- Norway

- /

- Renewable Energy

- /

- OB:MPCES

MPC Energy Solutions N.V. (OB:MPCES) Soars 39% But It's A Story Of Risk Vs Reward

MPC Energy Solutions N.V. (OB:MPCES) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

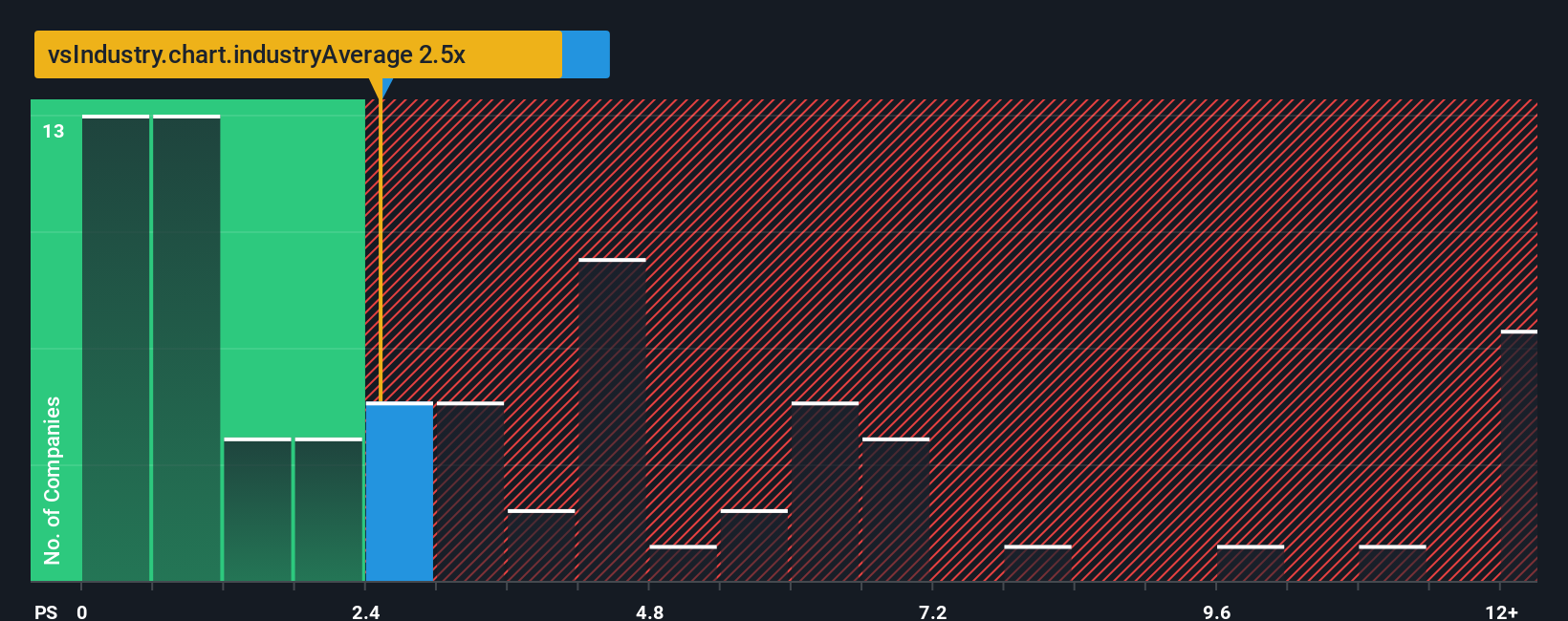

In spite of the firm bounce in price, MPC Energy Solutions may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.5x, since almost half of all companies in the Renewable Energy industry in Norway have P/S ratios greater than 3.5x and even P/S higher than 11x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for MPC Energy Solutions

How Has MPC Energy Solutions Performed Recently?

While the industry has experienced revenue growth lately, MPC Energy Solutions' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think MPC Energy Solutions' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as MPC Energy Solutions' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.8%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 50% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.6%, which is noticeably less attractive.

With this in consideration, we find it intriguing that MPC Energy Solutions' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On MPC Energy Solutions' P/S

Despite MPC Energy Solutions' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems MPC Energy Solutions currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with MPC Energy Solutions (including 1 which is potentially serious).

If these risks are making you reconsider your opinion on MPC Energy Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:MPCES

MPC Energy Solutions

An independent power producer, develops, builds, owns, and operates renewable energy assets in Latin America and the Caribbean.

Reasonable growth potential and fair value.

Market Insights

Community Narratives