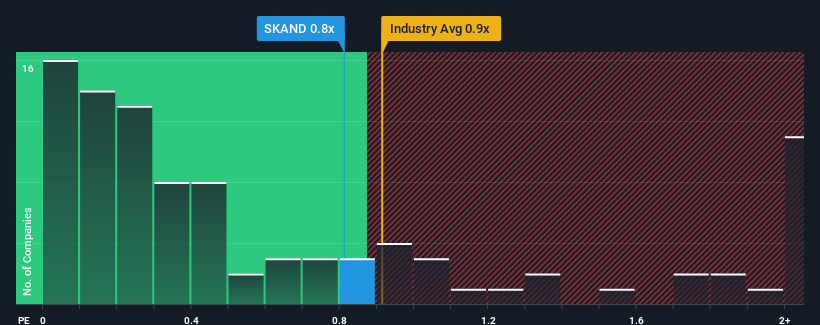

In spite of the firm bounce in price, there still wouldn't be many who think Skandia GreenPower's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Norway's Electric Utilities industry is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Skandia GreenPower

What Does Skandia GreenPower's P/S Mean For Shareholders?

For instance, Skandia GreenPower's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Skandia GreenPower, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Skandia GreenPower's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 51%. Still, the latest three year period has seen an excellent 35% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 4.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Skandia GreenPower's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Skandia GreenPower appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Skandia GreenPower's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Skandia GreenPower (of which 2 are a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on Skandia GreenPower, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SKAND

Skandia GreenPower

Engages in the provision of electricity and energy-saving services in Norway.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.