- Norway

- /

- Marine and Shipping

- /

- OB:2020

Need To Know: Analysts Just Made A Substantial Cut To Their 2020 Bulkers Ltd. (OB:2020) Estimates

One thing we could say about the analysts on 2020 Bulkers Ltd. (OB:2020) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business.

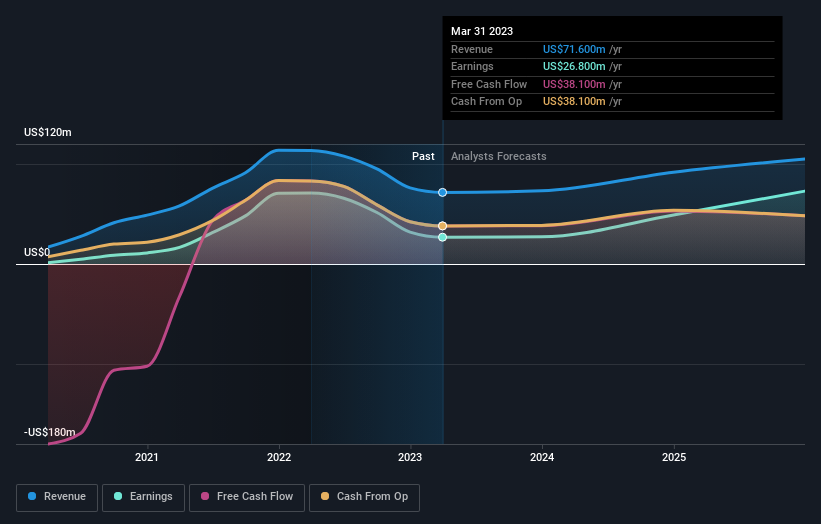

Following the downgrade, the current consensus from 2020 Bulkers' four analysts is for revenues of US$73m in 2023 which - if met - would reflect an okay 2.2% increase on its sales over the past 12 months. Per-share earnings are expected to accumulate 2.1% to US$1.21. Previously, the analysts had been modelling revenues of US$84m and earnings per share (EPS) of US$1.68 in 2023. Indeed, we can see that the analysts are a lot more bearish about 2020 Bulkers' prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for 2020 Bulkers

The consensus price target fell 5.1% to US$12.97, with the weaker earnings outlook clearly leading analyst valuation estimates. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on 2020 Bulkers, with the most bullish analyst valuing it at US$14.77 and the most bearish at US$9.26 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that 2020 Bulkers' revenue growth is expected to slow, with the forecast 2.9% annualised growth rate until the end of 2023 being well below the historical 34% p.a. growth over the last three years. Compare this with other companies in the same industry, which are forecast to see a revenue decline of 2.3% annually. Factoring in the forecast slowdown in growth, it's pretty clear that 2020 Bulkers is still expected to grow faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for 2020 Bulkers. Unfortunately, they also downgraded their revenue estimates, and our data indicates sales are expected to outperform the wider market. Even so, earnings per share are more important to the intrinsic value of the business. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of 2020 Bulkers.

Unfortunately, the earnings downgrade - if accurate - may also place pressure on 2020 Bulkers' mountain of debt, which could lead to some belt tightening for shareholders. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

We also provide an overview of the 2020 Bulkers Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:2020

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026