Telenor (OB:TEL): A Fresh Look at Valuation as Shares Quietly Climb

Reviewed by Simply Wall St

If you have been following Telenor (OB:TEL), the recent moves in its share price might have caught your attention. While no major headlines have driven the action, the gradual rise in the stock could spark questions about whether investors are starting to reevaluate Telenor’s prospects. Sometimes, it is these quieter shifts, not just the big news, that hint at changing market sentiment or a reassessment of value.

Looking at the past year, Telenor shares have steadily advanced, up 32% over twelve months and gaining almost 9% in the past three months. While there have not been dramatic swings, the overall momentum seems to be building, with modest revenue growth and stronger net income figures providing a supportive backdrop. The consistency here sets Telenor apart from more volatile names, even as the business continues to post annual improvements in its core financials.

This raises the question of whether the market is underestimating Telenor’s potential or if these gains simply reflect fundamentals. Investors may wonder if there is a buying opportunity at present or if the future growth story has already been priced in.

Price-to-Earnings of 22.4x: Is it justified?

Telenor is currently valued at a Price-to-Earnings (P/E) ratio of 22.4x, making it more expensive than its European telecom industry peers, whose average P/E is 19x. This suggests that investors are willing to pay a premium for Telenor shares relative to similar companies in the sector.

The P/E ratio compares a company’s current share price to its earnings per share. It provides a measure of how much investors are paying for each unit of earnings. For telecom companies like Telenor, this multiple is important, as it reflects expectations for future earnings growth and the underlying stability of profits.

While Telenor's current earnings quality and growth have attracted investor interest, the above-average P/E indicates that the market may be pricing in optimistic assumptions about its performance. Alternatively, it could reflect the perceived resilience and consistency of its business. Investors should consider whether paying a higher multiple is justified given modest growth forecasts.

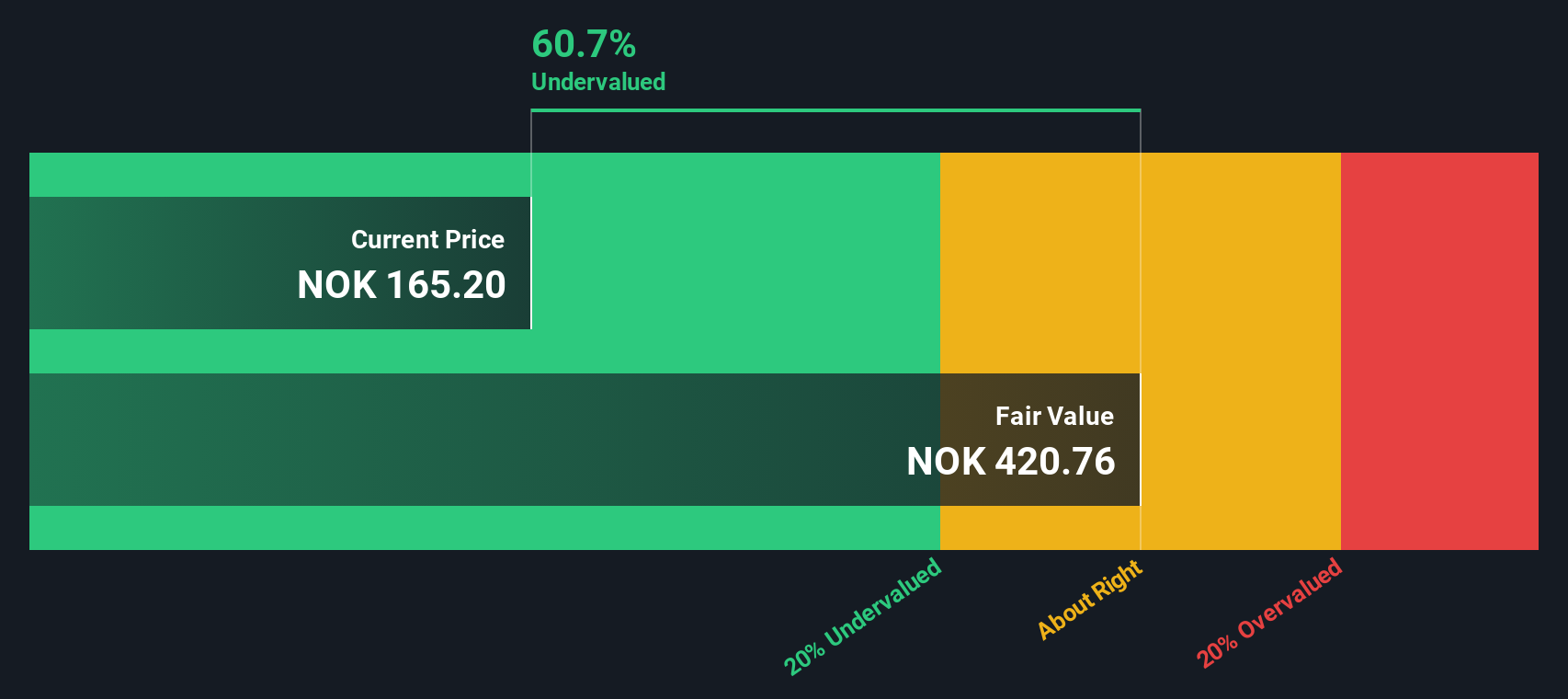

Result: Fair Value of $397.82 (UNDERVALUED)

See our latest analysis for Telenor.However, potential catalysts such as slower revenue growth or missing analyst price targets could quickly disrupt the recent optimism surrounding Telenor’s share price.

Find out about the key risks to this Telenor narrative.Another View: DCF Model Reinforces Undervaluation

While the earlier approach looked at market multiples, our SWS DCF model tells a similar story. This method estimates Telenor’s fair value based on projected future cash flows and finds the stock remains undervalued. Could both models be pointing to a potential opportunity, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Telenor Narrative

If you have your own perspective or feel the analysis misses something, you can review the numbers firsthand and shape your own outlook in just a few minutes. Do it your way

A great starting point for your Telenor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There are smart moves waiting beyond Telenor. Don’t limit yourself; see where your portfolio could go next by using these powerful tools:

- Target rapid growth by scanning undervalued stocks based on cash flows for overlooked opportunities that the market hasn’t fully priced in yet.

- Unlock game-changing innovation by checking out healthcare AI stocks featuring companies pioneering the future of medicine with artificial intelligence.

- Tap into unique yield potential by searching dividend stocks with yields > 3% for companies offering strong dividends with consistent returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OB:TEL

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives