- Norway

- /

- Communications

- /

- OB:SMOP

Here's Why We Think Smartoptics Group (OB:SMOP) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Smartoptics Group (OB:SMOP). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Smartoptics Group

Smartoptics Group's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Smartoptics Group's EPS skyrocketed from US$0.053 to US$0.088, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 66%.

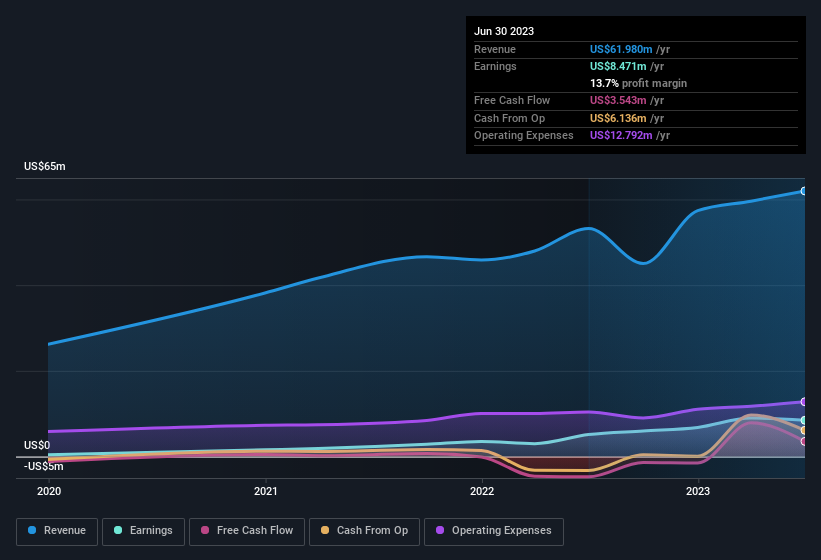

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Smartoptics Group is growing revenues, and EBIT margins improved by 2.9 percentage points to 16%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Smartoptics Group isn't a huge company, given its market capitalisation of kr1.9b. That makes it extra important to check on its balance sheet strength.

Are Smartoptics Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Smartoptics Group shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Chief Operating Officer Carina Osmund bought US$153k worth of shares at an average price of around US$28.90. It seems that at least one insider is prepared to show the market there is potential within Smartoptics Group.

It's reassuring that Smartoptics Group insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, Smartoptics Group has a very reasonable level of CEO pay. For companies with market capitalisations between US$100m and US$400m, like Smartoptics Group, the median CEO pay is around US$444k.

The CEO of Smartoptics Group was paid just US$264k in total compensation for the year ending December 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Smartoptics Group Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Smartoptics Group's strong EPS growth. To add to the positives, Smartoptics Group has recorded instances of insider buying and a modest executive pay to boot. On balance the message seems to be that this stock is worth looking at, at least for a while. You should always think about risks though. Case in point, we've spotted 1 warning sign for Smartoptics Group you should be aware of.

The good news is that Smartoptics Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SMOP

Smartoptics Group

Provides optical networking solutions and devices in the Americas, Europe, the Middle East, Africa, and the Asia–Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives