- Norway

- /

- Marine and Shipping

- /

- OB:HAUTO

Broker Revenue Forecasts For Höegh Autoliners ASA (OB:HAUTO) Are Surging Higher

Höegh Autoliners ASA (OB:HAUTO) shareholders will have a reason to smile today, with the covering analyst making substantial upgrades to this year's forecasts. The analyst has sharply increased their revenue numbers, with a view that Höegh Autoliners will make substantially more sales than they'd previously expected.

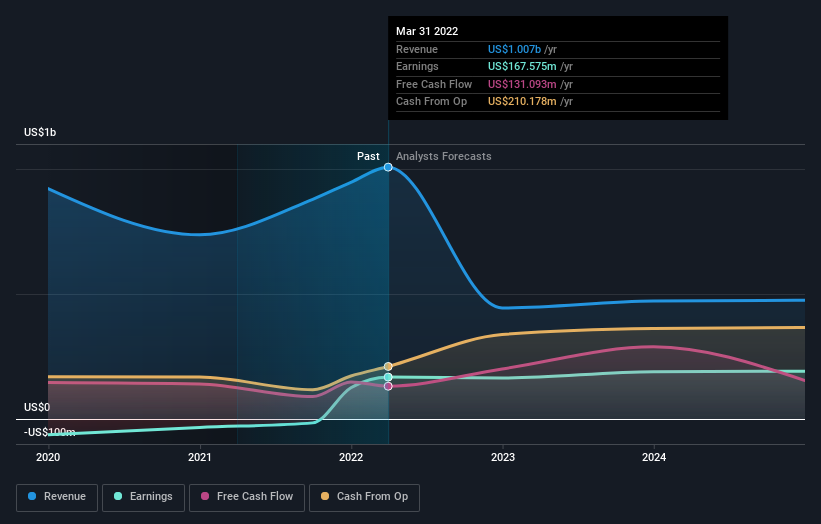

Following the upgrade, the consensus from sole analyst covering Höegh Autoliners is for revenues of US$778m in 2022, implying a painful 23% decline in sales compared to the last 12 months. Before the latest update, the analyst was foreseeing US$432m of revenue in 2022. It looks like there's been a clear increase in optimism around Höegh Autoliners, given the sizeable gain to revenue forecasts.

View our latest analysis for Höegh Autoliners

There was no particular change to the consensus price target of US$5.07, with Höegh Autoliners' latest outlook seemingly not enough to result in a change of valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 29% by the end of 2022. This indicates a significant reduction from annual growth of 29% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.3% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Höegh Autoliners is expected to lag the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst lifted their revenue estimates for this year. They're also anticipating slower revenue growth than the wider market. Given that the analyst appears to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Höegh Autoliners.

Looking for more information? One Höegh Autoliners broker/analyst has provided estimates out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Höegh Autoliners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HAUTO

Höegh Autoliners

Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives