Xplora Technologies (OB:XPLRA) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Xplora Technologies AS (OB:XPLRA) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Xplora Technologies

How Much Debt Does Xplora Technologies Carry?

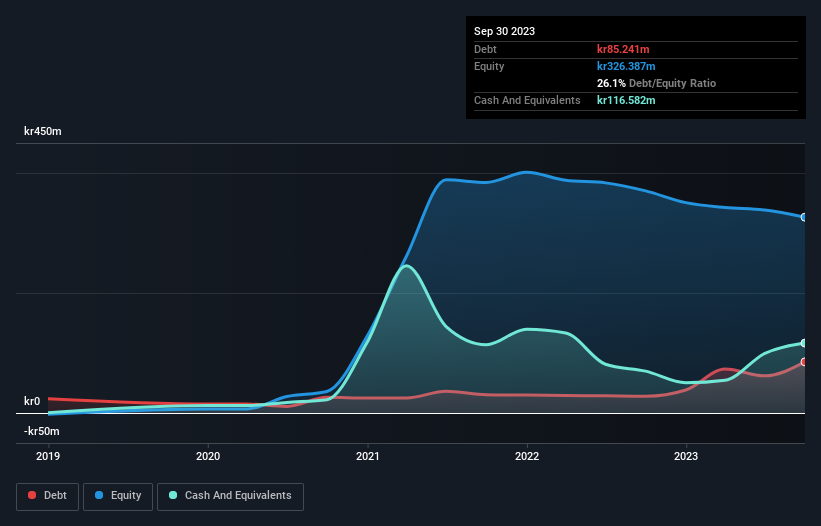

The image below, which you can click on for greater detail, shows that at September 2023 Xplora Technologies had debt of kr85.2m, up from kr27.9m in one year. However, it does have kr116.6m in cash offsetting this, leading to net cash of kr31.3m.

How Healthy Is Xplora Technologies' Balance Sheet?

We can see from the most recent balance sheet that Xplora Technologies had liabilities of kr182.4m falling due within a year, and liabilities of kr16.7m due beyond that. Offsetting this, it had kr116.6m in cash and kr88.6m in receivables that were due within 12 months. So it actually has kr6.04m more liquid assets than total liabilities.

This state of affairs indicates that Xplora Technologies' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the kr633.6m company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Xplora Technologies boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Xplora Technologies will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Xplora Technologies wasn't profitable at an EBIT level, but managed to grow its revenue by 31%, to kr656m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Xplora Technologies?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Xplora Technologies had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through kr11m of cash and made a loss of kr56m. While this does make the company a bit risky, it's important to remember it has net cash of kr31.3m. That means it could keep spending at its current rate for more than two years. Xplora Technologies's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Xplora Technologies has 3 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:XPLRA

Xplora Technologies

An information technology company, develops wearable smart devices and connectivity services for kids and families in Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives