- Norway

- /

- Marine and Shipping

- /

- OB:HSHP

3 European Growth Stocks With High Insider Ownership Expecting Up To 70% Earnings Growth

Reviewed by Simply Wall St

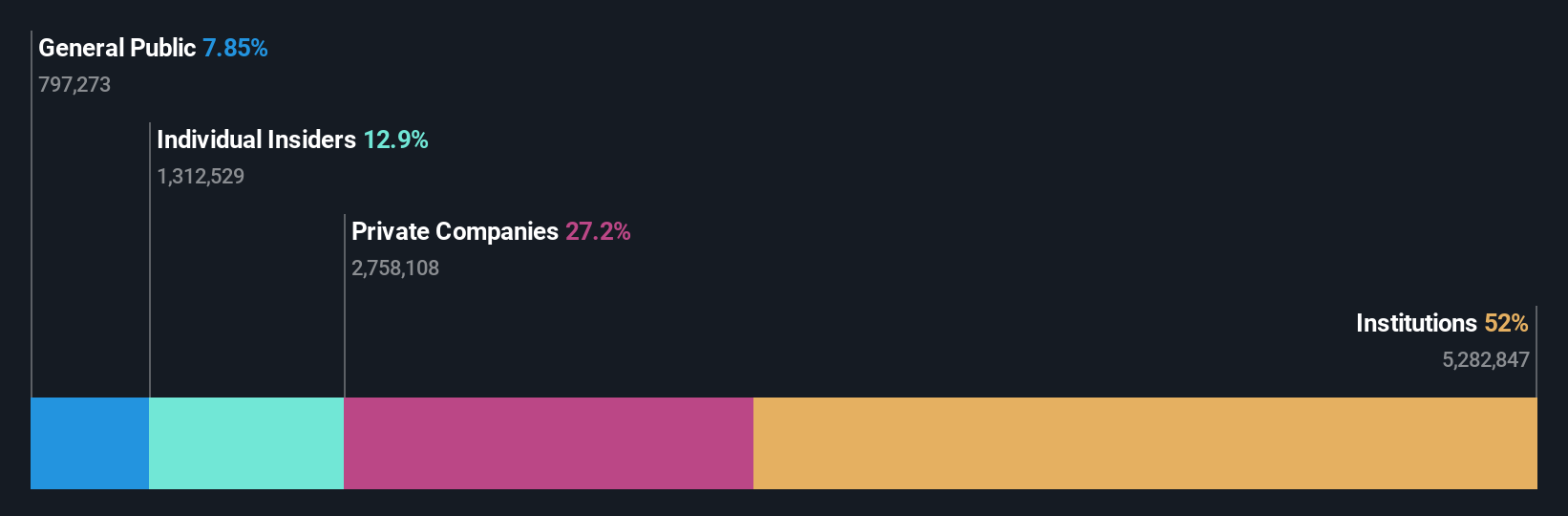

As European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index slightly up and major indexes showing varied performances, investors are closely watching growth companies that demonstrate resilience and potential amidst economic fluctuations. In this context, stocks with high insider ownership can be particularly attractive as they often signal strong alignment between management and shareholder interests, which is crucial during periods of expected earnings growth.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 38.8% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Guard Therapeutics International (OM:GUARD) | 13.1% | 81.4% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 58.3% |

Let's uncover some gems from our specialized screener.

Himalaya Shipping (OB:HSHP)

Simply Wall St Growth Rating: ★★★★★☆

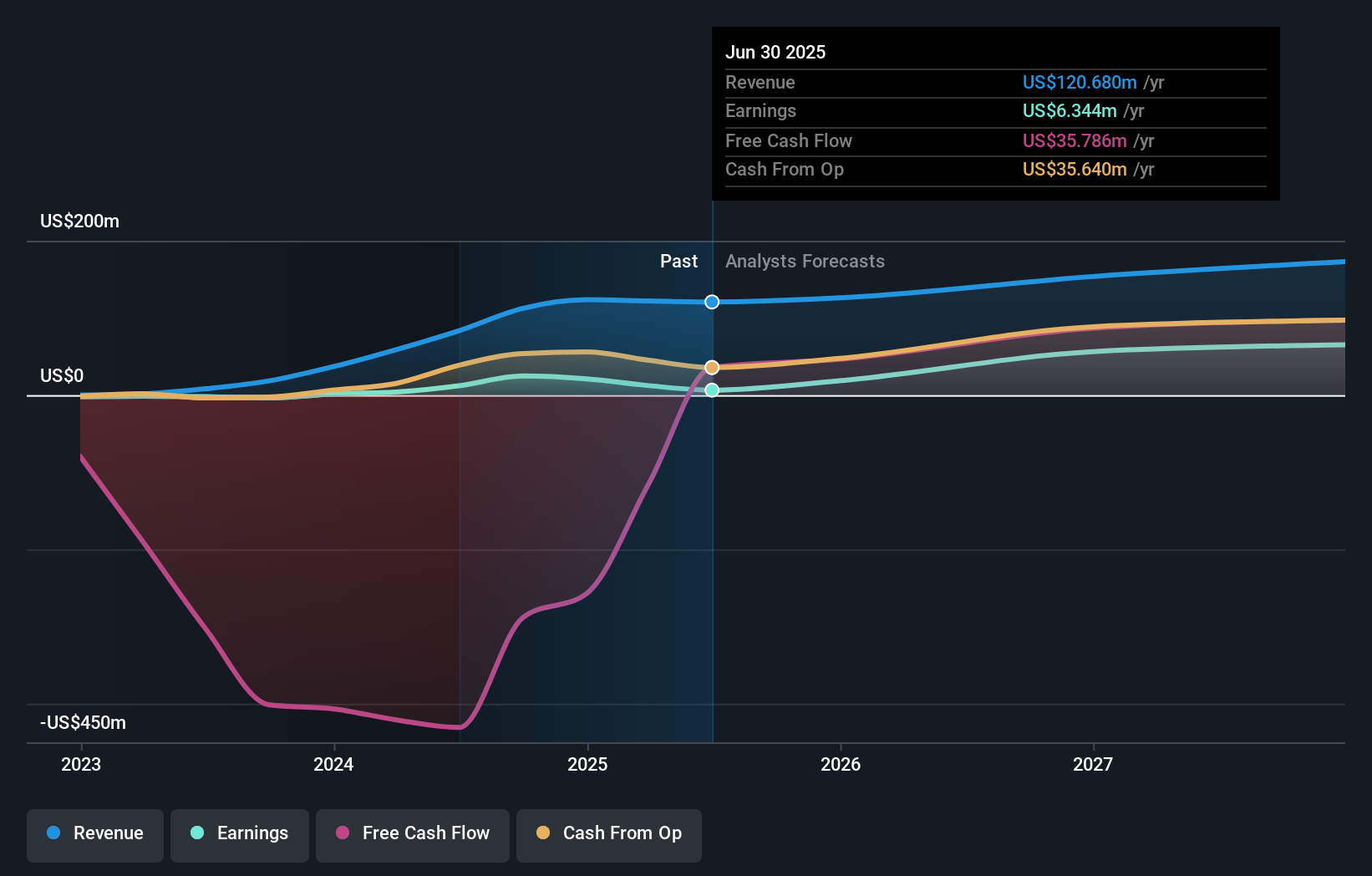

Overview: Himalaya Shipping Ltd. offers dry bulk shipping services globally and has a market cap of NOK3.72 billion.

Operations: The company generates revenue through its transportation and shipping segment, amounting to $120.68 million.

Insider Ownership: 30.5%

Earnings Growth Forecast: 70.7% p.a.

Himalaya Shipping demonstrates significant growth potential with earnings forecasted to rise substantially above the Norwegian market average. Despite trading well below its estimated fair value, profit margins have decreased from last year. Insider ownership remains high, though recent insider trading activity is minimal. The company has maintained a steady cash distribution strategy, recently approving a US$0.10 per share dividend for September 2025 amidst fluctuating revenue and earnings performance over the past year.

- Click here and access our complete growth analysis report to understand the dynamics of Himalaya Shipping.

- In light of our recent valuation report, it seems possible that Himalaya Shipping is trading beyond its estimated value.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

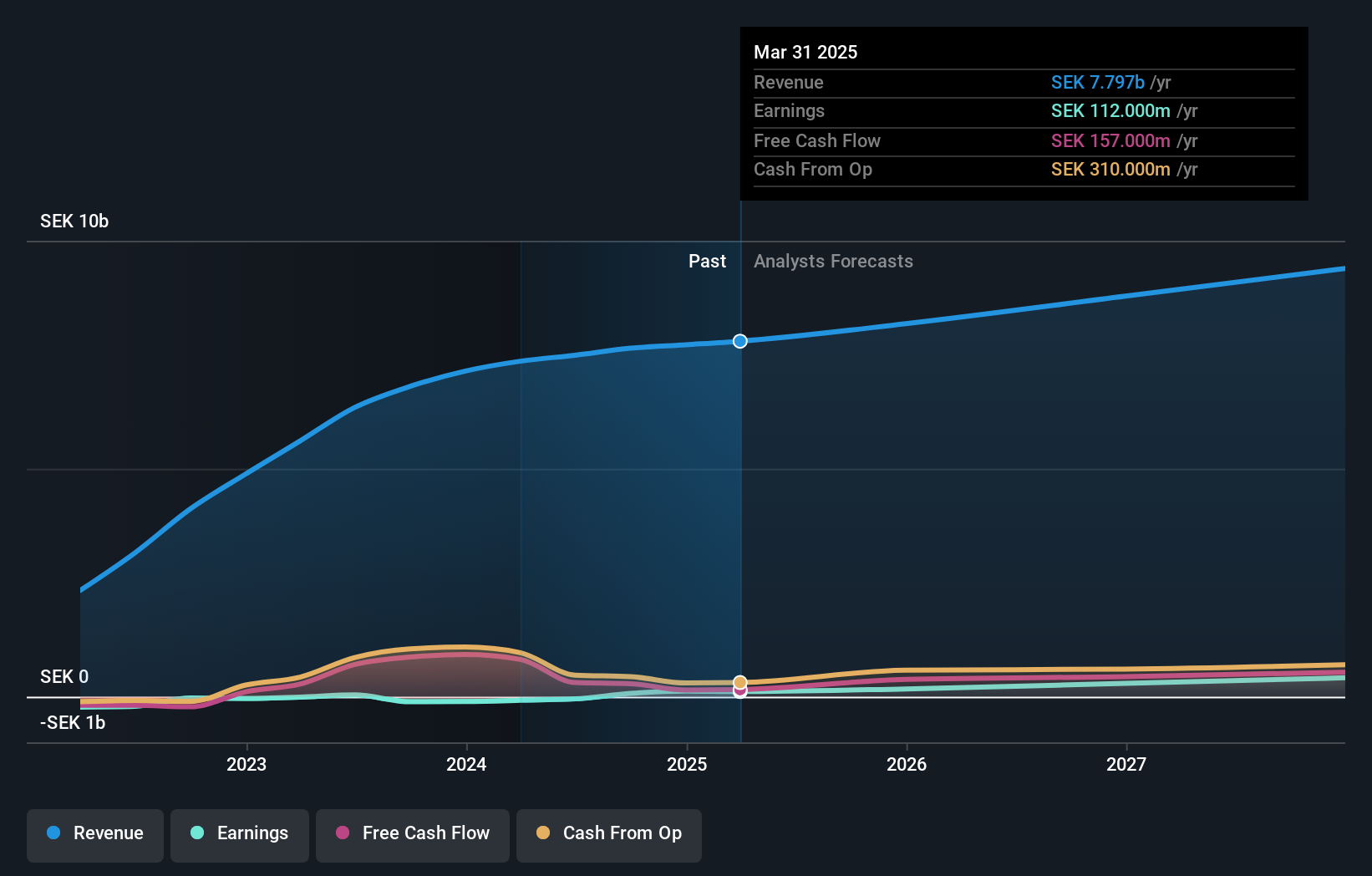

Overview: Humble Group AB (publ) is involved in the development, refinement, and distribution of fast-moving consumer products both in Sweden and internationally, with a market cap of SEK3.47 billion.

Operations: The company's revenue segments include Future Snacking at SEK1.08 billion, Sustainable Care at SEK2.38 billion, Quality Nutrition at SEK1.52 billion, and Nordic Distribution at SEK2.91 billion.

Insider Ownership: 19.6%

Earnings Growth Forecast: 61.4% p.a.

Humble Group's earnings are projected to grow significantly, outpacing the Swedish market average. Despite a forecasted low return on equity in three years, the company became profitable this year and trades well below its estimated fair value. Insider confidence is evident with substantial recent share purchases and no significant sales. Leadership changes include Noel Abdayem as acting CEO following Simon Petrén's departure, with a recruitment process for a new CEO underway.

- Click to explore a detailed breakdown of our findings in Humble Group's earnings growth report.

- According our valuation report, there's an indication that Humble Group's share price might be on the expensive side.

AlzChem Group (XTRA:ACT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AlzChem Group AG, with a market cap of €1.59 billion, develops, produces, and markets a variety of chemical specialties across Germany, the European Union, the rest of Europe, Asia, the NAFTA region, and internationally.

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, generating €363.96 million, and its Basics & Intermediates segment, contributing €161.10 million.

Insider Ownership: 12.9%

Earnings Growth Forecast: 17.4% p.a.

AlzChem Group exhibits strong insider ownership and is trading significantly below its estimated fair value. The company forecasts an 8.5% annual revenue growth, outpacing the German market's 6%. Recent earnings rose by 25%, with future earnings expected to grow at 17.4% annually, surpassing market averages. The strategic partnership with Ehrmann to launch high-protein creatine products highlights AlzChem's innovation in functional nutrition, potentially enhancing its growth trajectory and market presence in Europe.

- Click here to discover the nuances of AlzChem Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that AlzChem Group's current price could be inflated.

Taking Advantage

- Investigate our full lineup of 188 Fast Growing European Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Himalaya Shipping might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HSHP

High growth potential with adequate balance sheet.

Market Insights

Community Narratives