Expanded 1800 MHz Spectrum Access Could Be a Game Changer for Telenor (OB:TEL)

Reviewed by Sasha Jovanovic

- Tele2 AB and Telenor, through their joint network company Net4Mobility, recently secured new spectrum in the 1800 MHz band in Sweden for SEK 465,850,000 to support future 4G and 5G development.

- This move marks a critical step in modernising Sweden’s mobile networks, significantly boosting capacity, coverage, and network resilience countrywide.

- We’ll explore how the expanded 1800 MHz spectrum allocation supports Telenor’s efforts to strengthen its network infrastructure and competitive positioning.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Telenor's Investment Narrative?

If you’re considering Telenor as an investment, the big picture comes down to long-term network strength and measured Nordic growth. The recent acquisition of new spectrum in Sweden is a meaningful development: it has the potential to improve Telenor’s market position and operational resilience, particularly as demand for 4G and 5G services continues to rise. This move could be a short-term catalyst, supporting the company’s ambition for organic revenue growth despite market forecasts for only modest improvements. At the same time, however, high debt levels remain a risk and the board and management experience is still developing, factors that could raise questions about execution in a rapidly evolving telecom sector. Before this news, slow revenue growth and dividend sustainability stood out as key issues. The spectrum win may ease the risk outlook, but these areas are still worth watching. In contrast, the company’s high debt levels may raise concerns for investors focused on stability.

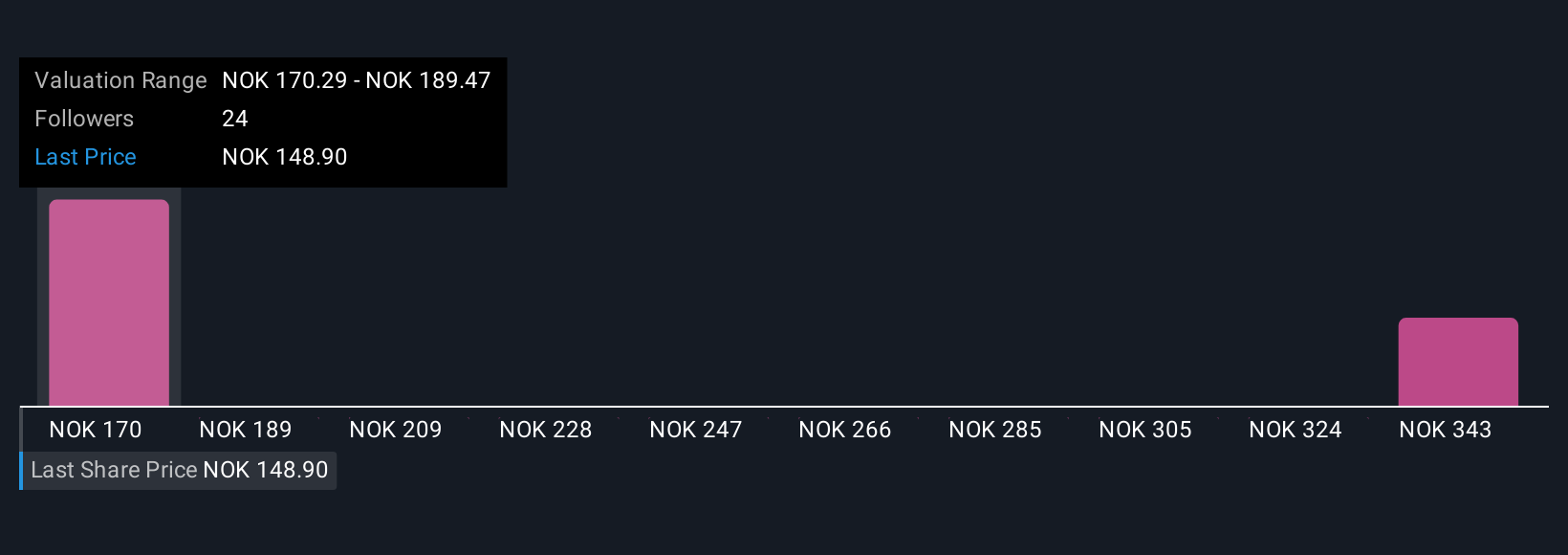

Telenor's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Telenor - why the stock might be worth just NOK169.59!

Build Your Own Telenor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telenor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telenor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telenor's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telenor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TEL

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026