- Norway

- /

- Renewable Energy

- /

- OB:CLOUD

Cloudberry Clean Energy (OB:CLOUD): One-Off Gain Challenges View on Sustained Profit Quality

Reviewed by Simply Wall St

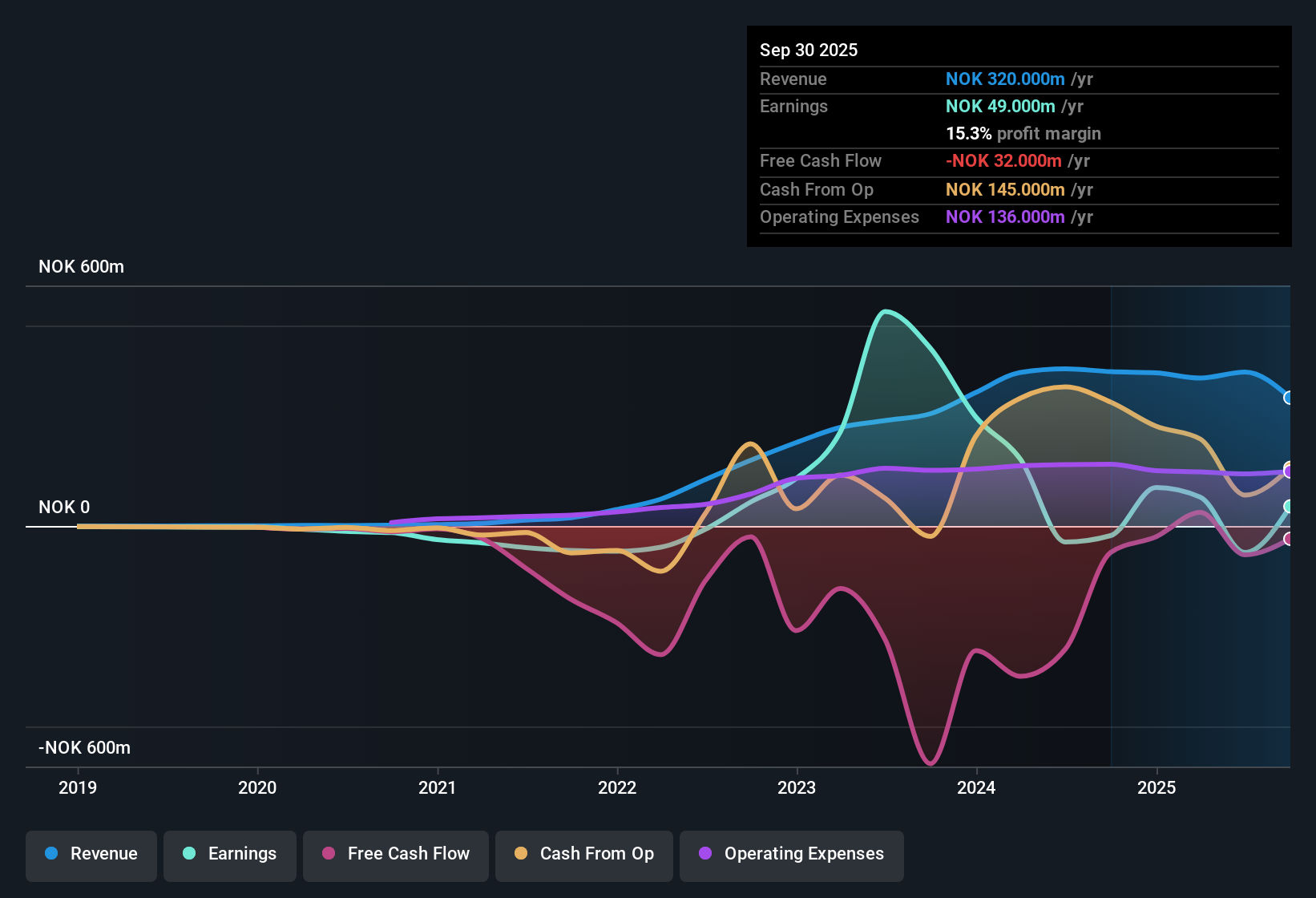

Cloudberry Clean Energy (OB:CLOUD) has crossed into profitability, posting earnings growth of 24.2% per year over the past five years. Looking forward, both revenue and earnings are forecast to soar, with revenue seen climbing 23.3% per year and earnings by 32.3% per year, significantly ahead of the Norwegian market average. While underlying profit and revenue trends appear positive, it is worth noting that the latest results included a substantial one-off gain of NOK 118.0 million, which may affect the interpretation of headline margins and ongoing profitability.

See our full analysis for Cloudberry Clean Energy.Next, we will see how these headline results compare against the most popular narratives in the market. Sometimes the numbers confirm what everyone says, and sometimes they bring a surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Drives Margin Shift

- The most recent period saw a significant one-off gain of NOK 118.0 million, making up a material part of reported profitability and creating a jump in headline margins that may not repeat.

- While growth trends remain robust and supportive of long-term optimism, the heavy reliance on this non-recurring item tests the view that profit expansion is as durable as bulls hope.

- Recent profit improvements are not solely the result of ongoing operations but are boosted by this exceptional gain.

- This means future reported margins could look very different once extraordinary gains are excluded, challenging the idea that underlying profitability is running ahead of industry averages.

P/E Multiple at 81.9x vs Industry 19.6x

- Cloudberry’s price-to-earnings ratio stands at 81.9x, more than 4 times the European renewable energy industry average of 19.6x and above peer levels, despite recent positive profit figures.

- Bears highlight that while impressive reported growth and optimism around clean energy policy have pushed up valuation multiples, such a premium requires sustained operational performance.

- A sector-wide enthusiasm for renewables lifts valuations, but the presence of non-recurring profit raises questions about the sustainability needed to justify this industry-leading P/E.

- Critics point to potential volatility if future profit normalizes lower in the absence of extraordinary gains, which could expose the current multiple as overextended versus sector peers.

DCF Fair Value Shows Upside Gap

- Cloudberry trades at NOK 12.62 per share, notably below its DCF fair value estimate of 20.20, indicating the market price sits at a meaningful discount relative to modeled cash flow value.

- Strong forecasts for both revenue and earnings, combined with perceived undervaluation on a cash flow basis, heavily support the case for further share price appreciation if growth targets are delivered.

- This gap highlights a potential opportunity for investors comfortable with sector volatility and able to see past short-term distortion from one-off items.

- With robust projected growth rates and market confidence in the utility-scale renewables story, the fair value differential may draw in buyers looking for value plays among clean energy firms.

Momentum for revenue and profit growth could be just the start. See what key fair value drivers set Cloudberry apart in the bigger picture. See our latest analysis for Cloudberry Clean Energy.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cloudberry Clean Energy's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Cloudberry’s high valuation multiples and reliance on non-recurring profit gains expose investors to significant downside risk if growth projections are not met.

If you want companies with a stronger cushion against unexpected setbacks, check out these 840 undervalued stocks based on cash flows to discover those trading well below their fair value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CLOUD

Cloudberry Clean Energy

Operates as a renewable energy company in Norway, Denmark, Switzerland, and Sweden.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives