Even With A 41% Surge, Cautious Investors Are Not Rewarding Xplora Technologies AS' (OB:XPLRA) Performance Completely

Xplora Technologies AS (OB:XPLRA) shares have continued their recent momentum with a 41% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 38%.

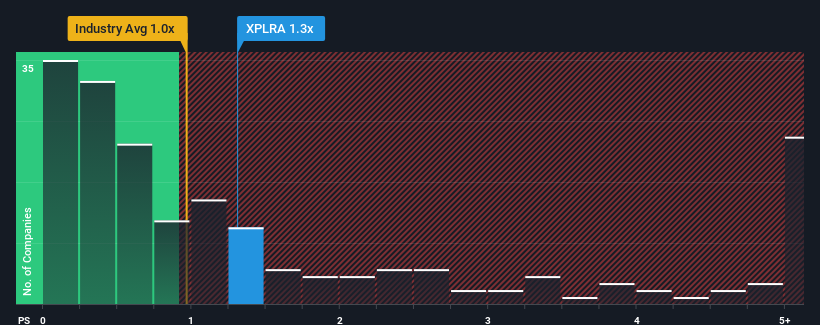

Although its price has surged higher, Xplora Technologies may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Electronic industry in Norway have P/S ratios greater than 3.5x and even P/S higher than 17x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Xplora Technologies

How Has Xplora Technologies Performed Recently?

The revenue growth achieved at Xplora Technologies over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xplora Technologies' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Xplora Technologies?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Xplora Technologies' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen an excellent 137% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Xplora Technologies' P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Even after such a strong price move, Xplora Technologies' P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Xplora Technologies revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Xplora Technologies, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:XPLRA

Xplora Technologies

An information technology company, develops wearable smart devices and connectivity services for kids and families in Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives