- Norway

- /

- Renewable Energy

- /

- OB:SCATC

Exploring 3 Noteworthy Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

In a week marked by a busy earnings season and mixed economic signals, small-cap stocks demonstrated resilience compared to their larger counterparts, even as major indices like the S&P MidCap 400 and Nasdaq Composite experienced volatility. With global markets grappling with uncertainties from labor disruptions to fluctuating manufacturing activity, identifying promising small-cap opportunities requires careful consideration of both market sentiment and insider actions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 23.3x | 0.8x | 30.65% | ★★★★★☆ |

| Maharashtra Seamless | 9.5x | 1.6x | 38.90% | ★★★★★☆ |

| Lion Rock Group | 5.5x | 0.4x | 49.47% | ★★★★☆☆ |

| NCL Industries | 12.4x | 0.5x | -34.36% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.7x | 0.7x | 30.76% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 15.0x | 1.7x | -48.16% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Dwarikesh Sugar Industries | NA | 0.9x | -19.80% | ★★★☆☆☆ |

| Safari Investments RSA | 5.5x | 3.2x | 6.26% | ★★★☆☆☆ |

| Bajel Projects | 257.1x | 2.0x | 26.19% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

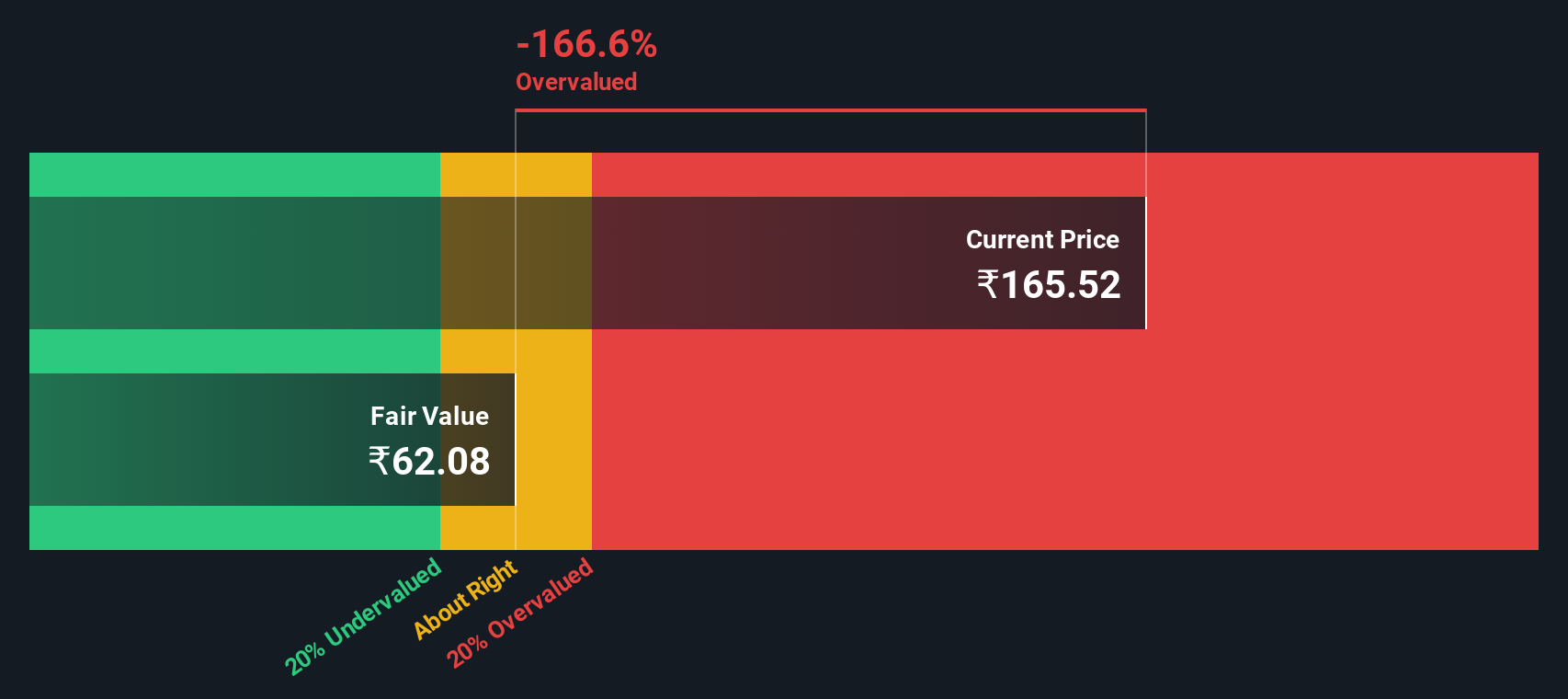

Paradeep Phosphates (NSEI:PARADEEP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paradeep Phosphates is a company engaged in the manufacturing and trading of fertilizers and other related materials, with operations contributing significantly to its market capitalization of ₹43.16 billion.

Operations: The company's primary revenue stream is derived from fertilizers and other trading materials, with recent revenue figures reaching ₹110.59 billion. Cost of goods sold (COGS) significantly impacts profitability, as seen in the most recent data where COGS was ₹81.46 billion. The gross profit margin has shown variability over time, recently recorded at 26.35%. Operating expenses and non-operating expenses also play a crucial role in shaping net income outcomes.

PE: 23.3x

Paradeep Phosphates, a smaller company in the fertilizer sector, has recently announced plans to expand its phosphoric acid capacity from 0.5 MMTPA to 0.7 MMTPA, aiming for complete backward integration and reduced import reliance. The company's Q2 earnings showed a significant increase in net income to INR 2,276 million from INR 894 million the previous year. Despite receiving an environmental penalty of INR 4 million for alleged violations, they have contested these claims while complying with directives. With insider confidence evident through share purchases earlier this year and projected earnings growth of over 27% annually, Paradeep Phosphates presents potential opportunities amidst its challenges.

- Click to explore a detailed breakdown of our findings in Paradeep Phosphates' valuation report.

Gain insights into Paradeep Phosphates' past trends and performance with our Past report.

Scatec (OB:SCATC)

Simply Wall St Value Rating: ★★★☆☆☆

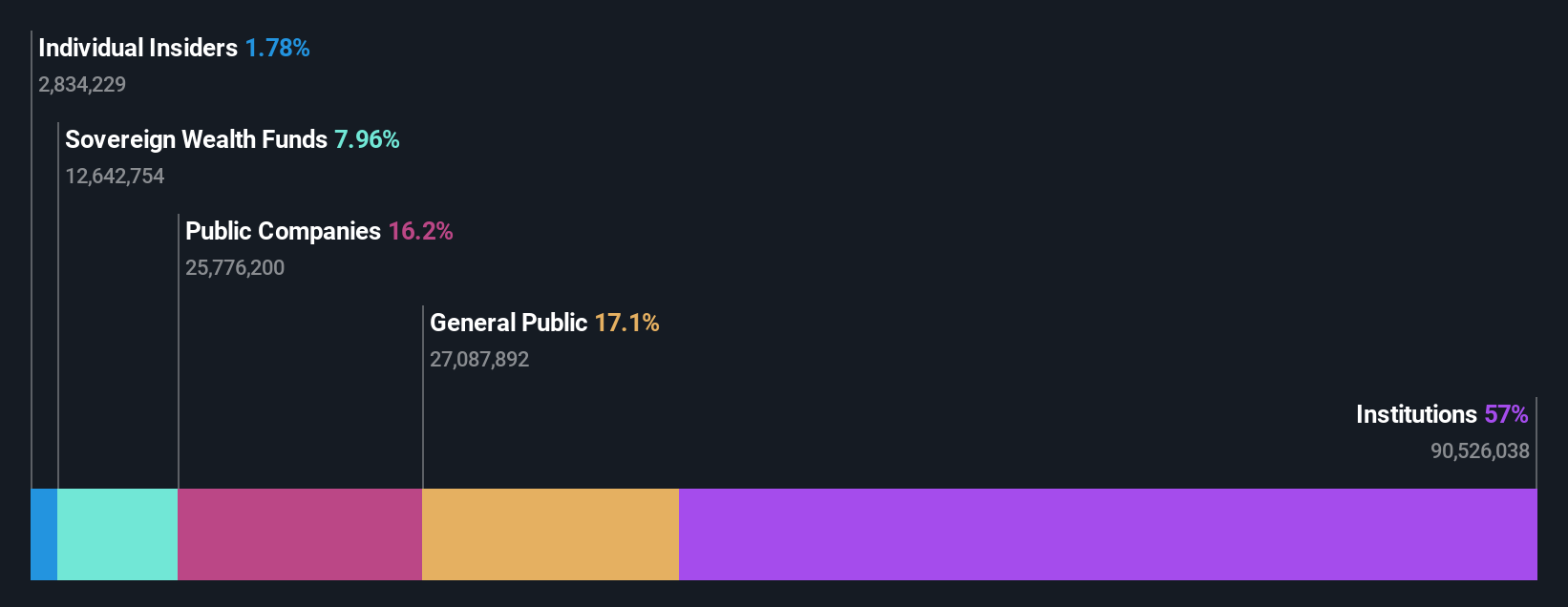

Overview: Scatec is a renewable energy company focused on developing, constructing, and operating solar power plants globally, with a market capitalization of NOK 11.33 billion.

Operations: The company's revenue streams include significant contributions from Development & Construction and Unallocated Residual Ownership Interests, with Segment Adjustment also playing a notable role. Over recent periods, the gross profit margin has consistently been at 100%. Operating expenses are primarily driven by general and administrative costs, alongside depreciation and amortization expenses.

PE: 7.3x

Scatec, a renewable energy company, has seen significant insider confidence with recent share purchases. Despite earnings projected to decline 24.4% annually over the next three years and reliance on external borrowing, Scatec's revenue for Q3 2024 surged to NOK 2.97 billion from NOK 947 million year-on-year, indicating potential undervaluation in the market. The company's strategic moves include a USD-denominated PPA in Egypt and a ZAR 3 billion battery project in South Africa, positioning it for future growth amidst financial challenges.

- Navigate through the intricacies of Scatec with our comprehensive valuation report here.

Understand Scatec's track record by examining our Past report.

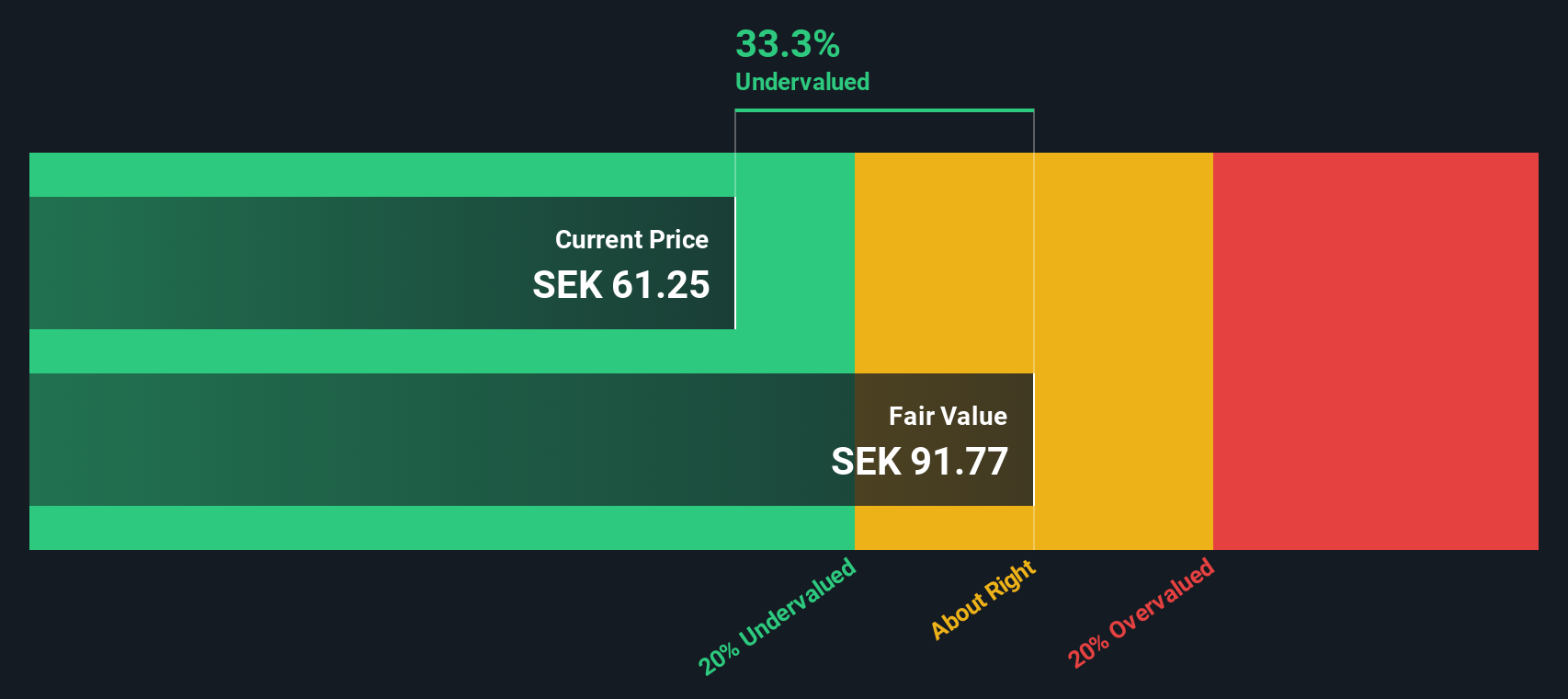

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Truecaller is a communications software company specializing in caller identification and spam blocking services, with a market cap of approximately SEK 20.32 billion.

Operations: The company generates revenue primarily from its communications software segment, with recent revenue recorded at SEK 1.72 billion. The gross profit margin has shown a trend of being over 75% in recent periods. Operating expenses are significant, with general and administrative expenses consistently forming a substantial portion of these costs.

PE: 35.5x

Truecaller, a company focused on enhancing communication safety and efficiency, has formed strategic partnerships with King Price Insurance and Halan to strengthen brand credibility and customer trust. The company’s Verified Business Caller ID solution is gaining traction globally, benefiting over 2,500 businesses. Despite relying solely on external borrowing for funding, Truecaller shows promising growth potential with earnings projected to increase by 21.76% annually. Recent insider confidence through share purchases further underscores belief in the company's future prospects.

Next Steps

- Reveal the 182 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SCATC

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)