Kitron (OB:KIT): Assessing Valuation After Defense-Driven Q3 Growth and EUR 100 Million Order

Reviewed by Simply Wall St

Kitron (OB:KIT) released its Q3 2025 earnings, highlighting a sharp jump in both revenue and net income, mainly due to rapid gains in the defense aerospace sector. The company also secured a major EUR 100 million order.

See our latest analysis for Kitron.

Kitron's momentum has really taken off over the past year, with positive news fueling a remarkable 109% year-to-date share price return and a 138% total shareholder return over twelve months. Recent contract wins and higher earnings guidance have clearly sparked investor confidence. The latest defense order and major backlog gains highlight the company’s robust long-term prospects.

If the surge in demand for defense tech has your attention, it’s worth exploring other names shaping this sector. See the full list in our Aerospace and Defense Screener: See the full list for free.

With shares already up more than 100% this year and guidance moving higher, investors have to ask: is Kitron still trading at an attractive value, or is all the growth already baked into the price?

Most Popular Narrative: 4% Overvalued

Kitron's share price recently closed at NOK 72.05, just above the most-watched narrative’s fair value estimate of NOK 69.26. Investors are weighing surging defense demand and robust future revenue projections against elevated valuation expectations.

Expansion and ramp-up of production facilities in Norway and Sweden, with the ability to triple production capacity in the EU and U.S., suggest an increase in future revenue and potential for improved net margins through economies of scale. Strategic M&A efforts are on track, which are expected to expand capabilities and solidify market leadership, potentially translating into higher future earnings as these acquisitions begin to contribute to the bottom line.

Kitron’s projected fair value comes with bold bets on future profit margins, revenue surges and aggressive market expansion. Want to see the precise financial targets that power this forecast? Curiosity will pay off when you read what’s driving their valuation story.

Result: Fair Value of NOK 69.26 (OVERVAULED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain pressures and weaker demand in Asia could quickly threaten Kitron’s impressive growth momentum. As a result, investors are likely to remain closely attuned to risk factors.

Find out about the key risks to this Kitron narrative.

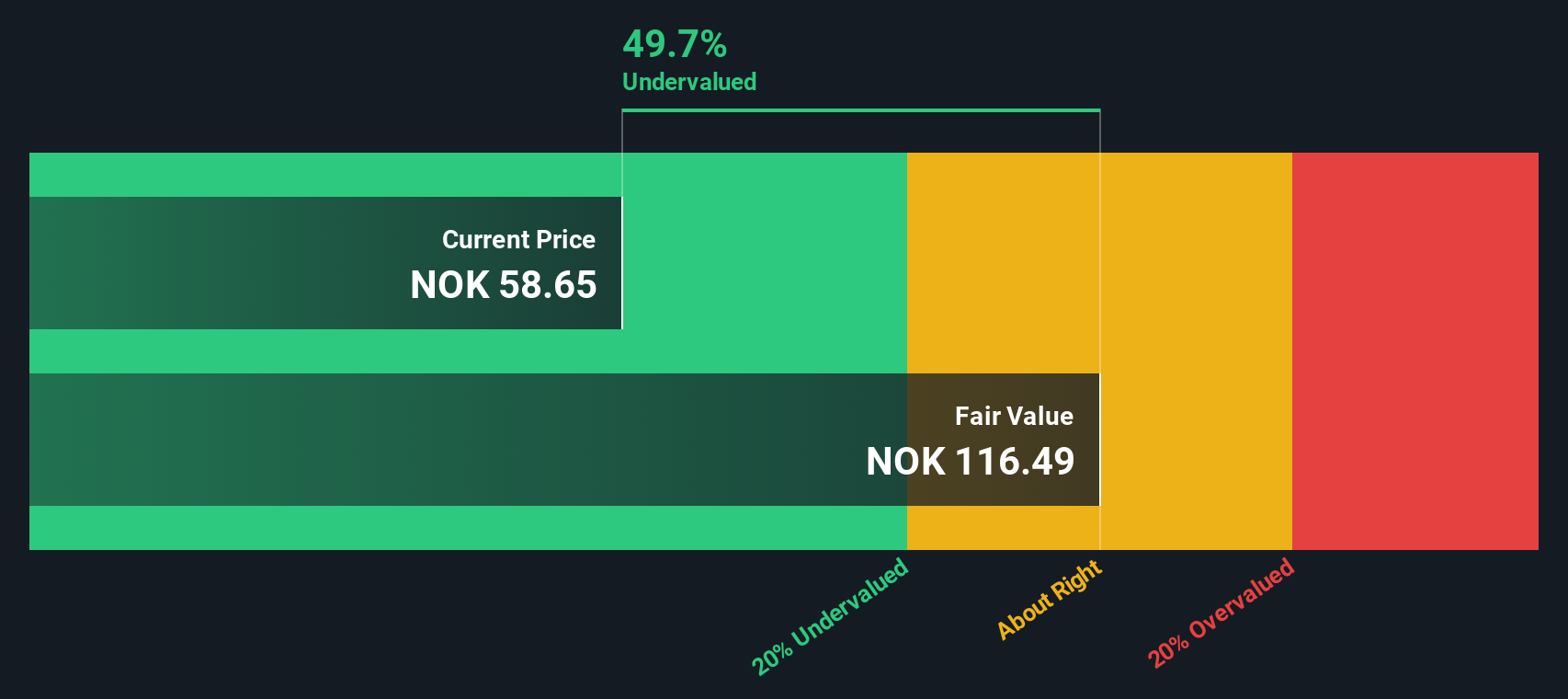

Another View: Discounted Cash Flow Calls It Undervalued

Taking a step back from the fair value narrative, our SWS DCF model offers a much more optimistic picture. Based on future cash flows, Kitron is trading around 37% below its estimated fair value. If this model proves right, today's price could be a rare entry point. Which method will prevail as the truer signal for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kitron for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kitron Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own version in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kitron.

Looking for More Investment Ideas?

If you want to take your investing to the next level, make sure you’re not missing out on fresh opportunities outside the usual headlines. Use these handpicked tools to spot your next winning stock before everyone else does.

- Tap into unmatched earning potential by browsing these 876 undervalued stocks based on cash flows where strong fundamentals meet attractive valuations. Upside awaits the proactive investor.

- Ride the wave of innovation and check out these 27 AI penny stocks that are fueling the AI transformation and capturing market momentum before it hits the mainstream.

- Boost your portfolio’s income streams by finding these 17 dividend stocks with yields > 3% offering solid yields and reliable payouts for steady long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kitron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KIT

Kitron

Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives