- Norway

- /

- Marine and Shipping

- /

- OB:WWI

Will Wilh. Wilhelmsen Holding’s (OB:WWI) Dividend Hike and Earnings Growth Change Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Wilh. Wilhelmsen Holding ASA recently reported third quarter 2025 earnings, showing increased sales and net income compared to the previous year, and approved a cash dividend of NOK 8.00 per share to be paid on November 20, 2025.

- The combination of improved financial performance and a new dividend underscores the company’s ability to generate cash while maintaining shareholder returns.

- We'll examine how the stronger quarterly earnings and dividend approval could shape Wilhelmsen Holding’s investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Wilh. Wilhelmsen Holding Investment Narrative Recap

To be a Wilh. Wilhelmsen Holding shareholder, you’ll need to believe that the company’s exposure to shipping, logistics, and energy offers a resilient mix, protected by diverse revenue streams and boosted by key associates. The strong Q3 results and declared dividend of NOK 8.00 per share support the near-term catalyst of sustained earnings outperformance and cash returns, but do not materially reduce the risks from revenue volatility tied to short-term incentives, especially in NorSea, or exposure to cost inflation.

The dividend approval announced on 5 November is the most relevant event, reaffirming management’s ability to convert earnings into distributions. This payout, combined with higher net income and EPS for the quarter, reinforces Wilhelmsen’s shareholder return commitment, though ongoing margin pressures and volatility in certain energy segments still temper visibility around future distributions.

However, investors should be aware that despite improved profits and dividends, exposure to sudden changes in government incentives could mean revenues are less predictable than they appear...

Read the full narrative on Wilh. Wilhelmsen Holding (it's free!)

Wilh. Wilhelmsen Holding's outlook projects $1.3 billion in revenue and $503.7 million in earnings by 2028. This is based on a 2.6% annual revenue growth rate and a $18.3 million decrease in earnings from the current $522.0 million.

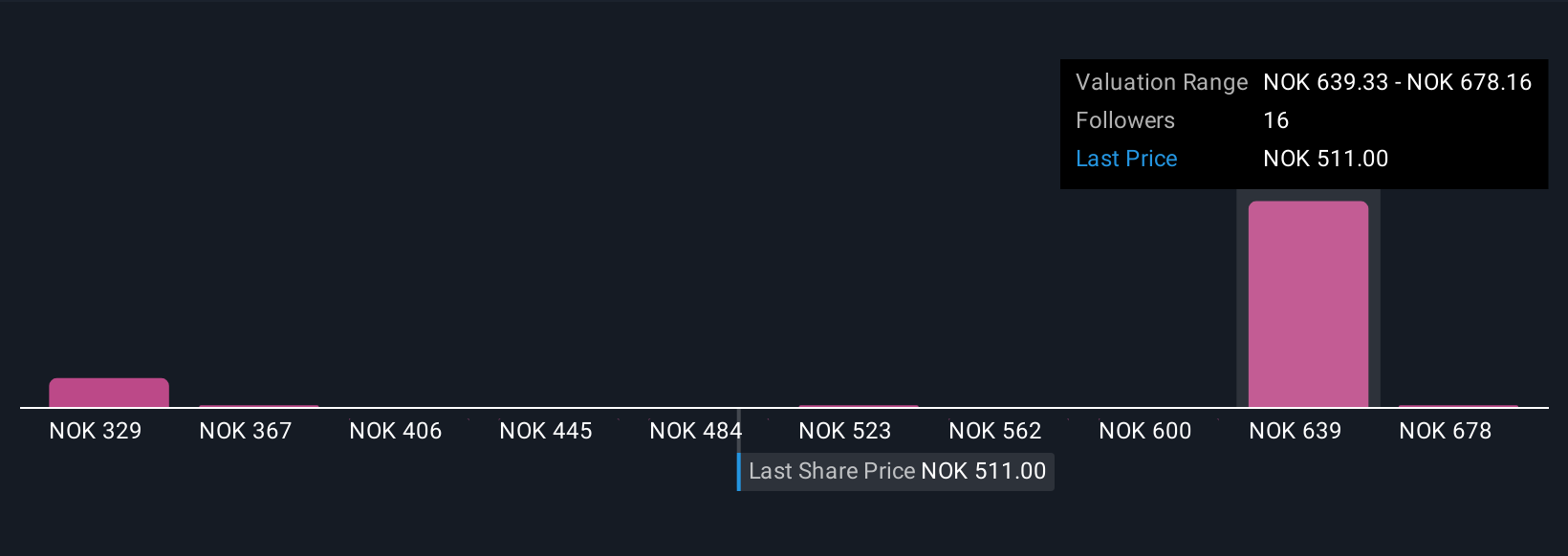

Uncover how Wilh. Wilhelmsen Holding's forecasts yield a NOK667.77 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members value Wilhelmsen between NOK328.66 and NOK716.99 per share, showing views stretch from deep discount to premium. With short-term government incentives still driving segments like NorSea, you’ll want to see how others account for potential swings in group earnings.

Explore 5 other fair value estimates on Wilh. Wilhelmsen Holding - why the stock might be worth as much as 40% more than the current price!

Build Your Own Wilh. Wilhelmsen Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wilh. Wilhelmsen Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wilh. Wilhelmsen Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wilh. Wilhelmsen Holding's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilh. Wilhelmsen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:WWI

Wilh. Wilhelmsen Holding

Provides maritime products and services worldwide.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives