- Norway

- /

- Communications

- /

- OB:NAPA

Napatech (OB:NAPA) Losses Worsen, Premium Valuation Faces Scrutiny Ahead of Earnings

Reviewed by Simply Wall St

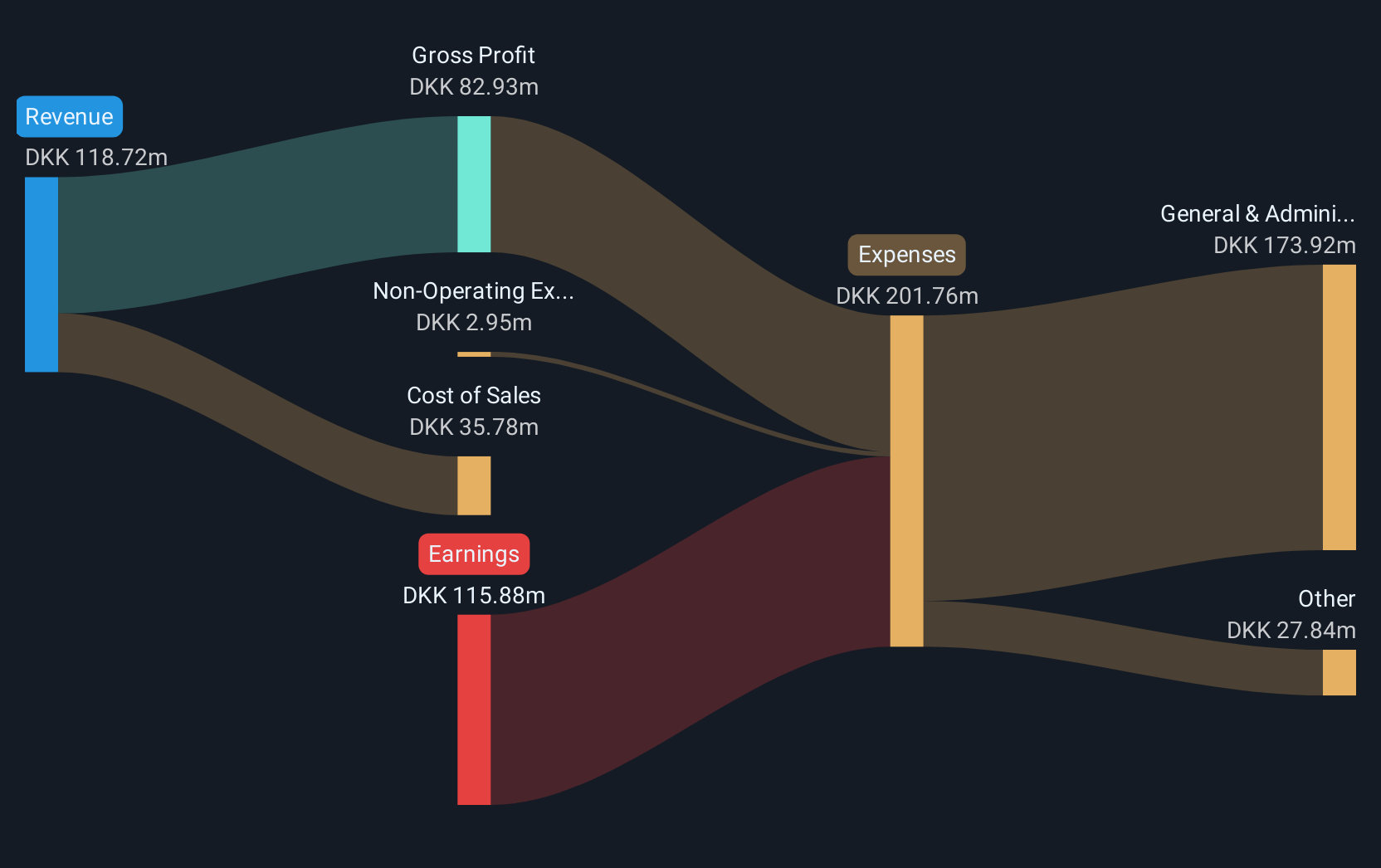

Napatech (OB:NAPA) has seen its losses worsen over the past five years, recording an average annual increase in losses of 59.8%. The company currently trades at a Price-to-Sales Ratio of 14.8x, well above the peer average of 5.6x and the European Communications industry average of 1.3x. With no evidence of improvement in net profit margin over the last year and a challenging record on profitability, the latest numbers highlight caution for investors hoping for a turnaround.

See our full analysis for Napatech.Next, we will put these results in context by measuring them against the dominant narratives about Napatech in the market. Some expectations may hold up, while others could face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Fails to Rebound

- Despite hope for improvement, Napatech has not shown any positive movement in its net profit margin over the past year; profitability remains under pressure with no turnaround visible in the reported figures.

- Bulls looking for an earnings inflection are confronted by the following factors:

- No signal of margin recovery, meaning performance lags both peers and the industry at large.

- The company's high Price-to-Sales Ratio, at 14.8x, stands apart but is unsupported by underlying profit quality.

Revenue Growth Signals Absent

- Risk flags were raised for both revenue and earnings growth with no supporting evidence in recent filings that an acceleration is materializing or expected in the near term.

- What’s especially notable is the following:

- The absence of reward statements met, underlining that none of the fundamental growth drivers are recognized in the current data.

- Losses have increased at a steep 59.8% average rate annually over five years, putting the brakes on any bull case for near-term momentum.

Valuation Premium Lacks Justification

- Napatech trades at a Price-to-Sales Ratio of 14.8x, which far exceeds both the peer group average (5.6x) and the industry average (1.3x), despite losses worsening over time and no recent earnings outperformance.

- Investors may question the following:

- Whether the elevated multiple is sustainable, since there is no sign of stabilization or upside in the current share price of 28.05.

- If the premium can be maintained, given the company has yet to deliver high-quality earnings or margin improvement that typically underpins such valuations.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Napatech's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Napatech’s deteriorating profits, stagnant margins, and expensive valuation highlight a lack of earnings momentum and cast doubt on near-term performance.

If you want to avoid overpaying for companies with questionable earnings quality, consider your next move by discovering better-priced opportunities through these 836 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Napatech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NAPA

Napatech

Provides programmable smart network interface cards and infrastructure processing units for cloud, enterprise, and telecom datacenter networks in the Americas and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives