Norbit's (OB:NORBT) Shareholders Will Receive A Bigger Dividend Than Last Year

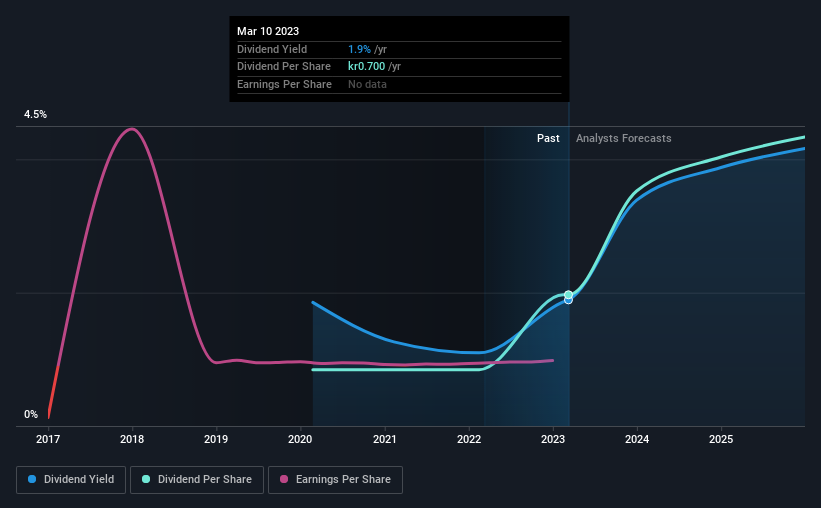

Norbit ASA (OB:NORBT) has announced that it will be increasing its dividend from last year's comparable payment on the 16th of May to NOK0.70. Based on this payment, the dividend yield for the company will be 1.9%, which is fairly typical for the industry.

See our latest analysis for Norbit

Norbit's Earnings Easily Cover The Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Based on the last payment, Norbit was earning enough to cover the dividend, but free cash flows weren't positive. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

EPS is set to fall by 53.0% over the next 12 months if recent trends continue. However, if the dividend continues along recent trends, we estimate the payout ratio could reach 83%, meaning that most of the company's earnings is being paid out to shareholders.

Norbit Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The dividend has gone from an annual total of NOK0.30 in 2020 to the most recent total annual payment of NOK0.70. This implies that the company grew its distributions at a yearly rate of about 33% over that duration. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 53% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Norbit is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Norbit that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Norbit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NORBT

Norbit

Provides technology solutions to customers in a range of industries.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion