Stock Analysis

- Norway

- /

- Marine and Shipping

- /

- OB:JIN

Shareholders have faith in loss-making Jinhui Shipping and Transportation (OB:JIN) as stock climbs 14% in past week, taking three-year gain to 2.9%

Jinhui Shipping and Transportation Limited (OB:JIN) shareholders should be happy to see the share price up 26% in the last month. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 11% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the stock has risen 14% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Jinhui Shipping and Transportation

Jinhui Shipping and Transportation isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Jinhui Shipping and Transportation grew revenue at 13% per year. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 4% per year. This implies the market had higher expectations of Jinhui Shipping and Transportation. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

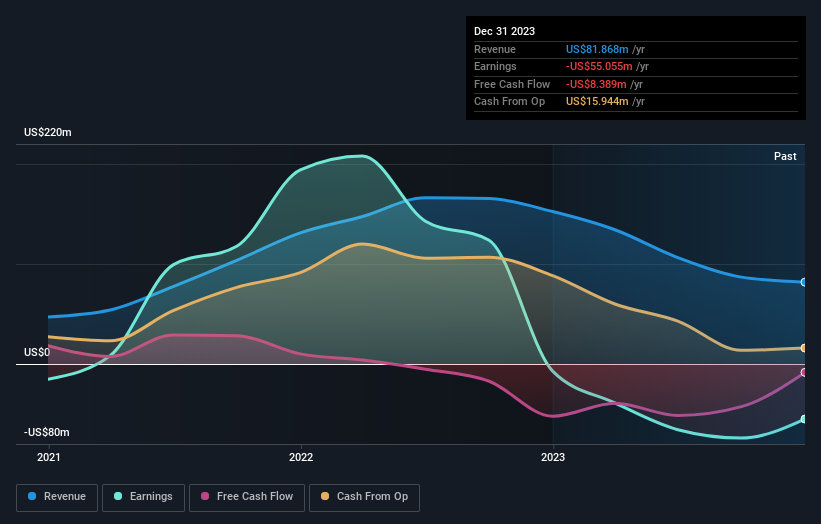

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Jinhui Shipping and Transportation stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Jinhui Shipping and Transportation's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Jinhui Shipping and Transportation's TSR of 2.9% over the last 3 years is better than the share price return.

A Different Perspective

Jinhui Shipping and Transportation shareholders are up 1.4% for the year. But that was short of the market average. On the bright side, the longer term returns (running at about 3% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Jinhui Shipping and Transportation (of which 1 doesn't sit too well with us!) you should know about.

Of course Jinhui Shipping and Transportation may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Jinhui Shipping and Transportation is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:JIN

Jinhui Shipping and Transportation

An investment holding company, engages in ship chartering and owning activities internationally.

Excellent balance sheet and slightly overvalued.