Here's Why We Think Telenor (OB:TEL) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Telenor (OB:TEL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Telenor with the means to add long-term value to shareholders.

How Fast Is Telenor Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Telenor has grown EPS by 23% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

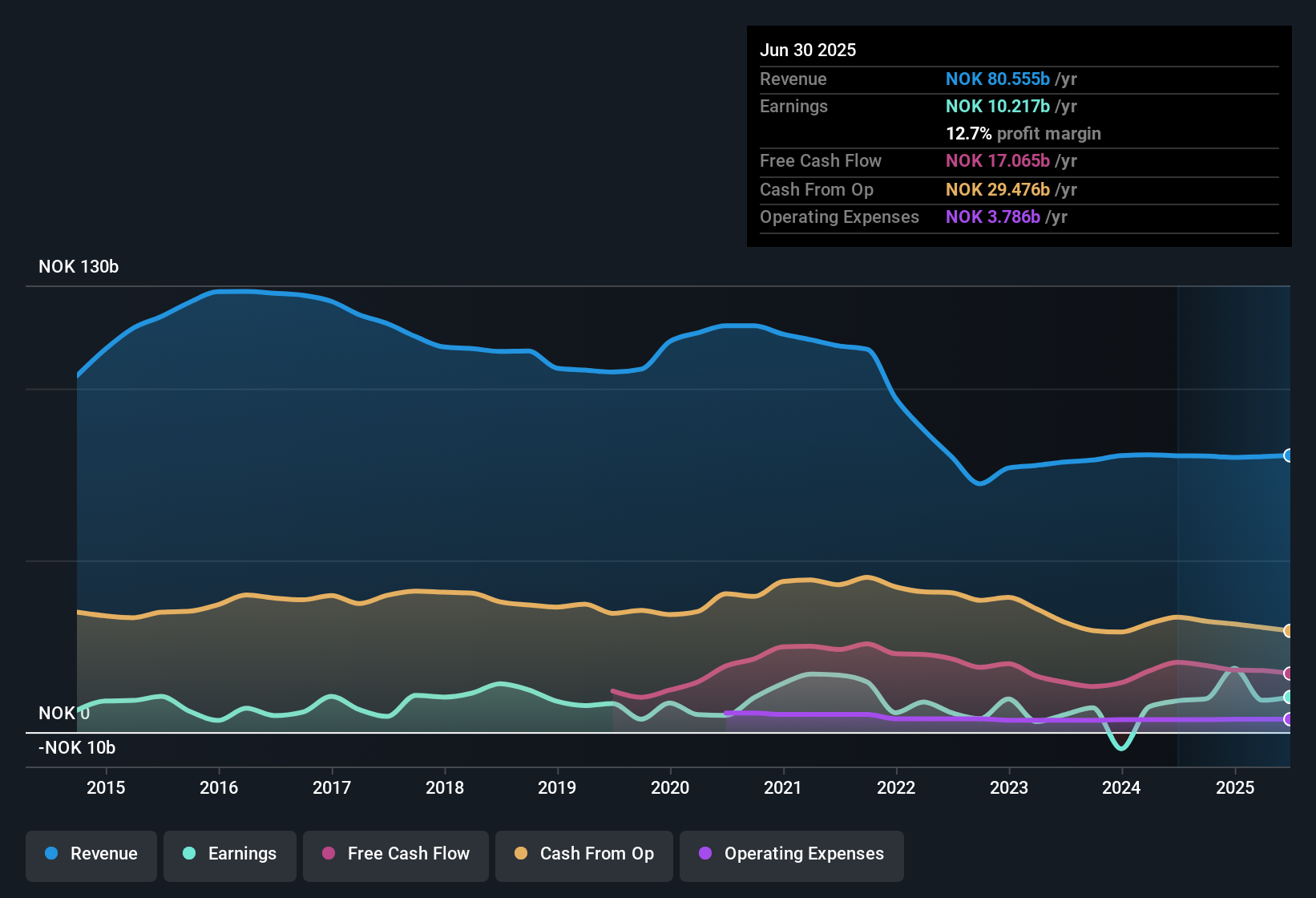

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for Telenor as both revenue and EBIT margins remained have been flat over the past year. That's not bad, but it doesn't point to ongoing future growth, either.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

See our latest analysis for Telenor

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Telenor's future profits.

Are Telenor Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Shareholders in Telenor will be more than happy to see insiders committing themselves to the company, spending kr2.9m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Independent Chairman Jens Olsen for kr1.6m worth of shares, at about kr157 per share.

It's commendable to see that insiders have been buying shares in Telenor, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations over kr80b, like Telenor, the median CEO pay is around kr15m.

The Telenor CEO received total compensation of just kr3.5m in the year to December 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Telenor Worth Keeping An Eye On?

For growth investors, Telenor's raw rate of earnings growth is a beacon in the night. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. On balance the message seems to be that this stock is worth looking at, at least for a while. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Telenor , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Telenor, you'll probably love this curated collection of companies in NO that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:TEL

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success